If you’re an exporter in India, navigating the maze of the GST refund process, you’ve probably come across something called the Bank Realization Certificate, or BRC. It might seem like just another piece of paperwork, but its role is far more significant than many realize. In this blog, we will break down everything you need to know about the Bank Realization Certificate for GST refund. We’ll cover what a BRC is, why it’s important, how it’s issued, and its direct impact on your GST refund process. This guide will be thorough and insightful, designed for exporters who want a clear, in-depth understanding of how BRC submission ties into tax refunds.

What is a Bank Realization Certificate (BRC)

Simply put, a Bank Realization Certificate (BRC) is a crucial financial document issued by banks that validates the receipt of payment from an overseas buyer in a foreign currency. When an Indian exporter sends goods or provides services to a buyer abroad, the payment for those exports must come through proper banking channels. The BRC acts as documented proof that this payment has been received.

More formally, the BRC is issued by the exporter’s authorized dealer bank (the bank through which foreign remittances are received) and contains details such as:

- Name and address of the exporter

- Invoice number and date

- Shipping bill details

- Amount received and currency issued

- Date of realization

Why is the BRC Important for GST Refunds

Under India’s Goods and Services Tax (GST) regime, exports are categorized as “zero-rated” supplies. This means that while exporters may pay IGST on goods or services at the time of export, they are entitled to claim a tax refund.

This is where the BRC’s role in GST refunds becomes critically important. The Central Board of Indirect Taxes and Customs (CBIC) mandates that exporters must demonstrate that they have actually received payment for their exports in foreign exchange. The only way to validate this is by submitting the BRC. In effect, the BRC is used by tax authorities to confirm that:

- The exporter has complied with FEMA regulations (Foreign Exchange Management Act)

- The export proceeds have been realized within the stipulated time frame.

- The refund being claimed is for genuine, completed transactions.

Without a BRC, tax authorities treat the export as incomplete, making your refund claim invalid or pending until proof is provided.

