Let’s face it — when you hear the words “reciprocal tariffs”, your first reaction is probably something like, “Uh-oh, here we go again.” And honestly, that’s fair. Tariffs usually mean more costs and more stress, especially when they come out of the blue with no warning, no discussion, and no exceptions.

That’s exactly what happened on April 2nd, when US President Donald Trump made a surprise announcement: a flat 26% tariff on all imports from India. No soft landing, no special treatment — just a full-blown tariff bomb dropped on one of America’s biggest trade partners.

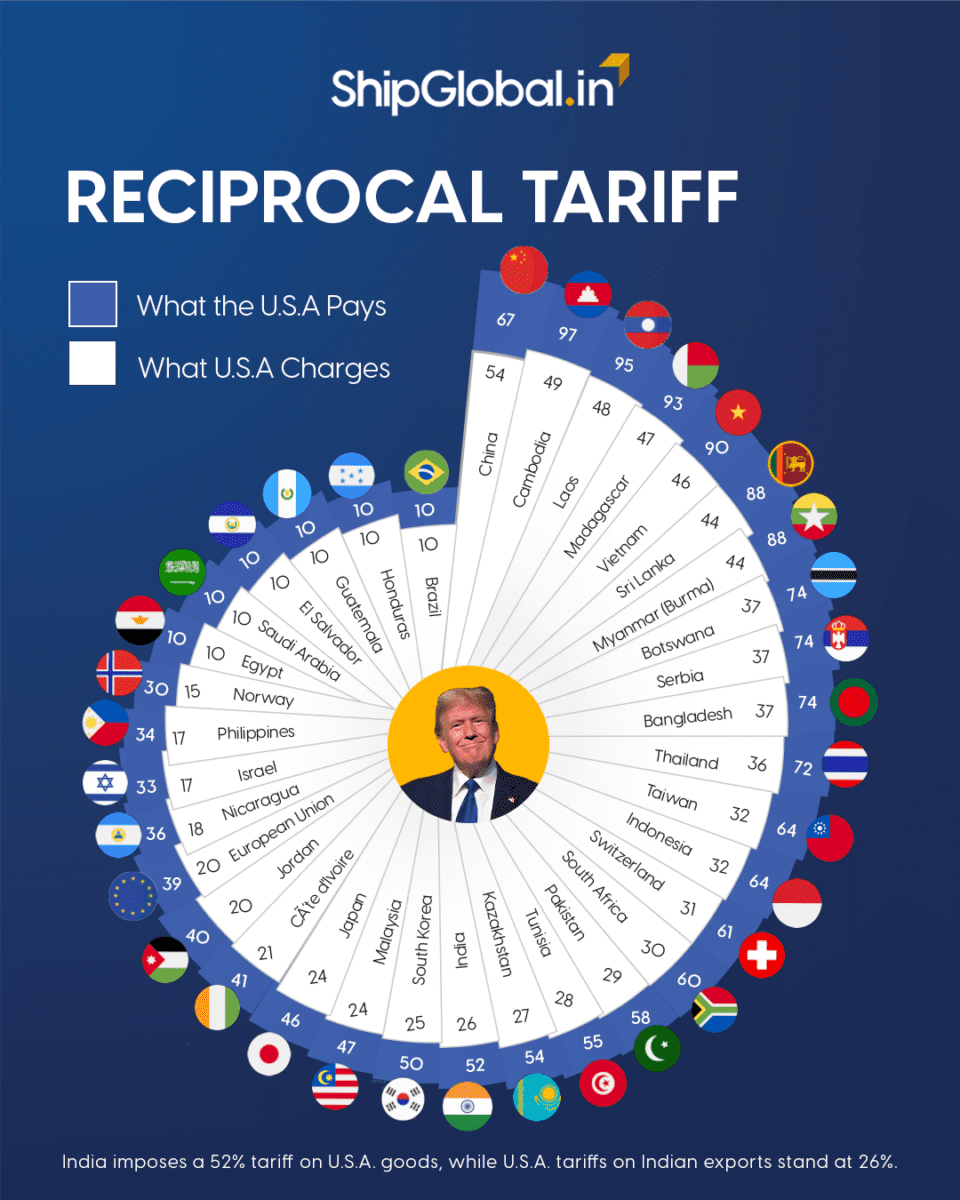

For context, that’s higher than what the US imposed on Japan (24%), South Korea (25%), and even the European Union (20%). Only China got hit harder, with a massive 67% tariff — a clear example of how shifting global trade dynamics are redrawing traditional trade routes.

