Salut!

France, your order for Indian Textiles and Apparel has been received and will be delivered on time.

Well, the appetite for Indian textiles globally has been growing at a massive rate and apparel exports to France specifically are becoming a lucrative opportunity in 2025.

As one of the world’s fashion capitals, France is not only a trendsetter but also a strict enforcer of compliance norms, sustainability expectations, and trade regulations. For Indian exporters looking to succeed in the French market, understanding the textile compliance France 2025 landscape is no longer optional — it’s essential.

In this guide, we break down everything Indian exporters must know to meet EU textile import regulations, navigate French fashion import rules, and build strong export strategies for Europe.

Why Focus on Apparel Export to France

France’s textile and fashion sector is part of a €100+ billion European apparel market that thrives on quality, innovation, and ethical sourcing. Indian exporters bring competitive advantages in terms of manufacturing scale, artisanal value, and cost efficiency. However, market entry in the French clothing trade demands more than low prices — it requires compliance, certifications, and an understanding of buyer behaviour.

The surge of apparel exports in France shows that the demand for organic cotton, sustainable fabrics, and digitally traceable supply chains has changed the game for apparel exports to France.

Textile Compliance France 2025: What’s Changing

Textile compliance in France by 2025 will be stricter than ever, especially under the European Union’s push for environmental responsibility and consumer safety. Key compliance areas include:

- Traceability of raw materials

- Sustainable packaging

- Restricted chemical use (REACH standards)

- Circular economy alignment for recyclability

India’s exporters must align their production and documentation with these principles to stay competitive.

Ready to Expand Globally?

If you’re looking to simplify your international shipping, navigate complex paperwork, and ensure smooth compliance, let ShipGlobal.in be your trusted logistics partner. From documentation and doorstep pickup to real-time tracking and global delivery, we handle it all — so you can focus on what you do best: growing your export business.

Your gateway to France and beyond.

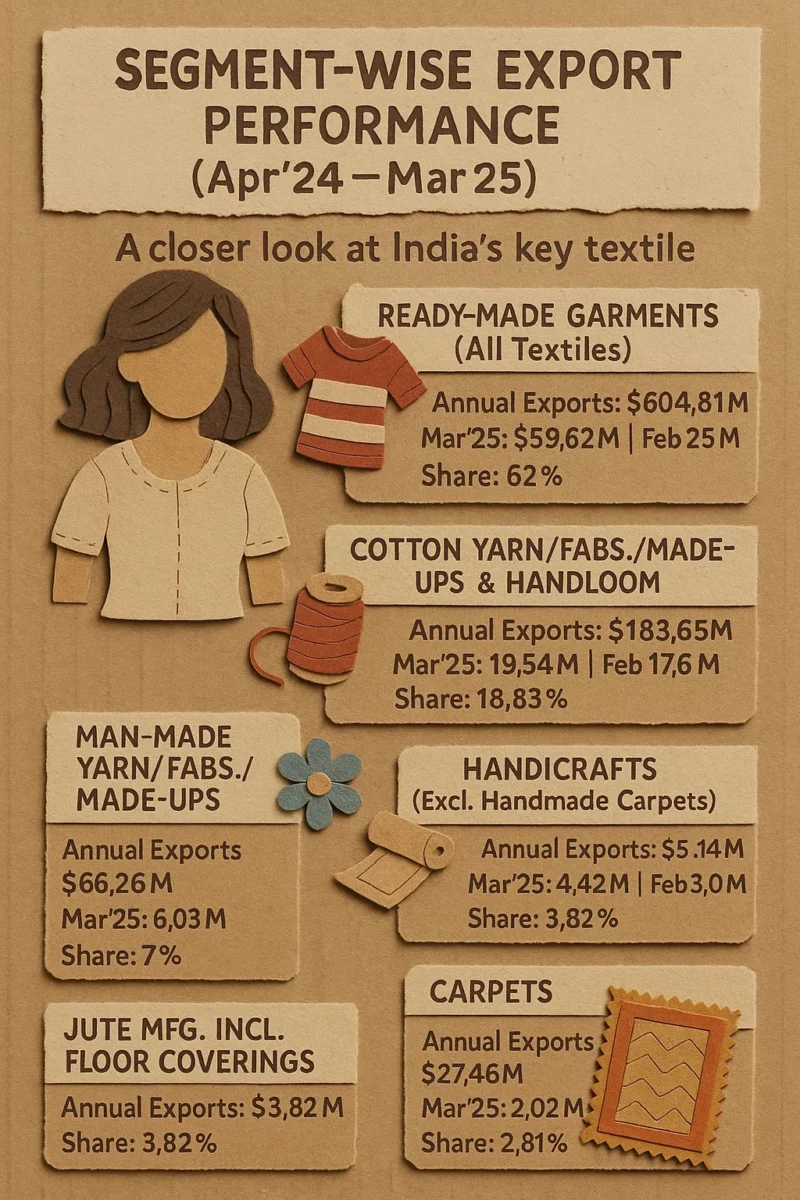

Export Performance Analysis of France (Apr 2024 – Mar 2025)

Overall Snapshot

- Total exports across all listed commodities stood at $975.56 million for the year.

