India’s Micro, Small, and Medium Enterprises (MSMEs) are often described as the backbone of Indian exports, contributing around 40% of outbound trade and generating millions of jobs across the country.

These small but dynamic businesses are deeply embedded in export-oriented manufacturing units, ranging from textiles and handicrafts to auto components and processed foods.

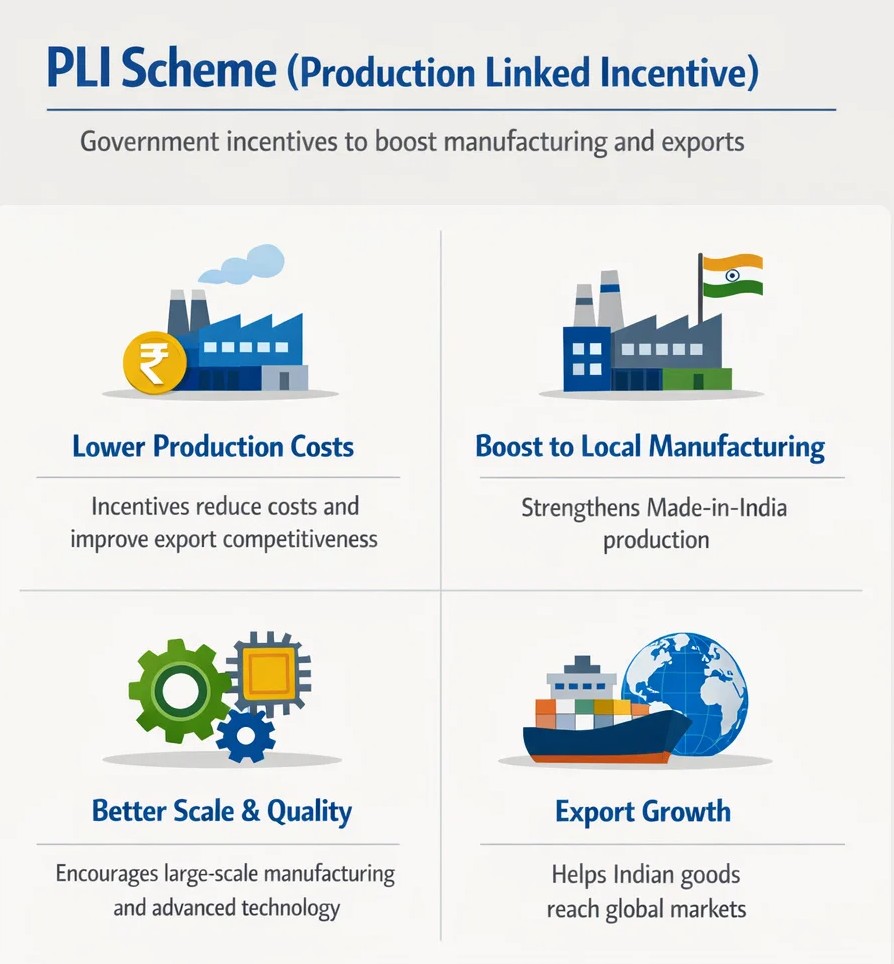

With the launch of the Production Linked Incentive (PLI) Scheme, the Government of India has attempted to redefine the country’s manufacturing and export ecosystem. Unlike older small business export schemes that offered tax breaks or subsidies upfront, the PLI is different; it rewards companies only when they achieve incremental production and export targets. This model ensures that incentives go to firms that perform and add value to the economy.

The eligibility of PLI scheme for MSME exporters is not very simple or easy. High capital investment thresholds and strict compliance requirements make it harder for smaller enterprises to apply directly. Yet, there are indirect ways for them to participate, especially through the PLI supply chain ecosystem, where larger firms depend on MSMEs for raw material procurement, components, and specialised services.

This article dives deep into the opportunities, challenges, and tips for MSMEs under the PLI framework, weaving in how the Indian government’s support for MSMEs and other allied programs can help these enterprises scale and compete globally.

PLI and MSMEs: Where Do They Fit?