Now, if you’re an exporter in India, this might sound like terrible news. And yes, the immediate reaction in the stock market was brutal. The Sensex dropped by over 500 points. The rupee weakened.

Everyone felt the heat. But here’s the thing: if you take a step back and look at the bigger picture, this situation might not be all bad. It could open some surprising doors for Indian businesses, especially in areas where competitive advantage can be leveraged.

This blog is for those who want to find the silver lining — for manufacturers, exporters, and entrepreneurs who believe in turning challenges into opportunities. We’ll break down what these tariffs mean, how different sectors are affected, and most importantly, how Indian exporters can still come out ahead through smart trade negotiation strategies and sector-specific export enhancement.

So, let’s not panic, let’s plan. Let’s understand what’s going on and how we can use this shift in global trade dynamics to our advantage.

Understanding the Reciprocal Tariff Landscape: How Bad Is It?

The new tariff policy isn’t just aimed at India, it’s a global shake-up. Over 180 countries are affected, with a new 10% baseline tariff and additional country-specific rates. India’s tariff has been set at 26%, which is higher than what countries like the EU (20%), Japan (24%), and South Korea (25%) are facing, but still far below China’s massive 67%.

At first glance, this might sound like a serious blow to India’s export potential. But if we take a closer look, there’s more to the story. Indian exporters have proven time and again that they can adapt — whether it’s through product diversification, tapping into government support schemes, or finding new buyers in global markets.

These trade policy implications could become a nudge in the right direction, pushing Indian businesses to explore better positioning, build deeper supply chain relationships, and expand in areas where we now have a cost or policy edge over competitors like China, Vietnam, or Bangladesh.

This is not the time to slow down it’s a moment to rethink, rework, and re-enter the US market with smarter strategies. Yes, the road just got a bit steeper. But for those ready to climb, the view from the top could be better than before — especially in light of India’s potential for manufacturing sector growth and stronger India-U.S. trade relations.

Trade War: What’s Happening Between the US and China Right Now (April 2025)

The United States and China are again locked in a heated trade war affecting global markets. This time, it’s more intense and widespread than before.

In early 2025, former U.S. President Donald Trump, who returned to office, announced new tariffs on all Chinese imports — starting at 10%, with some key products like electric vehicles and steel taxed as high as 60%. Trump claimed that China had been engaging in unfair trade practices and that these measures were necessary to protect American jobs and industries.

China quickly hit back. In April 2025, China raised tariffs on U.S. goods, increasing them from 84% to 125% on a wide range of American products — including energy, agriculture (like soybeans), and healthcare equipment. China stated that these countermeasures directly responded to the aggressive U.S. policies.

As a result, both countries are now charging very high taxes on each other’s imports, making goods more expensive and supply chains more complicated.

Big global companies like Apple, Nvidia, and Shein are already feeling the heat — shifting production, rethinking sourcing, and looking for more stable markets.

This situation has created uncertainty in the global trade ecosystem, but at the same time, it has opened up a huge opportunity for other countries, especially India, to step in as an alternative manufacturing and export hub.

Buyers in the U.S. and other markets are actively seeking non-China suppliers for products ranging from electronics and textiles to fashion and home goods.

The US-China trade tensions are far from over, and the decisions taken now could reshape international business for years to come.

A Sector Wise Breakdown

Let’s break it down because the impact of these reciprocal tariffs isn’t the same across every industry. While some sectors are likely to feel the pressure, others may find unexpected opportunities opening up based on current global trade dynamics.

