As a Shopify seller, going global is an exciting milestone. The idea of reaching new markets, growing your customer base, and scaling your business can be incredibly rewarding. However, one challenge that often catches sellers off guard is tax compliance.

Whether you’re venturing into the U.S., Europe, Australia, or anywhere else, expanding globally introduces a whole new layer of tax obligations.

Fortunately, the right tax and compliance tools for Shopify can help you navigate the complexities of cross-border regulations with confidence and efficiency.

Why Shopify Tax Compliance Matters More Than Ever

Expanding your Shopify store internationally is no longer just about translating your product descriptions or setting up international shipping.

Once you start selling to customers in different regions, you also become subject to those regions’ tax laws. This includes VAT (Value-Added Tax), GST (Goods and Services Tax), and state or federal sales tax requirements.

Imagine this scenario: You’re based in the U.S., and you’ve just made your first sale in Germany. You might not realize it, but that one sale may mean you’re required to register for VAT in Germany, file returns, and pay taxes. And if you’re selling digital goods, the tax laws become even more complex, as many countries have special rules for digital products.

This is why using international tax tools for Shopify is crucial. These tools ensure that your store is charging the correct tax rates, generating compliant invoices, and filing the appropriate reports. Without them, you risk penalties, delayed shipments, or even the suspension of your store in some regions.

Cross border tax compliance isn’t optional; it’s essential. Using global tax automation for eCommerce makes sure you’re not only following regulations but also building a business that’s sustainable and scalable.

Top Tax and Compliance Tools for Shopify

Now that we understand why tax compliance is important, let’s dive into the top tools that can help Shopify sellers like you stay compliant while scaling globally.

Avalara: The Global Powerhouse

Avalara is widely regarded as one of the most comprehensive e-commerce tax software platforms available.

It supports real-time tax calculation and compliance across more than 190 countries. What makes Avalara stand out is its ability to handle complex scenarios, including managing nexus in the U.S., VAT and GST in Europe and Asia-Pacific, and even digital goods tax compliance.

Avalara automates tax calculation at checkout, ensuring your customers are always charged the correct amount based on their location.

It also automates the preparation and filing of tax returns, reducing the time you spend on administrative tasks. In addition, Avalara can generate tax-compliant invoices, making it a full-service solution for global tax automation for eCommerce.

If you’re a high-volume Shopify seller expanding rapidly across multiple markets, Avalara is a top-tier choice.

Its robust features and global reach make it ideal for cross-border tax compliance and international tax tools for Shopify.

Quaderno: VAT/GST Compliance Made Simple

Quaderno is another excellent solution for Shopify VAT solutions, especially if you are expanding into Europe or other VAT/GST jurisdictions like Australia and Canada.

The tool is designed to automate every aspect of VAT/GST compliance, from calculating taxes at checkout to generating compliant invoices and filing tax reports.

One of Quaderno’s standout features is its ease of use. It integrates seamlessly with Shopify and provides a dashboard where you can monitor your tax obligations in real time.

The platform automatically validates VAT numbers, applies the correct tax rates based on customer location, and supports multiple currencies and languages.

For small to mid-sized businesses looking for a user-friendly and cost effective solution for VAT/GST compliance for Shopify, Quaderno is an excellent option. It covers the crucial aspects of Shopify tax compliance with minimal effort.

TaxJar: Sales Tax Automation for U.S. Sellers

TaxJar, now part of Stripe, is one of the best Shopify sales tax apps for U.S.-based sellers. The platform is designed to handle the intricacies of U.S. sales tax, which vary widely by state and even by municipality.

TaxJar automatically calculates the correct sales tax rate based on the buyer’s address and your nexus.

It also features AutoFile, which can automatically file your returns in multiple states. This is especially helpful if you’re selling across state lines and need to file in several jurisdictions. TaxJar’s dashboard provides a clear view of where you owe taxes and helps you stay ahead of filing deadlines.

If your primary market is the United States, TaxJar is an indispensable tool for managing tax compliance for online retailers. It’s one of the most widely used Shopify tax filing solutions available.

Sovos: Enterprise Grade Compliance

Sovos is a comprehensive compliance platform that offers enterprise-grade solutions for businesses selling in multiple countries.

The tool is built to handle every aspect of tax compliance, including VAT, GST, and digital tax obligations. It supports invoice validation, e-filing, and audit-ready reporting.

What sets Sovos apart is its focus on enterprise-level needs. It offers advanced analytics, risk management tools, and integration with ERP systems. This makes it ideal for large Shopify stores with complex operations and high transaction volumes.

Sovos may be more than what a small business needs, but it offers unparalleled support for global tax automation for eCommerce and cross-border tax compliance for larger sellers.

