Let’s say you’re Ananya, a freelance content writer based in Bangalore. You just wrapped up a project for a marketing agency in the UK and sent them an invoice for £1,000. A week later, you get a message from your bank:

“We’ve received the foreign inward remittance. Please share the purpose code for processing FIRC.”

You pause. FIRC? Purpose code? Why does your bank suddenly sound like a compliance officer?

If that sounds familiar, you’re in the right place. Whether you’re a freelancer, exporter, business owner, or anyone receiving money from abroad, understanding FIRC—the Foreign Inward Remittance Certificate, is essential.

Let’s walk through it, step-by-step.

What is FIRC

FIRC stands for Foreign Inward Remittance Certificate. It’s an official document issued by your bank that confirms you’ve received a payment from a foreign source into your Indian bank account.

Think of it as your legal proof that foreign currency came into India—and more importantly, into your account for a valid reason.

It doesn’t matter if you’re an individual freelancer, a startup, or an established exporter. If you’re receiving international payments, your FIRC is one of the most important compliance documents you’ll deal with.

Why is Foreign Inward Remittance Certificate Important

Banks, the RBI, and tax authorities all require a paper trail for foreign currency entering the country. Your FIRC provides that trail.

Here’s why it matters:

- It acts as proof of inward remittance for tax and audit purposes.

- It’s needed for claiming export benefits and incentives (especially for exporters of goods or services).

- It’s often required while applying for GST refunds on exports.

- It may be requested for regulatory compliance, foreign investment filings, or visa applications.

In short, your Foreign Inward Remittance Certificates proves that your foreign income is legitimate, properly classified, and officially recorded.