- For March 2025, exports totalled $94.61 million, almost flat compared to February 2025’s $94.9 million.

- The month-on-month overall growth is a marginal -0.31%, indicating a stable yet slightly slowing trend.

Segment-Wise Analysis

Ready-made Garments of All Textiles

- Annual Export Value: $604.81 million

- March 2025: $59.62 million | Feb 2025: $63.31 million

- Month-on-month Growth: -5.82%

- Export Share: 62% of the total

- Insight: This is the largest contributor to the sector. Despite a slight decline in March, it remains dominant, accounting for nearly two-thirds of total exports.

Cotton Yarn/Fabrics/Made-ups and Handloom Products

- Annual Export Value: $183.65 million

- March 2025: $19.54 million | Feb 2025: $17.67 million

- Growth: +10.61%

- Export Share: 18.83%

- Insight: Strong month-on-month growth indicates healthy global demand. It’s the second-largest segment, showing momentum.

Man-Made Yarn/Fabrics/Made-ups

- Annual Export Value: $68.26 million

- March 2025: $6.03 million | Feb 2025: $4.88 million

- Growth: +23.51%

- Export Share: 7%

- Insight: This category saw the highest monthly growth, highlighting increasing demand for synthetic textiles.

Handicrafts (Excl. Handmade Carpets)

- Annual Export Value: $54.14 million

- March 2025: $4.42 million | Feb 2025: $4.10 million

- Growth: +7.72%

- Export Share: 5.55%

- Insight: A modest but positive rise. Exporters in this niche are maintaining a steady pace.

Jute Manufacturers, Including Floor Coverings

- Annual Export Value: $37.24 million

- March 2025: $2.98 million | Feb 2025: $3.02 million

- Growth: -1.33%

- Export Share: 3.82%

- Insight: Slight decline but relatively stable. Could benefit from sustainability-driven demand.

Carpets

- Annual Export Value: $27.46 million

- March 2025: $2.02 million | Feb 2025: $1.92 million

- Growth: +5.31%

- Export Share: 2.81%

- Insight: A modest uptick in exports suggests resilience in demand for floor coverings.

Key Takeaways

- Ready-made garments are the flagship export but show a slight month-on-month decline.

- Man-made textiles are gaining momentum with the highest growth rate.

- Cotton based and handloom exports are also witnessing positive growth, reinforcing India’s strengths in natural fabrics.

- Smaller sectors like carpets and jute are stable, with minor fluctuations

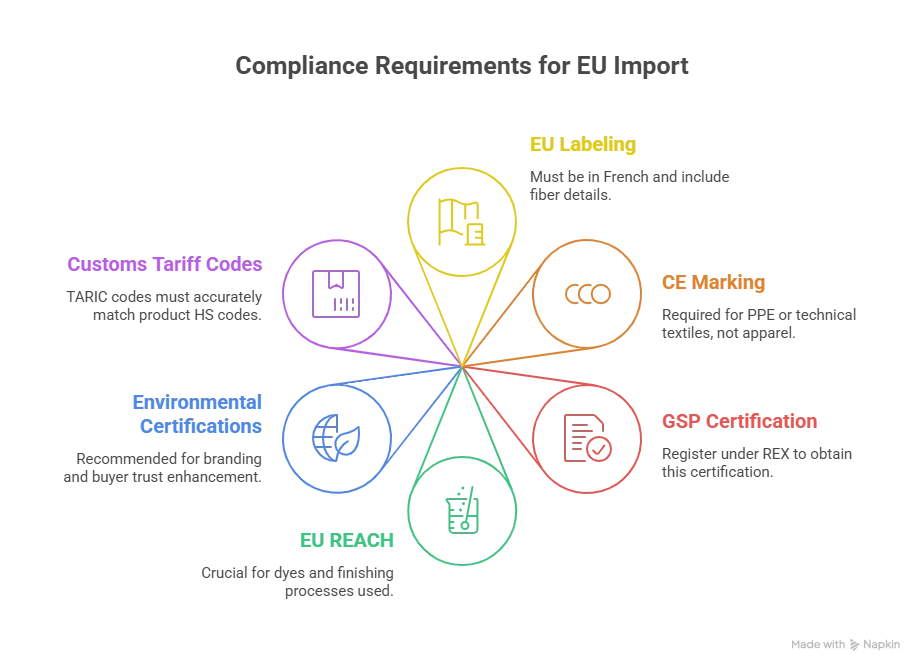

EU Textile Import Regulations

Since France adheres to EU textile import regulations, Indian exporters must meet the standards set by Brussels. These include:

- Accurate fibre content declaration

- Ban on harmful dyes and chemicals

- Care and wash instructions in the local language

- Proper customs declaration using the TARIC system

The EU’s 2025 sustainability roadmap further stresses extended producer responsibility (EPR) and carbon transparency for textile imports.

France Fashion Import Rules

Beyond EU regulations, France’s fashion import rules bring additional layers of scrutiny:

- French customs authorities (Douane Française) may inspect for false origin claims

- Non-compliance with recycling norms may lead to product recalls

- French consumers demand eco-certifications like OEKO-TEX®, GOTS, or Fair Wear

Exporters should be aware that buyers may request proof of environmental certifications even if not officially mandated.

CE Marking for Textile

CE marking for textiles is not mandatory for all clothing exports. However, if your product includes:

- Protective clothing (PPE)

- Children’s sleepwear with fire resistance

- Items with electronic components (e.g., smart wearables)

Then, CE compliance is essential under EU directives. In such cases, exporters must conduct conformity assessments and maintain technical documentation.

Textile Labelling Regulations EU-Wide

To access the French market legally, you must comply with textile labeling regulations in the EU. Labels must include:

- Full fibre composition

- Country of origin

- Care instructions

- Size details (in EU format)

- Safety warnings (if applicable)

All this must be printed in French, even if selling through marketplaces like Amazon.fr or Zalando.

GSP for Indian Textiles

The GSP (Generalised Scheme of Preferences) for Indian textiles continues to offer reduced or zero-duty access to the EU, including France. Benefits include:

- 0% duty on most cotton apparel

- 9.6% savings on synthetic fabrics

- Simplified customs clearance with Form A Certificate

To qualify, ensure your products meet the rules of origin and register with the REX system (Registered Exporter System).

Export Strategies for Europe

Success in France means mastering export strategies for Europe that go beyond logistics. Here’s how:

- Participate in trade fairs: Events like Première Vision Paris connect exporters to premium buyers.

- Invest in certification: OEKO-TEX®, GOTS, and SA8000 boost credibility.

- Adapt to French fashion cycles: Understand local trends and respond to seasonal launches.

- Digital first: French fashion buyers increasingly rely on B2B sourcing platforms and LinkedIn.

- Work with local partners: Distributors, agents, or eCommerce channels can ease market entry in the French clothing sector.

Final Checklist for 2025 Compliance and Market Success

| Requirement | Mandatory | Notes |

|---|---|---|

| EU-compliant labeling | ✅ | In French, with full fibre details |

| CE marking (if PPE or tech textile) | ⚠️ | Not needed for regular apparel |

| GSP certification (Form A) | ✅ | Register under REX |

| EU REACH chemical compliance | ✅ | Crucial for dye and finish processes |

| Environmental certifications | ⚠️ | Strongly recommended for branding and buyer trust |

| Customs tariff codes (TARIC) | ✅ | Must match product HS codes accurately |

Conclusion

Understanding the trends, it is clear to say that apparel exports to France will continue to rise in 2025. Indian exporters who align with textile and apparel compliance France 2025, master the France fashion import rules, and build strong export strategies for Europe. Once you master one country, the whole of Europe will be easy to target for you

It is the right time for Indian textiles, which are so deeply loved and celebrated in the European market.

India’s textiles are loved worldwide. With the right steps, they can conquer France, too.

Frequently Asked Questions

You need EU-compliant labelling, safe chemical use (REACH), and French-language care tags. CE marking is needed only for safety wear.

Yes, under the GSP for Indian textiles, you can get reduced or zero duty if you’re REX-registered and meet origin rules.

No. You can sell directly via platforms like Amazon, Etsy, or B2B marketplaces, if you follow EU rules.

Labels must show fibre content, country of origin, size, and care instructions all in French.

Ready-made garments, cotton & handloom items, jute products, and eco-friendly home textiles are in high demand.