In cross-border logistics, KYC (Know Your Customer) isn’t just a formality; it’s what keeps your shipments moving and your payments flowing without hiccups. It verifies your identity, links your transactions to verified tax records, and fosters trust with customs, banks, and regulatory systems.

That’s exactly why ShipGlobal.in asks for your Company PAN card (India) during onboarding. Your Permanent Account Number (PAN) is the key that unlocks everything: your IEC (Importer Exporter Code), your GSTIN, and smooth financial operations. With PAN in place, you get faster filings, cleaner customs clearance, and timely refunds, so nothing slows down your export journey.

Did you know:

- The Directorate General of Foreign Trade (DGFT) requires a PAN to issue your IEC, without which you cannot export.

- The CBIC (Central Board of Indirect Taxes & Customs) mandates that all shipping documents for GST-registered exporters include GSTIN, which is directly linked to your PAN. So at every step, your PAN makes it all work.

What is a Company PAN and who needs it?

A Permanent Account Number (PAN) is a 10‑character alphanumeric identifier issued by India’s Income Tax Department. While individuals, firms, LLPs, trusts, and companies can all have PANs, here we focus on the Company PAN, the PAN allotted to a registered business entity. For exporters, this is the anchor for tax and trade compliance.

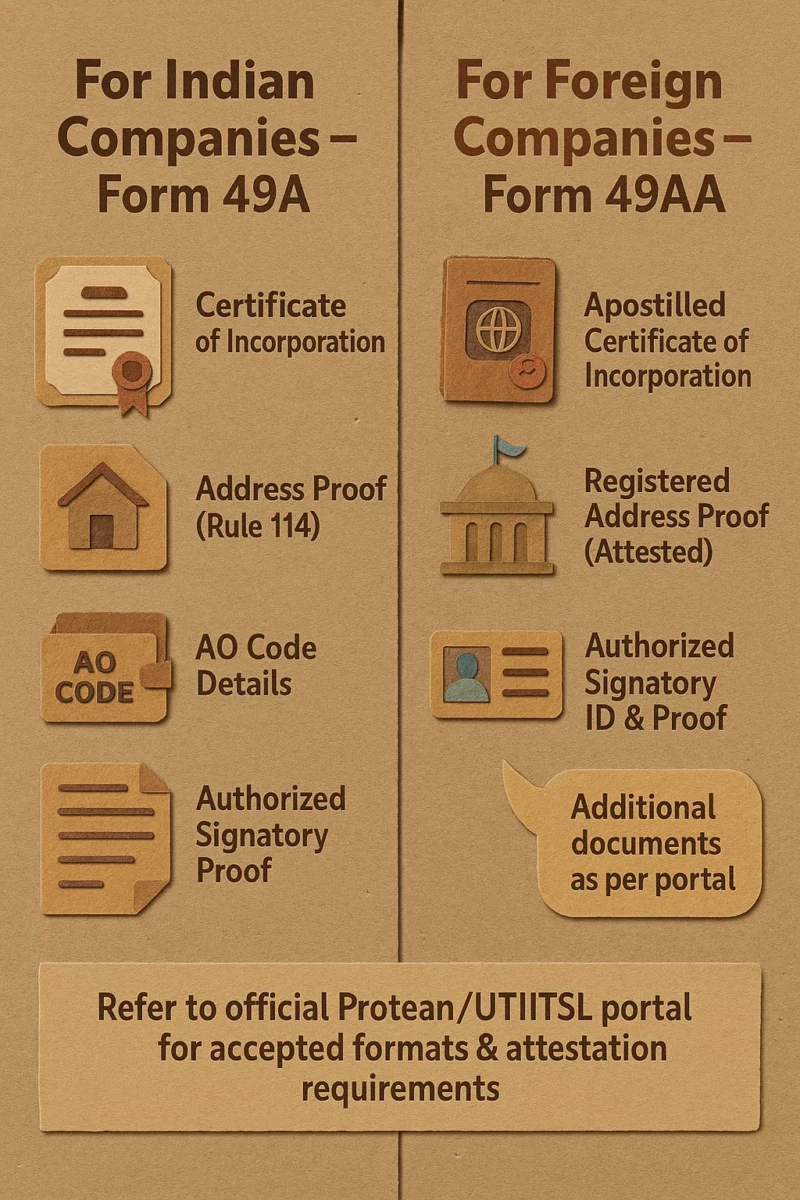

- Individuals vs companies: Individuals obtain a personal PAN; companies obtain a Company PAN using Form 49A (for entities registered in India). Foreign companies and non‑resident entities use Form 49AA. Both application paths are administered by authorised intermediaries like Protean eGov (formerly NSDL) and UTIITSL.

