AI Summary

The U.S. toy and baby product market now values safety, sustainability, and originality over just low cost. India meets these needs with eco-friendly toys, compliant textiles, and trusted exports. Clear documentation, proper HS codes, and lab certifications help Indian suppliers win trust. Major U.S. buyers already rely on India for consistent quality and ethical sourcing.

The global toys and baby products industry hasn’t just changed over the last few years. It transitioned; anyone involved in manufacturing or exports can feel it. Things that were optional earlier now matter a lot more.

Supply chains are spreading out. Children’s safety rules are getting tighter. And sustainability? That’s no longer a “nice to have.” It’s a real buying decision. American buyers are thinking differently now. They’re not just asking, “How cheap can this be?” They’re asking, “Is this safe? Is this climate-friendly? Is this responsibly made? And does it actually stand out?”

That shift is real.

And quietly, without too much noise, India has stepped into that gap. Over the last few years, India has positioned itself as a strong sourcing destination for U.S. toy importers. Not by racing to the bottom on price but by offering quality, safety, and originality in the same package.

American baby product sellers are looking for suppliers who understand regulations, care about materials, and can deliver something better than copy-paste products. That’s where India fits in.

Why the USA?

For Indian manufacturers and exporters, the USA stands out for two reasons, and both matter.

On one hand, it’s the world’s largest consumer market, with massive demand for toys, baby garments, and early-learning products. On the other, it’s one of the most tightly regulated markets in the world, especially for anything made for children.

That balance creates opportunity, but only for exporters who are prepared.

Exporting toys and baby products to the United States is a high-potential business, but it’s not a market you enter casually. Success depends on understanding compliance rules, using the correct HS code for toys and baby products, knowing how USA customs duties and import tariffs apply, and pricing products realistically through accurate CIF value calculation.

What This Guide Covers

This guide breaks down:

- HS code for toys and baby products

- How USA customs duties and import tariffs impact pricing

- CIF value calculation for smooth customs clearance

- Compliance expectations from U.S. buyers

- The growing role of Indian exporters and large U.S. buyers

Why the USA is a High Value Market for Indian Toy Exporters

Over the last decade, the B2B trade between the United States and India has grown steadily, especially in toys and baby products. U.S. importers are actively diversifying sourcing and looking beyond single-country dependence.

India fits well with what American buyers want today, not just on paper, but in real operations.

