Australia represents a prime destination for luxury goods, including fine gems and jewellery. With its high-income economy, established retail infrastructure, and appetite for global luxury brands, the country presents strong demand for high-value jewellery, semi-precious stones, and bespoke ornamentation. For businesses exporting gems and jewellery to Australia, understanding the logistics, customs requirements, and packaging standards is critical to ensuring successful delivery and compliance.

This comprehensive guide outlines the best practices, shipping options, packaging techniques, and regulatory considerations involved in exporting gems and jewellery to Australia.

Market Opportunity: Why Export Gems and Jewellery to Australia

Australia’s luxury market continues to expand due to several key drivers:

- A growing population with high disposable income.

- Strong demand for bridal and occasion-based jewellery.

- Increasing popularity of designer, ethical, and artisanal jewellery.

- Growth in online and cross-border e-commerce.

The Australian consumer tends to value quality, craftsmanship, and ethical sourcing, making it a lucrative destination for exporters specializing in both traditional and contemporary jewellery styles.

However, exporting gems and jewellery to Australia involves more than just shipping; it demands precision, security, and regulatory compliance.

Courier and Shipping Options: Choosing the Right Logistics Partner

When exporting gems and jewellery to Australia, choosing the right courier service ensures that your shipment arrives safely, securely, and on time.

Air Cargo Shipments

Air cargo is a preferred method for exporters handling large, wholesale, or bulk orders. This mode is especially useful for manufacturers and exporters supplying to Australian distributors or jewellery retailers.

Key advantages:

- Fast transit times (2–5 business days on average).

- Enhanced security handling for high-value cargo.

- Scheduled, controlled movement via certified freight carriers.

- Ideal for shipments containing large quantities of precious stones or finished jewellery.

Air cargo services typically operate through freight forwarding companies, many of which offer high-value cargo handling services with tracking and insurance.

Postal Network Shipments

Postal networks like India Post, Royal Mail, or USPS (in partnership with Australia Post) offer economical international parcel services.

Best suited for:

- Lower-value items or samples.

- Small, infrequent shipments.

- Non-urgent deliveries.

Drawbacks include:

- Longer delivery times (typically 10–21 days).

- Limited liability and lower maximum insurance coverage.

- Basic tracking that may not include every transit point.

Jewellery exporters using postal networks should exercise caution, especially with higher-value shipments, due to security and traceability limitations.

Door-to-Door Delivery Service

Courier services such as FedEx, DHL Express, UPS, and TNT provide comprehensive international shipping solutions. These services are highly recommended for jewellery exporters due to:

- Real-time tracking and delivery confirmation.

- Advanced customs clearance support in both the origin and destination countries.

- Optional insurance for high-value shipments.

- Electronic documentation handling and customs declarations.

Door-to-door services are particularly effective for direct-to-consumer (D2C) businesses or e-commerce exporters who require secure, reliable delivery to individual buyers.

Hand-Carry Jewellery Exports

In specific scenarios, especially involving luxury jewellery or high-profile clients, exporters may prefer to hand-carry items. This method involves transporting jewellery on a commercial flight, typically by a company representative.

This method can be effective for:

- Bespoke or extremely high-value orders.

- Trade exhibitions and fashion shows.

- Private client deliveries.

However, it requires strict adherence to legal protocols:

- Customs declarations on both departure and arrival.

- Supporting documents include invoices, certificates, and valuations.

- Accurate reporting to avoid fines or confiscation.

Professional exporters engaging in hand-carry methods often coordinate in advance with customs brokers to pre-clear items with the Australian Border Force.