Taxually: Your EU VAT Companion

Suppose Europe is part of your growth strategy. In that case, Taxually is a VAT-specific compliance tool that helps Shopify sellers register, report, and file VAT across the European Union and other VAT regions.

It simplifies the often-complex process of cross-border tax compliance by centralizing all your VAT registrations and filings in one dashboard.

Taxually supports VAT registration in countries like the UK, Germany, France, Spain, and more. It provides threshold alerts to let you know when you need to register in a new country and generates all necessary reports for your VAT returns.

For Shopify sellers focusing on Europe, Taxually is a fantastic choice for VAT/GST compliance for Shopify. It ensures you’re covered with international tax tools for Shopify that are designed specifically for the EU market.

Bonus Tools for Shopify Tax Compliance

Aside from the major platforms mentioned above, other niche tools can be incredibly useful depending on your business model:

- Exemptify: Helps manage tax exemptions for B2B transactions.

- SimpleTax: A lightweight tool for managing simple VAT filings.

- Xero and QuickBooks integrations: While not tax tools per se, integrating with accounting software can streamline your reporting and reconciliation, helping you meet Shopify tax filing requirements.

Each of these tools adds another layer of control, particularly for businesses with unique tax obligations or simplified workflows.

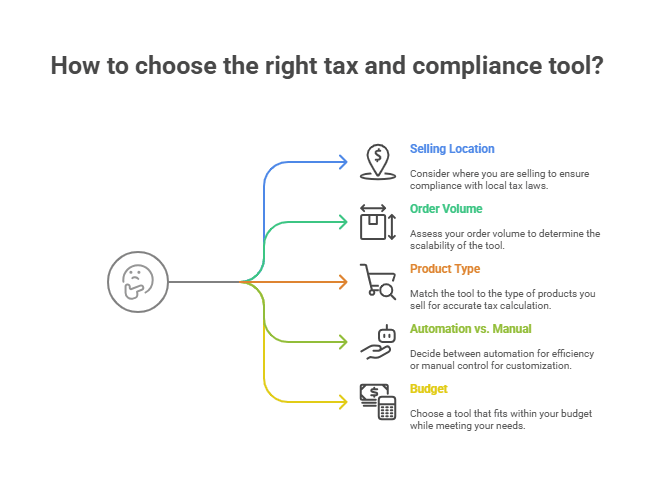

How to Choose the Right Tax and Compliance Tool

With so many tax compliance software options available, choosing the right tool can feel overwhelming. Use the questions below to narrow down the best Shopify tax automation solution for your business.

If your primary markets are in the U.S., TaxJar might be all you need for Shopify tax automation. For European expansion, consider Quaderno or Taxually.

High-volume sellers should look at enterprise-grade tax compliance software like Avalara or Sovos.

Digital products often have different tax rules. Make sure your Shopify tax automation tool supports digital goods tax compliance.

Some Shopify tax automation solutions offer full automation like AutoFile, while others provide more manual oversight.

Tools like Sovos are powerful but may be overkill for smaller stores. Balance features with affordability when selecting tax compliance software.

Conclusion: Scale Smart, Stay Compliant

Expanding your Shopify store globally opens up new opportunities, but it also adds complexity, especially when it comes to taxes. With tools like Avalara, Quaderno, TaxJar, Sovos, and Taxually, you can manage your tax obligations confidently and efficiently.

These platforms are purpose-built for Shopify tax compliance, offering real-time calculations, invoice generation, automated filings, and more. By investing in the right tax compliance solution, you’re not only protecting your business from legal issues but also freeing up time and resources to focus on what matters: growth.

So, whether you’re just starting your international journey or already shipping globally, make sure you’re equipped with the best tools for tax compliance. Your future self and your bottom line will thank you.

Remember, staying compliant isn’t just about avoiding fines, building trust with your customers and creating a sustainable, scalable business. Choose the right e-commerce tax software today and scale with confidence tomorrow.

FAQs

Tax compliance tools help Shopify sellers stay compliant with tax regulations in different regions, including calculating correct rates, filing returns, and generating legal invoices. Without them, you risk legal penalties and missed tax obligations.

TaxJar is widely considered one of the best Shopify sales tax apps for U.S.-based sellers due to its automation features and support for multiple states.

Yes, tools like Quaderno and Taxually are excellent for Shopify VAT solutions and are tailored for VAT/GST compliance for Shopify across European countries.

Platforms like Avalara and Sovos offer robust support for digital goods tax compliance, which is crucial if you sell downloadable or digital products.

While these tools automate much of the tax process, having an accountant can be helpful, especially for strategic planning and handling edge cases or audits.

Shopify’s native tax features are helpful but limited. For full cross-border tax compliance and advanced reporting, dedicated tax tools are highly recommended.