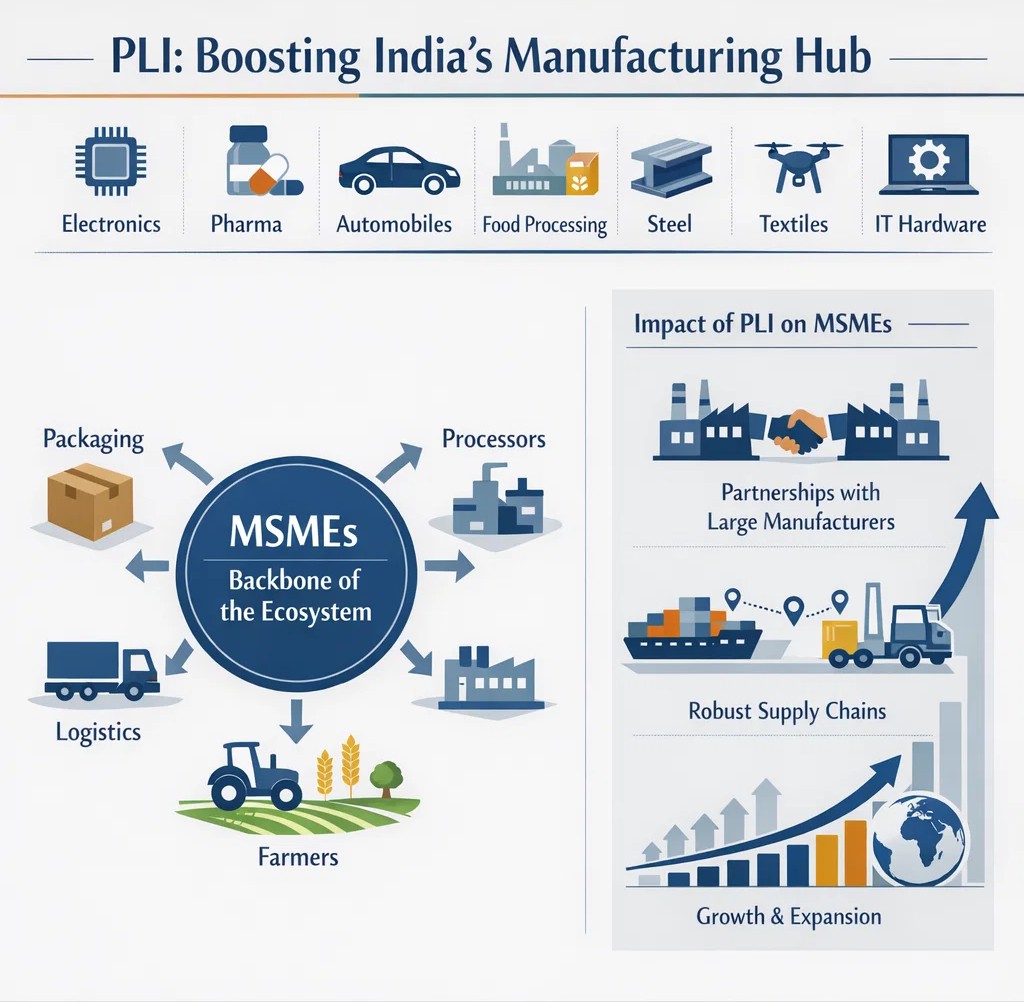

The PLI scheme for MSME is primarily designed to make India a global manufacturing hub in sectors like electronics, pharmaceuticals, renewable energy, telecom, auto components, food processing, textiles, speciality steel, drones, and IT hardware.

While large corporations are the direct beneficiaries, MSMEs still play a vital role. They are the hidden drivers of PLI growth, supplying inputs, providing services, and ensuring backwards and forward linkages.

For example:

- In the electronics sector, large mobile manufacturers approved under PLI rely on MSMEs for circuit boards, packaging, and logistics.

- In food processing, PLI beneficiaries sourcing processed foods often depend on small farmers, local processors, and packaging units.

- In automobiles, MSME component makers supply everything from wiring harnesses to specialised metal parts.

Thus, even if MSMEs cannot always register as PLI beneficiaries themselves, they can ride the wave of growth created by larger firms, ensuring MSME growth through PLI.

