The United Arab Emirates, particularly Dubai, has emerged as one of the largest and fastest-growing markets for fashion and textiles in the Middle East. With its strategic geographic location, thriving retail industry, and tax-friendly policies, Dubai presents a lucrative opportunity for Indian exporters. If you are planning to export apparel to Dubai, understanding the regulations, documentation, and compliance requirements is critical for successful operations.

This comprehensive guide provides a detailed step-by-step process on how to export apparel to Dubai, covering essential aspects like apparel export documentation in India, shipping documents for garment export, customs clearance, VAT regulations, and import duties.

Why Export Apparel to Dubai from India

India is among the world’s top textile and garment manufacturers, known for its wide product variety, skilled workforce, and competitive pricing. Dubai, on the other hand, is a global business hub that caters to both high-end and mass-market apparel. Indian exporters can benefit significantly from this trade route due to:

- High demand for ethnic, formal, and casual wear in Dubai

- Absence of import quotas

- Streamlined customs procedures

- Re-export opportunities to other GCC and African countries

Given these advantages, many exporters are choosing to export apparel to Dubai as a primary business strategy to expand globally.

Step-by-Step Process to Export Apparel to Dubai

1. Set Up Your Export Business Legally in India

Before initiating the export process, your business must be registered and compliant with the regulatory requirements in India. Here’s what you need:

- Import Export Code (IEC): Mandatory for all exporters and issued by the Directorate General of Foreign Trade (DGFT).

- GST Registration: Required for domestic tax compliance and claiming export benefits.

- Registration with Apparel Export Promotion Council (AEPC): Helps in availing government incentives and participating in international trade fairs.

- Bank account with an Authorized Dealer (AD) category bank for forex transactions.

Without a valid IEC, you cannot legally export apparel to Dubai or any other country.

2. Understand Apparel Export Documentation in India

Proper and complete documentation is one of the most critical steps in the process. The following documents are commonly required for apparel export documentation in India:

- Commercial Invoice for Clothing Export: A detailed invoice outlining the buyer and seller information, description of goods, quantity, unit value, total price, currency, incoterms (e.g., FOB, CIF), and terms of payment.

- Packing List for Textile Export: Contains the physical details of the shipment, such as carton count, item-wise packing details, dimensions, gross/net weight, and packaging type.

- Certificate of Origin for Exports: Issued by the Chamber of Commerce or export promotion council to prove the Indian origin of the garments. It may be mandatory to avail of preferential duty benefits in Dubai under specific trade agreements.

- Shipping Documents for Garment Export: Include the Bill of Lading (for sea freight) or Airway Bill (for air freight), insurance certificate, and shipping instructions.

- Export Declaration Form (EDF): Required to declare the export of goods from India.

Meticulous attention to these documents ensures that your shipment is not held up during the Dubai customs clearance process.

3. Determine the Correct HS Code for Garments Export

Every export item must be categorized under the Harmonized System (HS) of coding. The HS code for garments export helps customs authorities in both India and Dubai determine:

- The type of garment (e.g., men’s shirts, women’s dresses, baby clothing)

- Applicable import duties and taxes

- Regulatory controls, if any

For example:

- HS Code 6203.42 applies to men’s or boys’ cotton trousers

- HS Code 6109.10 applies to cotton T-shirts

Using incorrect HS codes can result in penalties, shipment delays, or even product seizures. It’s advisable to verify the codes through the DGFT portal or a customs broker.

4. Ensure Compliance with UAE Regulations

To legally export apparel to Dubai, your products must comply with the UAE’s import rules and standards. One of the key requirements is the Certificate of Conformity Dubai, which certifies that your garments meet the UAE’s health, safety, and quality standards.

The Emirates Authority for Standardization and Metrology (ESMA) mandates conformity for certain textile and apparel categories. Some products may also require:

- Fiber content labeling

- Washing and care instructions

- Size and origin labels

- Flammability and toxicity tests

Apparel shipments lacking proper conformity certification may be rejected or returned by Dubai customs.

5. Choose the Right Shipping Method and Prepare Documents

Depending on your order size, budget, and urgency, you can choose between:

- Air Freight: Fast but expensive; suitable for high-value or time-sensitive shipments.

- Sea Freight: More economical; suitable for bulk orders.

You must ensure that all shipping documents for garment export are accurately prepared and attached to the shipment. These include:

- Bill of Lading or Airway Bill

- Export Invoice

- Packing List

- Certificate of Origin

- Certificate of Conformity

- Insurance Certificate

These documents are submitted to customs and also shared with the buyer in Dubai for import processing.

6. Dubai Customs Clearance Process

Upon arrival in Dubai, the shipment enters the Dubai customs clearance process, which is facilitated by Dubai Customs. The importer (or your appointed customs agent) must submit:

- Import Declaration Form

- Original shipping documents

- HS code confirmation

- Payment receipts for duties and VAT

- Certificate of Conformity (if required)

Clearance is usually fast if all documentation is correct and complete. Any discrepancies can delay the process or incur penalties.

7. Calculate the Import Duty on Clothes in Dubai

When you export apparel to Dubai, you should account for the import duty on clothes in Dubai, which typically stands at 5% of the CIF (Cost, Insurance, Freight) value of the goods. However, if your shipment qualifies under a Free Trade Agreement or is re-exported through Dubai’s free zones, the duty may be reduced or waived.