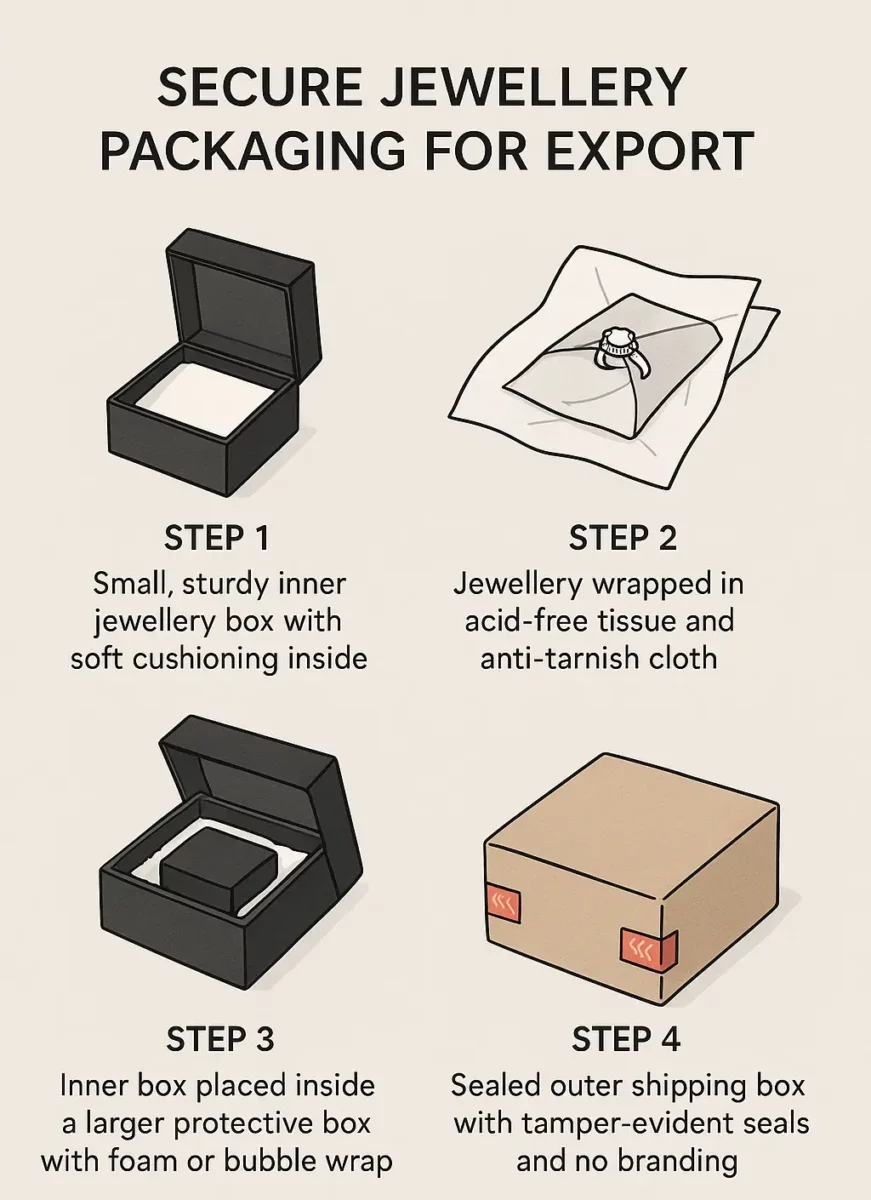

Secure Packaging for Exporting Gems and Jewellery Australia

Jewellery is inherently delicate and valuable, requiring specialized packaging techniques that protect both the physical condition and aesthetic integrity of each item. The goal is to ensure safety, discretion, and presentation.

Exterior Packaging: Security and Discretion

- Use plain, discreet outer boxes that do not disclose the contents or brand identity. Avoid labels that include terms like “gold,” “jewellery,” or “gems.”

- Reinforce packages with tamper-evident seals to deter and detect unauthorized access.

- Opt for high-strength cartons made of corrugated fiberboard for structural integrity.

Internal Packaging: Protection and Preservation

- Use sturdy jewellery boxes with cushioning to prevent movement and minimize shock during transit.

- Wrap individual pieces in acid-free wrapping to prevent chemical reactions, especially with gold, silver, and natural gemstones.

- Include anti-tarnish packaging materials, such as treated paper, cloth, or strips, to reduce oxidation in silver jewellery.

- For loose gemstones, utilize custom packaging for gems and stones, such as small vials, foam-padded holders, or multi-compartment containers.

Avoid overpacking, which can increase dimensional weight and shipping costs, but ensure that fragile items are individually protected within the box.

Customs Clearance in Australia

Australia enforces strict regulations on imported goods, particularly for high-value items like jewellery and gemstones. Ensuring compliance with customs procedures will reduce the risk of delays, penalties, or confiscations.

Key Documentation Required

- Commercial Invoice: Must include detailed descriptions, quantities, HS codes, unit prices, and total value.

- Certificate of Origin: Required to establish the country of manufacture.

- Valuation Certificate: Useful for high-value or unique pieces to verify declared worth.

- Packing List: Describes the packaging contents and layout.

- Airway Bill or Tracking Number: Issued by the courier or freight provider.

