Going global is a dream that every person who owns a business aspires to achieve. Tens of thousands of vendors in India selling everything from jewellery to toys are now able to connect to buyers all over the world because of the Internet and the ability to conduct business electronically.

However, one of the first things that any entrepreneur needs to do in order to export products from India is to get the correct documents for compliance. An AD Code (Authorized Dealer Code) is one of the most significant papers necessary for customs clearance.

What is AD Code

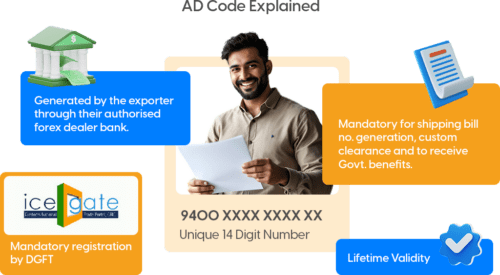

An AD Code (Authorized Dealer Code) is a unique fourteen-digit number issued by the bank where an exporter maintains a business current account. This code is officially shared by the bank through an AD Code Letter, which serves as an essential document in the export process. Obtaining an AD Code Letter is a standard and mandatory step for any business engaged in export activities.

Once an exporter has secured the IEC (Importer Exporter Code) from the DGFT (Directorate General of Foreign Trade), they can apply to their bank for the AD Code. This code, along with the AD Code Letter, is then registered with the customs department to enable electronic customs clearance.

The AD code letter must be kept safely to carry out future export transactions and facilitate seamless customs clearance.

Why is Authorized Dealer Code Certificate Necessary

An AD Code or Authorized Dealer Code serves several essential functions in the export process. It is vital for the following reasons:

- Customs Clearance: A shipping bill is needed in order to export goods out of India and to ensure smooth customs clearance. The AD Code is essential for preparing a shipping bill on ICEGATE or the Indian Customs Electronic Gateway. With the help of AD Code Certificate, a shipping bill can be created, and without it, the exportation process will be an issue.

- Government Benefits: Take advantage of the government benefits or financial assistance offered to exporters, including incentives, subsidies, GST refunds, or others. If your business is entitled to any government concessions, the AD Code allows you to quickly avail these benefits with the streamlined process while eliminating the need for manual paperwork.

- Compliance: The Authorized Dealer Code makes certain that your export activities do not violate the laws of India and other regulations governing foreign commerce, thus making customs formalities less of a problem.

How to Obtain an AD Code

To obtain an AD Code, the first thing that you need to do is to open a current account with a bank that is approved by the Reserve Bank of India to carry out operations in foreign exchange.

These banks are referred to as Authorized Dealers (AD). When your business account is created, you will be able to apply for a bank AD Code from the respective bank. It can be done through several working documents, which are required to go through verifications and approvals.

After obtaining the AD Code (via the bank’s authorisation letter), also referred to as the ad code in bank, you are required to register the same with customs. With the growing digitalization, the AD code registration process has become entirely digital and contactless. It should be completed on the Indian Customs website, ICEGATE.

Documents Required for AD Code Registration

You are required to submit several necessary documents while registering for an Authorized Dealer Code. These include:

| Document Name | Details / Requirements |

|---|---|

| Bank Certificate | Obtain a certificate from the bank in accordance with Customs Public Notice No. 93/2020 (dated 29 July 2020). Ensure it follows the prescribed format. |

| Company PAN Card | Submit a duly stamped and signed copy of the PAN (Permanent Account Number) Card of the company with its seal and signature. |

| IEC Certificate | Provide a stamped and signed copy of the IEC (Import Export Code) Certificate with the company’s seal. It uniquely identifies importers and exporters. |

| GST Certificate | Submit a signed and sealed copy of the GST (Goods and Services Tax) Certificate issued by the appropriate authority. |

| Cancelled Cheque | Provide a cancelled cheque issued in the company’s name, showing account details. This helps verify the linked bank account for AD Code registration. |

| Class 3 DSC (Digital Signature Certificate) | Obtain a Class 3 Digital Signature Certificate (DSC) from a licensed authority to validate the authenticity of online submissions. |

- Bank Certificate (in accordance with Customs Public Notice No. 93/2020 dated 29 July, 2020) – Obtain this certificate from the bank and make sure that it follows the format described in the customs public notice.

- Company PAN Card (along with seal and signature) – Submit a duly stamped and signed copy of the PAN (Permanent Account Number) Card of the company.

- IEC Certificate (along with seal and signature) – The submission of IEC (Import Export Code) Certificate with the company’s seal and signature is an important step since the code serves as a unique identification number for importers and exporters.