How is Bank Realization Certificate Issued

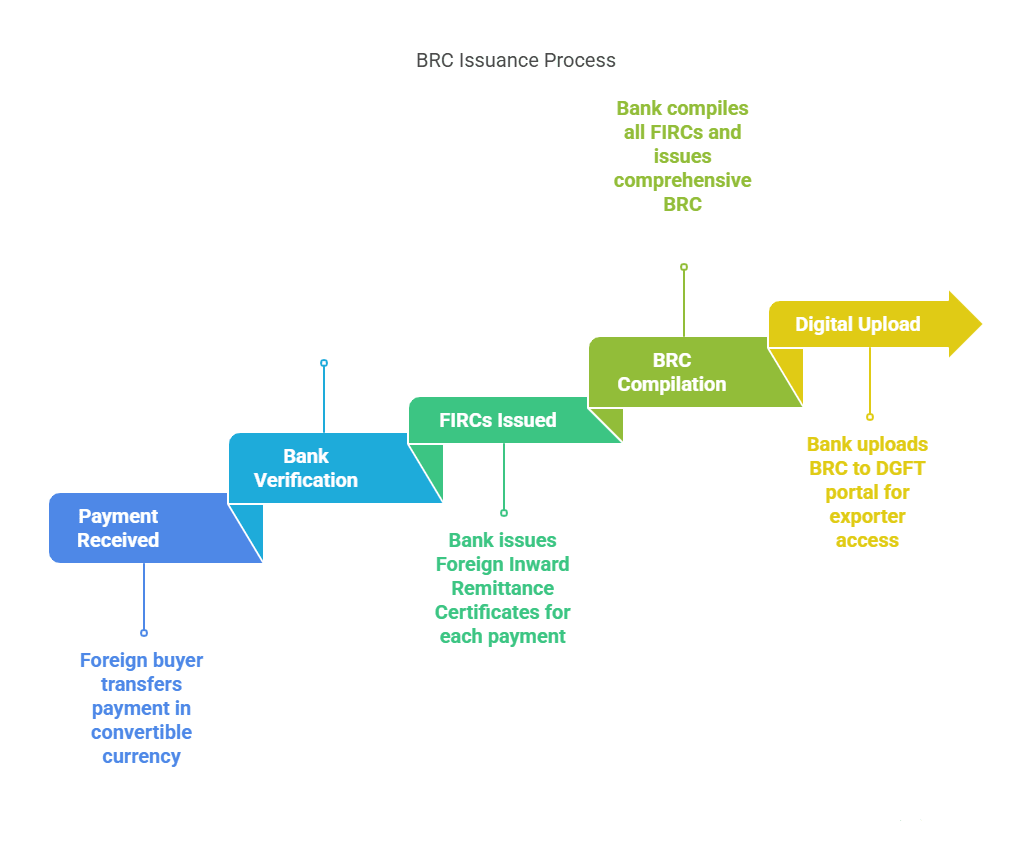

Getting a BRC involves several steps, and understanding this process is crucial for timely GST refunds. Here’s a detailed breakdown of how the BRC is issued:

- Receipt of Export Payment: The foreign buyer transfers payment once the exporter ships goods or provides services. This payment must be received in a convertible foreign currency.

- Verification by Bank: The authorized dealer bank verifies the transaction. They ensure the payment corresponds with the invoice and the export shipment details.

- FIRCs Issued: For each payment received, the bank issues a Foreign Inward Remittance Certificate (FIRC). These certificates are essential in compiling the full BRC.

- BRC Compilation: After verifying all remittances for a particular invoice, the bank issues a comprehensive BRC. This document certifies the total amount realized against the export.

- Digital Upload: Most banks now upload BRCs on the DGFT (Directorate General of Foreign Trade) portal. Exporters can access them online, which facilitates easy submission for GST refunds.

Timelines are key here. Delays in bank verification or errors in invoice data can postpone the issuance of BRCs, thus delaying your GST refunds.

BRC Submission for GST Claims

Submitting a BRC is not just an optional step in the GST refund journey; it’s a mandatory requirement. The BRC submission for GST claims involves attaching the BRC to your refund application on the GST portal. This submission must match your shipping bill, invoice details, and foreign inward remittance records.

Authorities scrutinize this submission to ensure that the exporter has not just declared a shipment but has also successfully received the payment. It’s one of the final checkpoints before refund processing begins. Errors in BRC submission—whether due to mismatched amounts, incorrect invoice numbers, or missing data—can stall the refund application.

GST Refund Process for Exporters: Where BRC Fits In

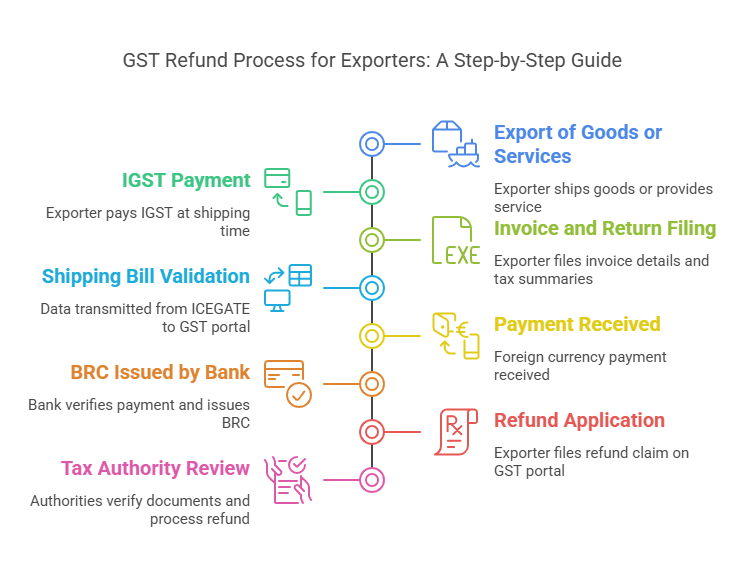

Let’s walk through a detailed view of the GST refund process for exporters and see exactly where the BRC fits in:

- Export of Goods or Services: The Exporter ships the goods or provides the service to a foreign customer. The shipping bill and commercial invoice are generated.