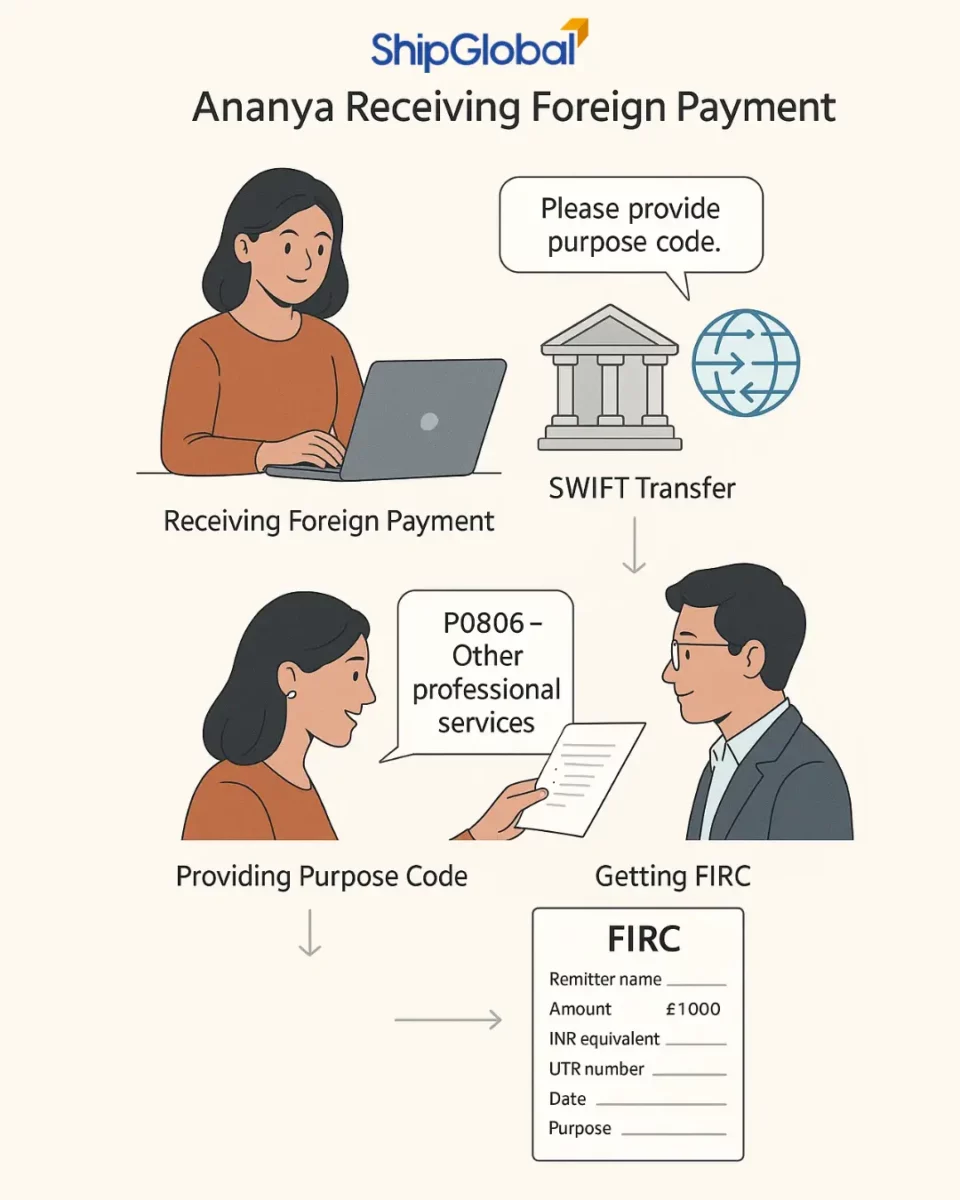

Real-Life Scenario: Ananya’s FIRC Journey

Let’s go back to Ananya. She’s done with her work, her UK client pays the invoice, and she receives a credit of £1,000 (converted to INR) in her bank account.

Now what?

- The bank receives the foreign remittance through a SWIFT transfer.

- The transaction is marked for compliance, and the bank sends Ananya a request to share a “purpose code.”

- Ananya checks with her CA and replies: “P0806 – Other professional services.”

- Once the bank gets the correct code, it generates the FIRC.

- The FIRC includes details like the name of the remitter, amount, currency, equivalent INR amount, UTR number, date of credit, and the purpose of the payment.

Now Ananya has a formal document that proves her UK client paid her, and that she received the money legally in India.

What Information Does an FIRC Contain

A typical Foreign Inward Remittance Certificate will have:

- Name and address of the beneficiary (you)

- Name and address of the remitter (the client)

- Date of remittance and date of credit

- Amount in foreign currency and equivalent INR

- Mode of receipt (SWIFT, etc.)

- Purpose of the remittance (based on the RBI’s purpose code)

- UTR (Unique Transaction Reference) number

- Name of the Authorized Dealer (the bank)

Who Issues the FIRC

Only banks that are licensed as Authorized Dealers (AD) Category I by the RBI can issue FIRCs. This includes most major banks in India like ICICI, HDFC, SBI, Axis, and others.

The certificate is issued after the bank verifies the transaction, purpose code, and relevant compliance documentation.

Paper FIRC vs. Electronic FIRC (e-FIRC)

Traditionally, FIRCs were issued as physical documents. But most banks now issue electronic FIRCs (e-FIRCs), which are just as valid but delivered digitally, either by email or through the bank’s online portal.

e-FIRCs are faster, easier to track, and don’t require manual stamping or signing.

What Triggers the Need for an FIRC

Any time you receive foreign currency in India for:

- Export of Goods: When you ship products overseas and receive payment in foreign currency, your bank issues an FIRC to validate the inward remittance. This proof is often required for GST refunds and export incentives.

- Export of Services: If you provide professional services (like marketing, design, or consulting) to a foreign client and get paid in USD, EUR, GBP, or any other foreign currency, you’ll need an FIRC to confirm the inflow.

- Software Development: Payments from international clients for software development, app building, SaaS subscriptions, or IT maintenance fall under service exports. FIRCs are required to prove these earnings for taxation and compliance.

- Consulting or Freelancing: Freelancers working with clients abroad—such as designers, writers, or consultants, must obtain FIRCs for foreign payments to show that the money was legitimately earned.

- Licensing or Royalties: If you license software, patents, trademarks, or content to overseas companies and receive royalty payments, you need FIRCs to certify these earnings.

- Business Investments from Abroad: Any business that receives equity investment, venture capital, or shareholder funding from abroad must secure an FIRC to prove the legitimacy of the funds to the RBI and other regulators.

you’ll likely need an FIRC. Even if your client doesn’t ask for it, your tax advisor or the government might.