- GST Certificate (along with seal and signature) – Submit a copy of the GST (Goods and Services Tax) Certificate along with the company’s seal and signature. The certificate must be issued by the appropriate authority.

- Cancelled Cheque (issued in the name of the company) – Provide a cancelled cheque bearing the name and account details of the company. The company’s bank account linked with the AD Code registration gets verified as a result, establishing the authenticity of the account.

- Class 3 DSC (Digital Signature Certificate) – Obtain a Class 3 Digital Signature Certificate (DSC) from a licensed authority to validate the authenticity of the online submission process and ensure improved security. This is mostly done for providing electronic submissions of forms or documents to the government agencies.

Relationship Between AD Code and IEC Code

While understanding the cross-border trade facilitation in India cannot be comprehended without the understanding of a number of codes, the AD Code (Authorized Dealer Code) and IEC Code (Import Export Code) are particularly crucial regulatory standards. Though they have separate functions, they are correlated and function concurrently to make export and import easier.

The IEC Code is the basic code that any business striving to venture into the international markets should meet. They are provided by the Directorate General of Foreign Trade (DGFT) and act as an identification number for exporters and importers. IEC is a legal requirement for export and import businesses since an IEC authorization allows a business to undertake export and import activities legally.

The AD Code, however, is to be acquired from an authorized dealer bank and is necessary for the clearance of goods through customs at the major ports in India. It connects exporters with banks by facilitating the foreign exchange remittances of exported proceeds and is in consonance with the guidelines framed by the RBI.

Any person who seeks an Authorized Dealer Code should first obtain an IEC Code. Combined, these codes ensure legal compliance and best practice standards in global trade.

An IEC coupled with AD Code further opens doors to global opportunities for Indian businesses and companies.

Connection between AD Code and EDPMS

The AD Code (Authorized Dealer Code) is a unique number issued by a bank that is linked with an exporter’s bank account. Once registered with Customs, the AD Code ensures that all export transactions are routed through the Export Data Processing and Monitoring System (EDPMS), a central database managed by the RBI. This linkage enables the automatic reporting of shipping bills and the realisation of export proceeds, facilitating exporters’ compliance with FEMA regulations and allowing authorities to monitor foreign exchange inflows effectively.

Role of DGFT

The Directorate General of Foreign Trade (DGFT) is the policy-making body responsible for regulating and promoting India’s exports. It issues the Import Export Code (IEC), which is mandatory for all exporters, and frames policies that align with foreign trade objectives. While DGFT does not issue AD Codes directly, its policies define the compliance framework within which AD Codes, EDPMS, and other export documentation operate.

Role of RBI

The Reserve Bank of India (RBI) is the primary regulator overseeing the flow of foreign exchange into India. It mandates the use of AD Codes and manages EDPMS, ensuring that all export proceeds are realised within stipulated timelines. By monitoring export data through EDPMS, RBI ensures transparency, prevents misuse of foreign exchange, and enforces compliance with FEMA guidelines.

Role of Customs

Customs plays a crucial role in linking AD Codes with the exporter’s shipping bills. When an exporter registers their AD Code with Customs at a particular port, it ensures that all subsequent export documentation and shipping bills are automatically mapped to that code. This enables smooth credit of export incentives, quicker clearances, and proper reporting to EDPMS, creating a seamless bridge between the exporter, the bank, and regulatory authorities.

Conclusion

In India, it is not possible to export without an AD Code since it has a significant role to play in facilitating smooth customs clearance of goods. Anyone who acquires an Authorized Dealer (AD) Code gets to enjoy streamlined cross-country commerce.

Moreover, an Authorized Dealer Code registration with customs offers significant benefits to exporters like you. You can avail the various benefits offered by the government, including duty rebates, GST refunds, and others only after you have successfully registered it with customs.

FAQs

Yes, an AD Code can be registered online on the ICEGATE portal. Once the AD Code is forwarded to you through your bank, the registration application as well as all supporting documents can be lodged electronically to customs.

No, exporting without an AD Code is not allowed. The AD Code is obligatory for customs formalities and documentations, since it helps meet the regulatory standards of the country for imports and exports.

Yes, the AD Code is assigned according to the branch where you have a business account or more precisely, where the business account is created. The exporters need to apply for a new AD code for every port from where they intend to ship goods.

Exporters need to provide their Import Export Code (IEC), business PAN, bank certificate or bank letter, and supporting documents like GST registration certificate.