- IGST Payment: At the time of shipping, the exporter pays IGST. This payment can be claimed as a refund later, provided all compliance steps are met.

- Invoice and Return Filing: Exporter files invoice details under GSTR-1 and tax summaries under GSTR-3B.

- Shipping Bill Validation: Data from the shipping bill is transmitted from the ICEGATE to the GST portal.

- Payment Received: Foreign currency payment is received in the exporter’s account.

- BRC Issued by Bank: The authorized bank verifies payment details and issues the BRC.

- Refund Application: Exporter files the refund claim on the GST portal, submitting BRCs, shipping bills, and returns.

- Tax Authority Review: Authorities verify BRC and other documents before approving and processing the refund.

This makes the BRC a linchpin in the entire GST refund mechanism.

BRC Compliance for GST Benefits

Maintaining BRC compliance for GST benefits involves a disciplined approach. You must ensure all BRCs are timely, accurate, and in sync with your GST filings. Here’s why compliance is crucial:

- Avoid Penalties: Non-submission or erroneous submission of BRCs can attract penalties and interest.

- Ensure Timely Refunds: Accurate BRCs expedite the refund process, reducing your cash flow burden.

- Minimize Scrutiny: Consistent compliance keeps you off the radar for audits and verification delays.

Best practices for compliance include:

- Reconciling BRC data with invoice and shipping details

- Storing digital and physical copies of BRCs

- Regular follow-ups with banks to avoid delays

Linking BRC with GST Returns

Linking BRC with GST returns ensures the government can cross-verify the refund application seamlessly. This linking is done by matching details from:

- Shipping bill (filed at customs)

- GST returns (GSTR-1 and GSTR-3B)

- BRC (issued by the bank and uploaded on DGFT)

When there is inconsistency among these documents, it leads to errors or delays in a refund. This is why many exporters experience refund rejections, they fail to ensure these records match across platforms.

To avoid this, always:

- Use consistent invoice numbers

- Declare accurate values

- Double check data before submission

BRC Verification for Tax Refunds

The BRC verification for tax refunds is not just a formality. Tax officers carefully cross-examine each document to ensure:

- The export is genuine

- Payment has been received in convertible foreign currency

- The amount aligns with the declared invoice and shipping bill

They often rely on DGFT and ICEGATE portals for digital verification, which increases the importance of accurate digital submissions. BRC mismatches or delays can flag your refund for manual review, extending the refund timeline significantly.

BRC and Integrated GST (IGST) Refunds

There’s a direct link between BRC and Integrated GST (IGST) refunds. IGST is typically paid at the time of export, and the exporter later claims this amount back. The refund is processed only when:

- The shipping bill data matches GST returns

- The BRC confirms that payment was received

Failure to provide a BRC means the refund application is considered incomplete. Additionally, any delay in BRC issuance means your funds are stuck with the government, affecting your liquidity.

In essence, the BRC is the final proof that closes the loop on a tax-free export.

Common Issues in BRC Submission

Despite its importance, exporters frequently face problems with BRC submission that can severely delay their GST refunds. Some of the most common issues include:

- Mismatch in Data: Discrepancies between BRC, shipping bill, and GST returns are the top reasons for refund delays.

- Delayed Bank Actions: Sometimes, banks take weeks to issue BRCs due to internal verification or missing documents.

- Incorrect Invoice Numbers: Typographical errors can break the digital matching mechanism used by tax portals.

- Missing BRC on DGFT Portal: If your bank does not upload the BRC, you cannot link it with your GST return.

- Lack of Coordination: Different departments within an organization (finance, logistics, tax) not working in sync can cause lapses in documentation.

Avoiding these issues requires a meticulous and proactive approach to documentation and internal communication.

Impact of BRC on GST Refunds: Financial, Operational, and Compliance Dimensions

Understanding the broader impact of the Bank Realization Certificate (BRC) on GST refunds can help exporters manage risk, improve cash flow, and avoid bureaucratic roadblocks. The role of BRC goes far beyond being a routine formality—it has direct and measurable consequences on your export business.