- NRIs and foreign entities: Form 49AA is the route for foreign citizens/entities. Documentation typically requires notarization or apostille/consular attestation (per Rule 114 documentation standards). This is especially relevant when a PAN for a foreign company doing business in India is needed – for example, investing in an Indian entity, earning India‑sourced income, or otherwise triggering Indian tax/compliance obligations.

PAN and IEC

Think of PAN as the first domino that enables the rest of your export stack:

- IEC depends on PAN

DGFT states clearly: “To apply for an IEC, PAN, bank account and valid address in the name of the firm is mandatory.” Without a valid PAN, you cannot obtain an IEC – so you cannot legally export goods. - PAN → GSTIN linkage

India’s GSTIN is a 15‑digit identifier built on State code + PAN. Your tax identity under GST is PAN‑based, which is why the GSTIN you quote in export documentation reflects your PAN. - Export refunds flow through GSTIN

IGST refunds rely on correct GSTIN declaration in shipping documents (as mandated by CBIC), ensuring data matches between Customs and GST systems. An accurate PAN‑linked GSTIN is thus essential to avoid refund delays.

Customs, Shipping, and PAN

PAN influences customs and shipping documentation in several ways:

- Shipping Bills and Bills of Entry: CBIC has mandated that GSTIN be declared in import/export documents (from 15 February 2020) for GST‑registered parties. Where GST doesn’t apply (e.g., fully exempt items), authorities have also guided that PAN (authorised as IEC) can suffice. In all cases, the chain traces back to PAN as the root identifier.

- ICEGATE and PAN mapping: Customs’ ICEGATE systems interface with IEC/GSTIN and maintain PAN‑based references for users, duty payments, and reconciliations, another reason your Company PAN must be cleanly recorded.

- TDS on foreign payments: Under Section 206AA, if a payee doesn’t furnish PAN, **tax must be withheld at the higher of the prescribed rate or 20%. Furnishing PAN helps ensure the correct (often lower) TDS applies, including under DTAA rates were eligible. There’s also a Rule 37BC relaxation for certain non‑residents if specified details are provided – but having a PAN remains the clearest path to avoid automatic 20% withholding and paperwork frictions.

How to apply for a Company PAN: Domestic & foreign businesses

| Category | Domestic Businesses (Form 49A) | Foreign Businesses / NRIs (Form 49AA) |

|---|---|---|

| Where to Apply | Protean eGov (NSDL) or UTIITSL — authorized by the Income Tax Department | Protean eGov (NSDL) or UTIITSL — authorized by the Income Tax Department |

| Application Form | Form 49A | Form 49AA |

| Documents Required | Certificate of Incorporation and entity details as per Rule 114 | Certificate of Registration/Incorporation; identity & address proofs apostilled or attested by Indian Embassy/Consulate or authorized bank officials |

| Submission Mode | Online via Protean eGov or UTIITSL | Online via Protean eGov or UTIITSL |

| e-PAN vs Physical PAN | e-PAN (PDF) accepted for KYC; faster to obtain. Physical PAN can be dispatched within India or abroad with applicable fees. | e-PAN widely accepted; physical PAN dispatch available internationally with applicable fees. |

| Processing Time | e-PAN: few days. Physical PAN: ~2–4 weeks in India (varies by documents & dispatch). | e-PAN: few days. Physical PAN: ~2–4 weeks or longer for international delivery. |

| Status Tracking | Track application and dispatch via Protean eGov or UTIITSL portals. | Track application and dispatch via Protean eGov or UTIITSL portals. |

Routes to apply

- Indian companies use Form 49A; foreign companies/NRIs use Form 49AA. Applications can be made online via Protean eGov or UTIITSL, both authorised by the Income Tax Department.

Documents and Attestation

- Indian entities (49A): Certificate of Incorporation and entity details per Rule 114.

- Foreign entities (49AA): Certificate of Registration/Incorporation; identity/address proofs duly apostilled or attested by an Indian embassy/consulate (or authorised bank officials), as per documentation rules.

Where to apply

- Protean eGov (NSDL): PAN application, forms download, and status services.

- UTIITSL: End‑to‑end PAN application and status tracking.

e‑PAN vs physical PAN

- e‑PAN (PDF) is widely accepted for KYC and can be faster to obtain; a physical PAN card can be dispatched to Indian or foreign addresses with applicable fees. UTIITSL provides reprint/dispatch fee details for India and overseas delivery.

Timelines (indicative)

- Processing timelines vary by completeness of documents and dispatch location. Practical guidance suggests e‑PAN can be issued faster (days), while physical cards are often delivered in 2–4 weeks domestically and can take longer internationally – plan accordingly and track status with the chosen provider. (Official portals provide application status and dispatch tracking.)