HS Codes for Exporting Gems and Jewellery to Australia

Accurate classification is crucial for duty assessment and customs processing. Common HS codes include:

- 7101 – Natural pearls.

- 7102 – Diamonds, whether or not worked.

- 7103 – Precious and semi-precious stones, unmounted or set.

- 7113 – Articles of jewellery and parts thereof, of precious metal or clad.

Incorrect classification may lead to inspection delays, miscalculated duties, or fines.

Australian Border Force Import Process

The Australian Border Force (ABF) regulates imports to ensure product safety, accurate tax collection, and legal compliance. All shipments are subject to screening and may be selected for physical inspection, especially if the declared value is high or if the documentation is incomplete.

Key considerations:

- Ensure your courier electronically submits customs declarations in advance.

- Keep all declarations consistent with commercial invoices.

- Avoid under-declaring value; this can lead to serious penalties and reputational damage.

GST Threshold and Tax Implications

The GST threshold on jewellery (AUD 1,000+) is a major concern for exporters and buyers alike.

- Goods imported into Australia with a customs value above AUD 1,000 are subject to 10% GST, which must be paid before the goods are released.

- Additional duties may apply depending on classification, trade agreements, and declared value.

- For direct-to-consumer shipments, it’s important to notify buyers of potential GST and customs fees, or include these in the shipping charge and prepay via your courier.

Failure to pre-clear taxes may lead to parcel refusal by the buyer or extended customs holding times.

Insurance and Risk Management

Insurance is non-negotiable when shipping jewellery. The value of the items, combined with the risks of loss, theft, or damage in transit, makes insurance essential.

- Choose comprehensive insurance that covers door-to-door movement, including all transit points.

- Confirm that coverage includes high-value shipments and not just the declared customs value.

- Some couriers offer third-party insurance services that specialize in valuable cargo.

Document the value of your shipment with invoices, certificates, and photographs in case of claims.

Tracking, Customer Communication, and Returns

Maintaining transparency with clients is critical in the luxury market.

- Use couriers that offer real-time tracking with delivery confirmation.

- Provide estimated delivery timelines and alert customers of customs-related delays.

- Establish a clear return policy for clients in Australia, including conditions for returns, who bears the shipping cost, and handling of customs fees or taxes on returned goods.

Offering return logistics through the same courier can streamline the experience and enhance customer satisfaction.

Final Checklist for Exporting Gems and Jewellery to Australia

To ensure seamless and secure exporting of gems and jewellery to Australia, follow this checklist:

- Select a shipping method based on value, urgency, and volume.

- Package securely using acid-free, anti-tarnish materials.

- Label discreetly and apply tamper-evident seals.

- Classify goods accurately using the correct HS codes.

- Prepare full and accurate commercial documentation.

- Understand and comply with GST requirements for AUD 1,000+ shipments.

- Ensure all shipments with door-to-door coverage.

- Provide tracking and proactive communication to clients.

- Clarify return and replacement policies in advance.

Conclusion

Australia offers significant growth opportunities for exporters of gems and jewellery. Whether you are a boutique designer, wholesale manufacturer, or e-commerce seller, the keys to successful exporting lie in strategic logistics, careful packaging, customs compliance, and transparent customer service.

By following the best practices outlined above, including choosing the right courier, using secure packaging for high-value items, complying with the Australian Border Force import process, and addressing the GST threshold on jewellery (AUD 1,000+), you can build a dependable and profitable export channel into the Australian market.

If you need assistance drafting export invoices, selecting packaging materials, or setting up shipping procedures tailored to Australian regulations, feel free to ask. I can also help you create templates for customs documents or packaging checklists to streamline your operations.

FAQs

For high-value items, use door-to-door delivery services like DHL, FedEx, or UPS. For bulk orders, air cargo shipments are ideal. Postal network shipments are low-cost but less secure. Hand-carry exports are suitable for ultra-luxury pieces.

Yes, if you use secure packaging, discreet outer boxes, tamper-evident seals, and ensure the shipment.

You’ll need:

1. Commercial invoice

2. HS codes

3. Certificate of origin

4. Valuation certificate

5. Airway bill/tracking number

Yes, if the value exceeds AUD 1,000, a 10% GST is charged. Couriers can help collect or prepay this.

Use sturdy boxes with cushioning, acid-free wrapping, and anti-tarnish materials. Avoid branding and always seal packages securely.