Always confirm with Dubai Customs or your local agent to get the latest duty structure based on HS codes and product type.

8. VAT in UAE on Textile Imports

In addition to customs duty, the UAE levies a 5% Value Added Tax (VAT) on most imported goods, including textiles and garments. The VAT in the UAE on textile imports is calculated on the sum of the CIF value plus the import duty.

Exporters must be aware that the VAT is usually borne by the importer, but it influences overall pricing and must be reflected in their trade contracts or commercial invoice.

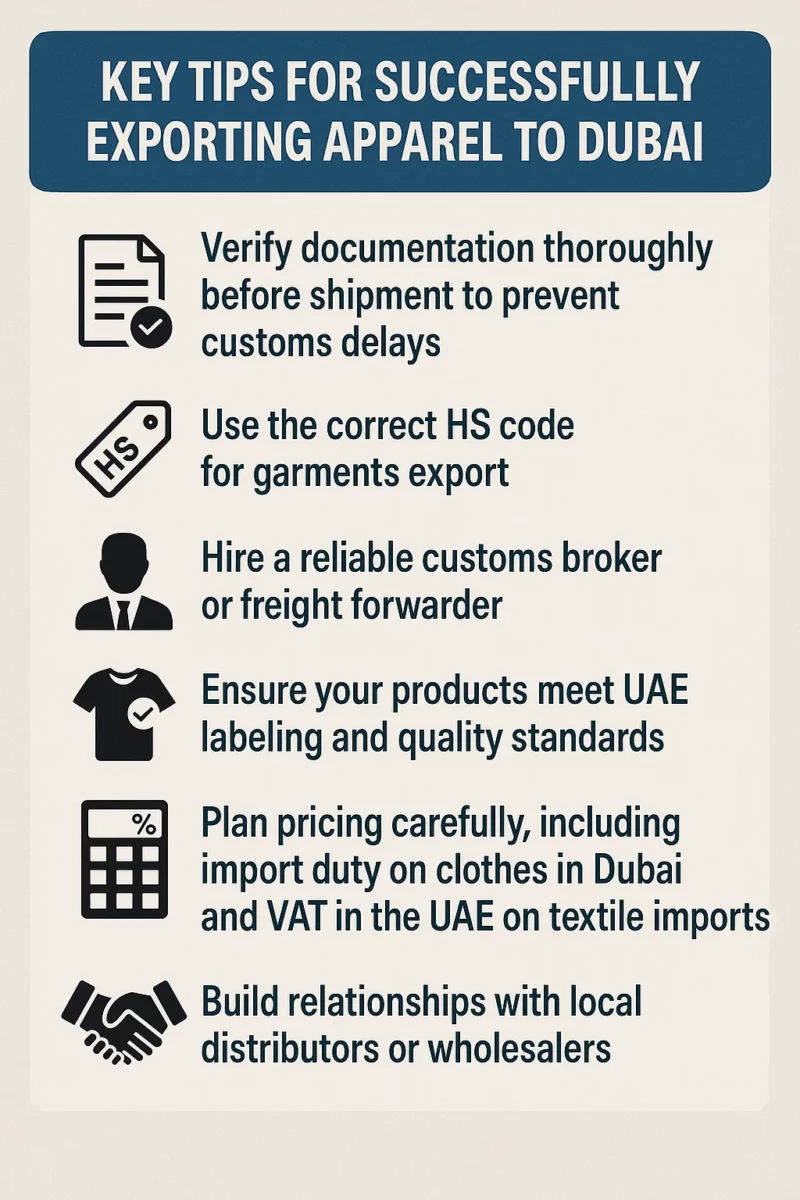

Key Tips for Successfully Exporting Apparel to Dubai

- Verify documentation thoroughly before shipment to prevent customs delays.

- Use the correct HS code for garments export for accurate duty and VAT calculations.

- Hire a reliable customs broker or freight forwarder who understands the Dubai customs clearance process.

- Ensure your products meet UAE labeling and quality standards and obtain the certificate of conformity in Dubai, where applicable.

- Plan pricing carefully, including import duty on clothes in Dubai and VAT in the UAE on textile imports, to maintain profitability.

- Build relationships with local distributors or wholesalers in Dubai to grow your presence in the market.

Conclusion

The decision to export apparel to Dubai can be a significant turning point for Indian garment manufacturers and exporters. With strong bilateral trade ties, efficient logistics, and robust demand, Dubai remains one of the best markets to explore. However, success lies in mastering the end-to-end process, from apparel export documentation in India to customs clearance in Dubai.

By following this detailed step-by-step process, you can reduce risks, minimize delays, and establish a profitable garment export business from India to Dubai.

If you’re new to exporting or unsure about the documentation and compliance process, consider working with an export consultant or freight forwarder who specializes in Middle East markets.

FAQs

You’ll need a commercial invoice for clothing export, a packing list for textile export, a certificate of origin for exports, shipping documents for garment export, and possibly a certificate of conformity in Dubai.

It includes exporter/importer details, HS code, product description, quantity, unit price, total cost, and Incoterms like FOB or CIF.

The HS code for garments export classifies apparel types for customs. It determines applicable import duty on clothes in Dubai and VAT in the UAE on textile imports.

Yes, the certificate of origin for exports proves the garments are made in India and may qualify for duty benefits in the UAE.

The certificate of conformity from Dubai certifies that garments meet UAE safety and quality standards. It is mandatory for certain textile products.