PLI export value addition or value-added exports for MSMEs, especially under the PLI (Production Linked Incentive) scheme. By moving beyond raw or bulk exports to finished, branded, and processed products, MSMEs can increase margins, improve global competitiveness, and access new international markets. The PLI scheme supports this shift by incentivising manufacturing, quality upgrades, and scale, helping MSMEs invest in better technology, compliance, and export-ready products that meet global standards.

Opportunities for MSME Exporters under PLI

1. Value Addition in Exports

Traditionally, many MSME exporters export raw or semi-finished goods, earning slim margins. With the PLI push, there is a chance to shift from commodity exports to value-added exports. By investing in technology upgradation subsidy programs, MSMEs can modernise production lines, produce higher-quality goods, and command better prices globally.

For instance, instead of exporting raw cotton, a textile MSME could move into technical textiles or man-made fiber fabrics, which are covered under PLI and have strong global demand. Take advantage of a time when you can reap supply chain localisation benefits.

2. Employment Generation through MSMEs

One of the biggest advantages of the PLI scheme is that it encourages large-scale investment, which in turn creates jobs. MSMEs benefit from this trickle-down effect. As PLI-approved firms scale up, they require more suppliers and service providers, directly expanding opportunities for smaller enterprises. This strengthens employment generation through MSMEs, particularly in rural and semi-urban areas where these businesses are concentrated.

3. Supply Chain Localisation

Global supply chains are shifting due to geopolitical changes, pandemic disruptions, and rising costs in China. The Indian government is pushing for supply chain localization, and PLI is a key tool here. Multinational corporations setting up plants in India are encouraged to source locally.

This creates enormous opportunities for MSME exporters in India, who can plug into these value chains as component suppliers, raw material providers, or specialized service partners.

4. Funding Options for MSME Exporters

Another opportunity comes from the Indian government’s support for MSMEs in financing. Exporters can tap into:

- Credit Guarantee Fund Scheme for MSMEs (CGTMSE)

- Export Credit Guarantee Corporation (ECGC) schemes

- Priority sector lending by banks

- Specialised MSME credit access programs for working capital and raw material procurement

These funding options ensure that even smaller enterprises can scale their export-oriented manufacturing units and meet growing global demand.

5. Ease of Doing Business in India

PLI coincides with broader reforms aimed at improving the ease of doing business in India. Simplified GST filing, online PLI registration portals, and reduced customs barriers make it easier for MSMEs to integrate into export ecosystems. Digitalisation also ensures transparency, reducing bureaucratic delays.

Challenges for MSME Exporters under PLI

Despite these opportunities, exporting challenges for small businesses remain significant.

1. High Capital Investment Thresholds

Most PLI schemes demand hundreds or even thousands of crores of investment. For example, in electronics, companies must commit to multi-year investments running into large sums. This makes direct participation almost impossible for MSMEs, which typically operate with far smaller capital bases.

2. Exporting Challenges for Small Businesses

MSMEs face several hurdles:

- Difficulty in accessing low-cost credit.

- Heavy reliance on imported inputs for raw material procurement.

- Meeting global quality standards, packaging norms, and certifications.

- Limited marketing and branding capacity compared to large corporations.

These exporting challenges for small businesses make it hard for them to scale globally, even under the PLI ecosystem.

3. Documentation and Compliance Burden

PLI incentives are linked to strict performance audits. Companies must prove incremental production, submit regular reports, and undergo inspections. While large firms have compliance teams, MSMEs often struggle with documentation-heavy processes.

4. Sectoral Inclusion Under PLI

Not all sectors are covered. Gems and jewellery, handicrafts, and agricultural commodities — which are traditionally strong in the MSME sector — are outside the PLI scheme. These exporters must rely on other small business export schemes, such as RoDTEP (Remission of Duties and Taxes on Export Products) or MEIS (Merchandise Exports from India Scheme).

5. Export Finance for MSMEs (ECGC, CGTMSE)

Schemes like ECGC provide credit risk insurance on export receivables, while CGTMSE enables collateral-free loans, helping MSME exporters access funding and protect against payment risks.

Practical Tips for MSMEs to Leverage PLI

Even with limitations, MSMEs can adopt smart strategies to capture value from PLI.