PAN checklist: Documents needed for Company PAN

To smooth approvals, prepare a clean PAN document checklist for companies:

- For Indian companies (49A):

- Certificate of Incorporation (Registrar of Companies)

- Company address proof (as per Rule 114)

- AO details (generated during the application process)

- Authorised signatory proof (Board resolution/authorisation, if prompted by the portal)

- Certificate of Incorporation (Registrar of Companies)

- For foreign companies (49AA):

- Certificate of Incorporation/Registration (apostilled/consular attested)

- Registered address proof (apostilled/attested)

- Authorised signatory identity & authority (apostilled/attested)

- Any additional proofs requested by the portal for Proof of Identity/Address under Rule 114(4)

- Certificate of Incorporation/Registration (apostilled/consular attested)

Refer to the official instructions for Form 49AA (Protean/UTIITSL) for accepted alternatives; the portal will specify exact formats and attestation requirements.

Why ShipGlobal.in requires PAN for KYC

At ShipGlobal.in, your Company PAN enables us to set up a fully compliant export profile that integrates with India’s tax and customs rails:

- PAN–GSTIN–IEC linkage in your profile: We connect your Company PAN with GSTIN (PAN‑based) and IEC (PAN‑required) so your shipments, invoices, and data match across DGFT, GST, and Customs systems, minimising mis‑matches that cause holds or refund delays.

- Fraud prevention and audit trail: PAN anchors your KYC to a government‑issued tax ID, improving verification and deterring misuse of identities in cross‑border flows.

- Real‑time documents and refunds: CBIC requires GSTIN in export documents for GST‑registered exporters; since GSTIN is PAN‑based, having a verified Company PAN keeps your documentation accurate and speeds up IGST refund reconciliation.

- Correct TDS handling on services: When you receive cross‑border service income or make certain foreign remittances, PAN helps ensure withholding follows the correct rate (and not the default 20% under Section 206AA). This clarity protects your margins and avoids avoidable disputes.

Conclusion

For Indian exporters, a Company PAN isn’t a formality; it’s your access pass to the entire export ecosystem:

- You cannot get an IEC without a PAN (DGFT rule).

- Your GSTIN is PAN‑based, and CBIC requires GSTIN in shipping documents for GST‑registered exporters.

- Customs and ICEGATE use PAN‑linked identifiers for filings, payments, and refunds.

- TDS outcomes are cleaner with PAN; without it, Section 206AA can enforce 20% withholding by default.

If you’re just getting started, apply for your Company PAN via Protean eGov or UTIITSL, assemble the right documents (apostilled where required), and link it to your IEC and GSTIN. Then, when you onboard with ShipGlobal.in, your KYC will be swift, your documentation consistent, and your refunds and reconciliations far smoother.

References & confirmations

- DGFT (IEC): PAN is mandatory to apply for IEC; IEC is required for import/export. DGFT

- CBIC (Customs): GSTIN (PAN‑based) must be declared in bills/shipping documents for GST‑registered exporters effective 15 Feb 2020. ieport.com

- PAN applications: Forms 49A/49AA, official instructions and portals via Protean eGov and UTIITSL. Protean eGov TechnologiesProtean eGov TechnologiesUTIITSL

- TDS without PAN: Section 206AA imposes higher withholding (up to 20%). Rule 37BC offers limited relief for specified non‑residents when details are furnished; PAN avoids the default hike. Saral ProKPMG India

Frequently Asked Questions (FAQ’s)

Form 49A is for companies, firms, or entities incorporated in India. This form is for foreign companies, NRIs, or entities not registered in India but who need a PAN—for example, for doing business in India, investing, or complying with Indian tax laws.

Yes, foreign companies can apply for a Company PAN using Form 49AA via authorised online portals like Protean eGov (NSDL) or UTIITSL. However, documents such as the Certificate of Incorporation, address proof, and identity of authorised signatory must be apostilled or consular attested before submission.

An e-PAN is a digitally signed PDF version of the PAN card and is widely accepted for KYC and compliance purposes.

A physical PAN card is the printed version that is mailed to your registered address. You can choose to receive either or both, depending on your preference and address type (Indian or foreign).

If all documents are in order, an e-PAN can be issued in just a few working days.

Physical PAN cards typically take 2–4 weeks for delivery within India and longer for international addresses, depending on postal services and document verification timelines.

A foreign company applying through Form 49AA must provide:

1. Apostilled/consular attested Certificate of Incorporation

2. Registered address proof (also attested)

3. Authorised signatory’s ID and authority document

4. Any additional proofs as requested under Rule 114(4) by the portal

It’s important to follow the specific documentation and attestation format outlined by Protean or UTIITSL.