How to Request an FIRC from Your Bank

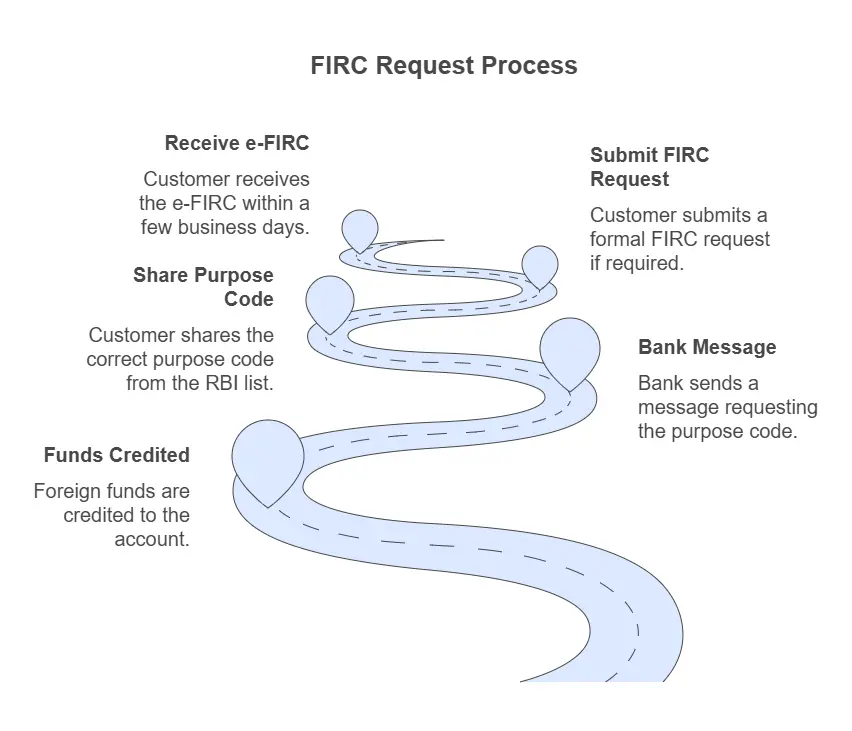

Each bank has its own process, but the typical steps are:

- Wait for the foreign funds to be credited.

- Check for a message from your bank requesting the purpose code.

- Share the correct purpose code from the RBI list.

- If required, submit a formal FIRC request (some banks have online forms).

- Receive your e-FIRC within a few business days.

Some banks may charge a nominal fee for issuing an FIRC.

Can You Skip the FIRC

Technically, if you’re not claiming any government benefits, refunds, or deductions, and if your CA isn’t asking for it you might not need an FIRC for every transaction.

But in most professional and export scenarios, it’s safer to have it. It’s your official record, and it keeps your documentation clean.

Final Thoughts

If you’re receiving payments from abroad, don’t ignore the FIRC. It’s not just a bureaucratic document—it’s your proof of legitimacy, your ticket to benefits, and your shield during audits.

Understand it, request it when needed, and store it safely.

Whether you’re a creative professional like Ananya, an IT consultant, or a business owner, knowing how FIRC works puts you one step ahead when it comes to compliance and financial clarity.

FAQs

A purpose code indicates the reason you received the foreign payment. The Reserve Bank of India (RBI) requires this to classify the transaction correctly. For example, “P0806” is for professional services.

Refer to the RBI’s official list of purpose codes or consult your Chartered Accountant (CA) to identify the correct one based on the nature of your work or service.

FIRCs are issued by Authorized Dealer (AD) Category I banks in India, like ICICI, HDFC, SBI, Axis, etc., after verifying compliance documents and the purpose code.

If you’re not claiming government incentives or filing regulatory documents, and your CA doesn’t require it, you might skip it. However, it’s best practice to request and keep it for all foreign transactions.

No. A BRC (Bank Realisation Certificate) is mainly used in exports of goods and services and is issued after realizing foreign payment. Sometimes, an e-FIRC can be submitted as supporting evidence while applying for a BRC.

Usually within 3–7 business days after submitting the correct purpose code and request. Timelines vary by bank.