1. Garments and Textiles

The Indian textile and garment sector might just be the biggest winner in this new tariff game. With Chinese apparel facing a steep 54% tariff and Bangladesh’s goods attracting 37%, India, even with a 26% rate, suddenly looks like a much more attractive sourcing option for US buyers.

Thanks to India’s well-developed textile ecosystem, a skilled workforce, and strong production capacity across states like Tamil Nadu, Gujarat, and Punjab, Indian exporters are in a solid position to grab market share. Large American retailers looking to reduce their dependency on China and diversify their sourcing are now eyeing India more seriously than ever.

This is a great time for Indian manufacturers to double down on quality, sustainability certifications, and faster turnaround times. The key lies in being visible, whether it’s through trade fairs, online B2B platforms, or direct outreach to buyers and leveraging India’s competitive advantage in this category.

2. Gems and Jewellery

Gems and jewellery are one of India’s top export categories to the US, accounting for over 11% of total exports. While the new 26% reciprocal tariff will impact pricing and margins, Indian exporters can still stay competitive, especially when comparing the situation with countries facing even harsher duties or higher production costs.

India has the advantage of skilled artisans, a global reputation for quality craftsmanship, and the ability to deliver both high-end and affordable jewellery. This is a sector where branding, design innovation, and product differentiation will be key. Customised collections, lightweight jewellery, and certified origin-based pieces could help Indian exporters maintain and even grow their presence in the American market.

Exporters may also look at increasing their presence on US marketplaces like Amazon, Etsy, or Walmart to sell directly to consumers a smart export enhancement tactic while avoiding some traditional B2B pressures.

3. Pharmaceuticals

The Indian pharmaceutical sector, which exports over $12 billion worth of medicines and healthcare products to the US, has managed to escape the immediate impact of the new reciprocal tariffs. This is a huge relief for companies that supply essential generics and affordable medicines to the American healthcare system.

However, the exemption may not last forever. It gives Indian pharma companies a window to strengthen their foothold, expand their product lines, and invest further in research and innovation. The global reputation of India’s pharma industry, especially in generics and biosimilars, is a strong asset in trade negotiation strategies and long-term economic diplomacy.

Firms should also look at enhancing FDA compliance, ensuring timely filings for new drug approvals, and improving production efficiency to stay ahead of any potential trade policy implications.

4. Electronics and Smartphones

While India also faces a 26% tariff here, competitors like Vietnam (46%) and Thailand (36%) are under heavier pressure. That, combined with India’s growing role in global electronics manufacturing — thanks to the Production-Linked Incentive (PLI) scheme creates a golden window of opportunity and drives manufacturing sector growth.

Companies like Apple, Foxconn, and Samsung have already expanded their presence in India. Exporters in this space should focus on scaling production of components, improving backend supply chains, and building stronger capabilities in testing and certification for global markets.

5. Machinery and Heavy Equipment

With tariffs on Chinese industrial goods reaching up to 54%, India’s machinery exporters now have a better chance of entering and expanding in the US market. Whether it’s tools, pumps, auto parts, or heavy equipment components, Indian manufacturers are already known for competitive pricing and quality.

To truly capitalise, businesses in this segment should consider forming export consortiums, offering after-sales support in the US, and tapping into state and central incentives under Make in India and PLI schemes to secure long-term tariff concessions.

6. General Manufacturing and Industrial Goods

Many of India’s top export categories, including refined petroleum products, electronics hardware, nuclear reactor components, and specialty chemicals, will need to absorb some short-term shocks. But with global supply chains shifting and a renewed focus on sourcing alternatives to China, Indian exporters have an edge if they stay agile.

The challenge here isn’t just about tariffs. It’s about understanding global trade dynamics, adjusting to trade policy implications, and positioning India as a reliable, quality-driven, and fast-moving supplier. Certifications, quality standards, and logistics partnerships will all play a crucial role in staying competitive under the new rules.