1. Cash Flow and Working Capital

One of the most immediate and tangible impacts of BRC on GST refunds is on cash flow. Since GST refunds, especially Integrated GST (IGST) refunds, are often significant amounts, delays in BRC issuance directly hold up that money.

If your refund is ₹10 lakhs and the BRC is delayed by 60 days, that’s 60 days of tied-up capital that could have been reinvested in new shipments or operations.

Proactive BRC compliance ensures that exporters receive timely refunds and maintain healthy liquidity. For small and medium-sized exporters, this can be the difference between scaling up or struggling to fulfill orders.

2. Operational Bottlenecks

Without a valid BRC, your refund application is considered incomplete, stalling the entire GST refund cycle. Exporters often prepare all shipping, invoice, and return documentation in time, only to be held back by pending BRCs from banks.

This introduces bottlenecks in operational planning:

- Inability to estimate refund timelines

- Difficulty forecasting working capital availability

- Delay in reinvestment into sourcing, manufacturing, or logistics

3. Compliance Ratings and Risk Profiling

Government systems are becoming increasingly data-driven. Your record of timely BRC submissions affects your profile in the GSTN (Goods and Services Tax Network) and other government databases.

Consistent BRC compliance for GST benefits can:

- Improve your standing for automatic or fast-track refunds

- Reduce audit scrutiny

- Position your business as low-risk, facilitating easier trade facilitation

Conversely, frequent delays or mismatches in BRC verification for tax refunds may flag your account for manual audits or increased documentation checks.

4. Loss of Interest on Refund Delays

While the law allows for interest payments on delayed GST refunds beyond 60 days, in reality, interest claims are time-consuming and not always honored smoothly. The root cause in many cases? Improper BRC linkage or late submission.

In such cases, exporters lose not just time but the potential interest income they’re entitled to. Proper linking of BRC with GST returns helps mitigate this.

5. Risk of Refund Rejection or Legal Penalties

Perhaps the most critical impact is the risk of refund rejection. If the tax authorities suspect that:

- The export was not completed

- Payment was not received

- The data is inconsistent

…your claim may be rejected outright. Worse, if such errors are repeated, they could result in notices, penalties, or disqualification from zero-rated benefits.

6. Impact on Buyer-Seller Trust and Reputation

Refund delays due to BRC issues can impact your supply chain relationships. Exporters reliant on advance payments or refund-backed funding may delay dispatches or default on supplier payments.

In the long run, buyers and suppliers could begin to question your operational reliability, especially if you frequently fail to meet timelines because of financial constraints caused by delayed tax refunds.

Final Thoughts

The Bank Realization Certificate for GST refund is much more than a formality—it’s the bedrock of India’s GST refund process for exporters. Understanding the BRC role in GST refunds, ensuring prompt and accurate BRC submission for GST claims, and aligning your records for BRC compliance for GST benefits are non-negotiable if you want your refunds processed without hiccups.

Whether you’re dealing with BRC verification for tax refunds or navigating BRC and Integrated GST (IGST) refunds, remember this: accurate documentation and timely submission are your best allies.

FAQs

A BRC is a certificate issued by your bank that confirms the receipt of a foreign currency payment for your export. It proves that the export transaction is complete and payment was received through legal banking channels.

Yes. For zero-rated exports, tax authorities require the BRC as proof that you received a foreign payment. Without it, your refund application will be considered incomplete or invalid.

The authorized dealer bank (usually the bank through which you receive foreign payments) issues the BRC after verifying that the remittance corresponds with the export invoice and shipment.

A Foreign Inward Remittance Certificate (FIRC) is issued for each remittance. The BRC is a consolidated certificate based on multiple FIRCs for a particular export invoice or shipment.

Where can I access the BRC once it’s issued?

Most banks digitally upload the BRC on the DGFT portal. Exporters can download it from there and use it while filing GST refund applications.

Yes, BRC is mandatory for GST refund on export of goods or services. Without BRC, tax authorities can’t verify that foreign currency was realized against export invoices. Unlike FIRC, BRC directly links payment to exports, making it essential for proving eligibility and successfully claiming GST refunds.