- Form Strategic Partnerships

- MSMEs should align with large PLI beneficiaries as suppliers, subcontractors, or logistics partners. This ensures steady demand and integration into global supply chains.

- MSMEs should align with large PLI beneficiaries as suppliers, subcontractors, or logistics partners. This ensures steady demand and integration into global supply chains.

- Invest in Technology Upgradation

- Use available subsidies for automation, R&D, and digitalisation. Modernising production helps MSMEs compete globally and meet the strict quality requirements of PLI-backed industries.

- Use available subsidies for automation, R&D, and digitalisation. Modernising production helps MSMEs compete globally and meet the strict quality requirements of PLI-backed industries.

- Focus on Niche Exports

- Instead of competing in mass markets, MSMEs should target high-demand niches such as organic processed foods, technical textiles, or EV components, which have direct synergies with PLI sectors.

- Instead of competing in mass markets, MSMEs should target high-demand niches such as organic processed foods, technical textiles, or EV components, which have direct synergies with PLI sectors.

- Strengthen Raw Material Procurement

- Building resilient procurement networks ensures stability and cost efficiency. Local sourcing reduces import dependence and improves eligibility for supply chain localisation programs.

- Building resilient procurement networks ensures stability and cost efficiency. Local sourcing reduces import dependence and improves eligibility for supply chain localisation programs.

- Leverage Credit and Finance Schemes

- MSMEs should actively use funding options for MSME exporters like ECGC support, SIDBI schemes, and export credit from banks. Adequate financing is essential for scaling production.

- MSMEs should actively use funding options for MSME exporters like ECGC support, SIDBI schemes, and export credit from banks. Adequate financing is essential for scaling production.

- Compliance Preparedness

- Maintain consistent financial records, align GST/IEC filings, and ensure ease of doing business compliance to avoid rejections during government audits. Investing in basic ERP/accounting systems can ease the compliance burden.

7. Export market diversification for MSMEs

- Export market diversification is essential for MSMEs looking to grow sustainably. By exploring new markets and targeting new buyers, exporters reduce dependence on a single country and spread business risk. Selling across multiple countries helps MSMEs achieve stable growth, adapt to changing demand, and unlock new revenue opportunities in global trade.

Conclusion

The Production Linked Incentive Scheme is a game-changer in India’s industrial policy. For MSMEs, direct participation is challenging due to the PLI scheme’s eligibility requirements, which often necessitate high capital and scale. However, the indirect opportunities are immense.

By becoming part of the PLI supply chain ecosystem, MSMEs can benefit from localised procurement, technology transfers, and long-term export contracts. In this era where we have ease of doing business for exporters, you can definitely use schemes like PLI. With careful planning that focuses on value addition in exports, MSME credit access, backwards and forward linkages, and raw material procurement, small businesses can thrive.

The real strength of PLI lies not just in boosting big corporations but in catalysing a broader transformation where small exporters adapt, innovate, and integrate into global supply chains. If MSMEs leverage these opportunities well, they will not only generate employment but also secure India’s position as a leading manufacturing and export powerhouse.

Frequently Asked Questions

MSMEs are central to India’s exports, and while PLI scheme for MSME is limited, they drive MSME growth through PLI by supplying parts, raw materials, and services in the PLI supply chain ecosystem, creating value addition in exports and generating employment.

Direct participation is difficult because production-linked incentives for the MSME sector usually demand high investment, but small exporters can still benefit from small business export schemes and by working with PLI beneficiaries as vendors in export-oriented manufacturing units.

The government supports MSMEs with funding options for MSME exporters like ECGC export credit, CGTMSE guarantees, SIDBI technology loans, and priority lending, all aimed at improving MSME credit access and enabling raw material procurement and capacity expansion.

The key exporting challenges for small businesses include high capital thresholds, compliance audits, limited sectoral inclusion under PLI, difficulties in raw material procurement, and the pressure to meet international quality standards.

The best tips for MSMEs to export are to partner with PLI-approved firms, upgrade technology with subsidies, focus on value addition in exports, secure finance through Indian government support for MSMEs, and align operations with the ease of doing business India reforms.