Policy and Diplomacy: India-U.S. Trade Relations

India has taken a thoughtful and steady approach to this situation. Instead of reacting with more tariffs on US goods, we’re choosing to talk it out and work towards a better trade deal. And honestly, that’s the smart move.

By focusing on building a strong and fair India-U.S. Trade Relationship, India is creating chances for lower tariffs in the future through trade negotiation strategies, new business opportunities between both countries, and long-term stability for our exporters through effective economic diplomacy.

At the same time, industry groups and exporters should also support this effort by sharing real examples of how smoother trade benefits both sides. These stories can help in getting better terms during the discussions and push for possible tariff concessions.

Why This Isn’t as Bad as It Looks

The overall impact of the 26% reciprocal tariff on India’s economy may not be as severe as it seems at first glance. Analysts point out that the most vulnerable Indian exports affected by this policy account for only around 1.1% of the country’s GDP. This suggests that while certain sectors may feel the pressure, the broader export ecosystem remains stable.

In addition, India’s trade surplus with the United States is relatively modest. This makes the possibility of a prolonged trade conflict or strong retaliatory action less likely. The current tariff move is significant, but not necessarily a sign of deeper economic strain between the two countries or an unmanageable shift in global trade dynamics.

Despite short-term challenges, the fundamental strengths of Indian exports continue to hold steady. India remains an important and reliable player in global supply chains, with advantages in cost, scale, and production capabilities. Several industries, including textiles, pharmaceuticals, and machinery, still have room to grow, especially as global buyers look to diversify their sourcing, offering scope for export enhancement and competitive advantage.

In short, while this development may disrupt certain trade flows and create short-term adjustments, it does not pose a serious threat to India’s long-term export potential. The situation calls for strategic responses rather than panic, and the current trade policy implications may still offer growth opportunities, even in the face of new tariffs.

Making the Most of It: A Strategic Playbook for Exporters

- Reframe challenges as opportunities: Especially in sectors where competing countries are worse off.

- Shift to value-added products: Compete not on price but quality, sustainability, and reliability.

- Strengthen US relationships: From trade shows to direct partnerships, visibility matters.

- Diversify risk: Explore emerging markets that are still under-tapped for Indian products.

These steps support export enhancement and fuel manufacturing sector growth in India, making the most of global market shifts.

Conclusion: Not Just Surviving, But Leading

While the new reciprocal tariff policy may have created concern across global markets, a closer look reveals that India is not among the worst hit. Countries like China are facing tariffs as high as 54–67%, while nations like Vietnam, Thailand, and Bangladesh are also dealing with significant rate increases. In comparison, India’s 26% tariff, though impactful, is relatively moderate, giving Indian exporters a unique chance to stay competitive and build a lasting competitive advantage.

India is being targeted, but not isolated. This creates an opportunity to focus on product improvement, supply chain efficiency, and market-specific strategies. Exporters that work on value addition, innovation, and sustainability can still find success in the US and other global markets. Sectors like textiles, pharmaceuticals, electronics, and machinery remain well-placed to take advantage of the current shifts in sourcing trends, especially as global buyers reduce their dependence on Chinese suppliers — a critical moment shaped by evolving global trade dynamics.

India’s strong manufacturing base, policy support through schemes like PLI, and its ability to adapt to changing trade policy implications place it in a better position than many other economies. With a stable approach to economic diplomacy and trade negotiation strategies, India is not only absorbing the shock it is also preparing to turn it into long-term gain.

This isn’t just a time to hold steady. It’s a chance to lead.

Happy Shipping!

Frequently Asked Questions

Reciprocal tariffs are extra charges on imports made to match the charges another country places on exports. The U.S. added a 26% tariff on Indian goods because it wants to match what other countries charge for U.S. products. India is one of many countries included in this new rule.

Exporters can focus on making better-quality products, explore new countries to sell to, and use government support schemes like PLI. They can also connect directly with buyers through trade shows or online platforms to stay competitive.

Industries like textiles, pharmaceuticals, electronics, and machinery are still in a good position. Since some other countries face even higher tariffs, Indian businesses have a better chance to grow if they plan smartly.