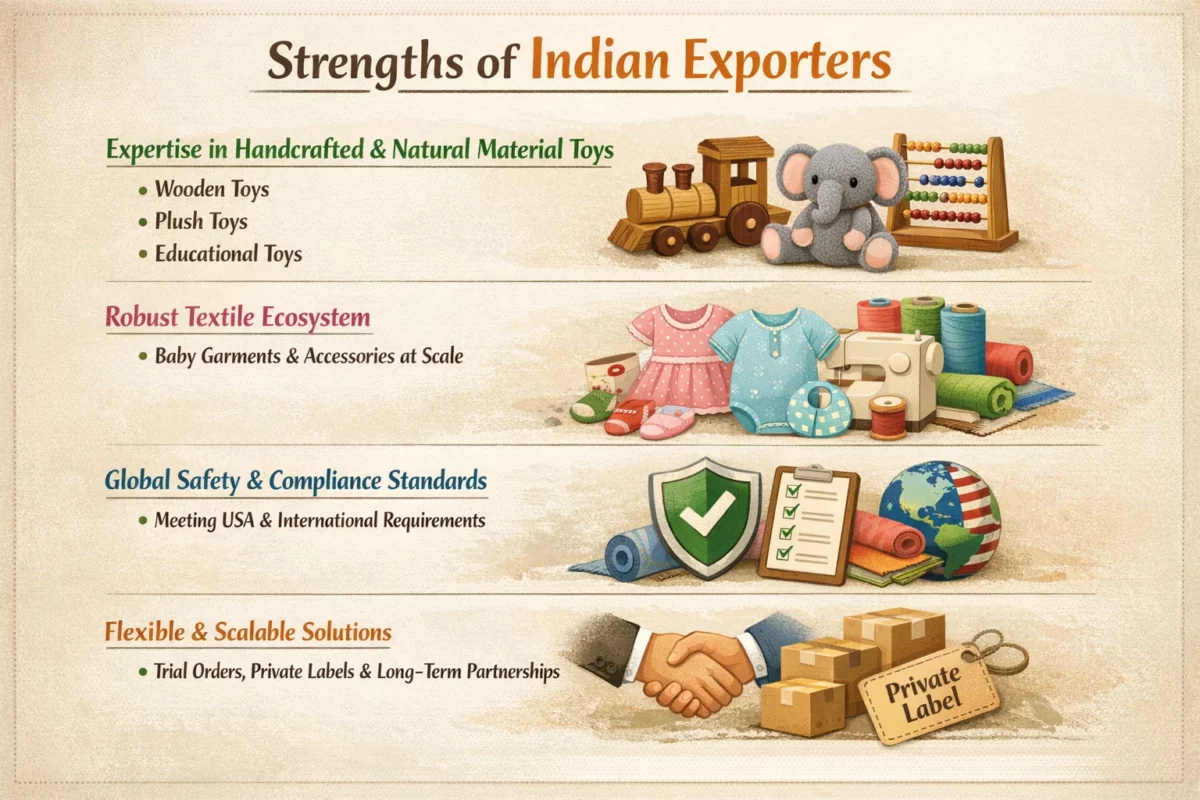

Indian exporters offer:

- Strong capabilities in handcrafted and natural-material products, particularly Indian exporters of wooden toys, plush toys, and educational toys.

- A mature textile ecosystem supporting baby garments and accessories at scale.

- Increasing alignment with global safety and compliance standards expected by USA toy importers and American baby product distributors.

- Flexibility to handle trial orders, private labels, and long-term scale.

Together, these strengths make Indian suppliers attractive to U.S. buyers who value reliability, safety, ethical sourcing, and long-term partnerships, not just low prices.

Indian Exporters of Wooden Toys, Plush Toys, and Educational Toys

Let’s talk about what India actually exports the most, and why the U.S. keeps buying.

- Wooden Toys

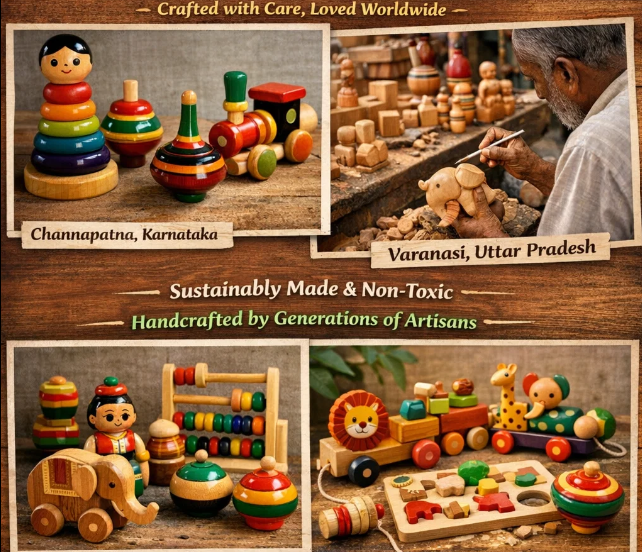

Wooden toys are one of India’s strongest export stories. And honestly, for good reason.

These toys are usually made from sustainably sourced wood, finished with non-toxic paints, and built to last. That checks all the right boxes for eco-conscious U.S. buyers.

A lot of these products come from traditional toy clusters like:

- Channapatna (Karnataka)

- Varanasi (Uttar Pradesh)

These regions aren’t new to the game. Generations of craftsmen have been perfecting woodwork here long before “sustainable” became a buzzword.

- Plush Toys

India exports plush toys in large volumes made from polyester, cotton, and other soft materials. But… here’s the catch

The U.S. is strict. Very strict.

Plush toys must meet safety rules around:

- Flammability

- Lead content

- Chemical usage

This is where third-party lab testing and proper compliance become non-negotiable. No shortcuts here. If compliance is weak, shipments don’t move.

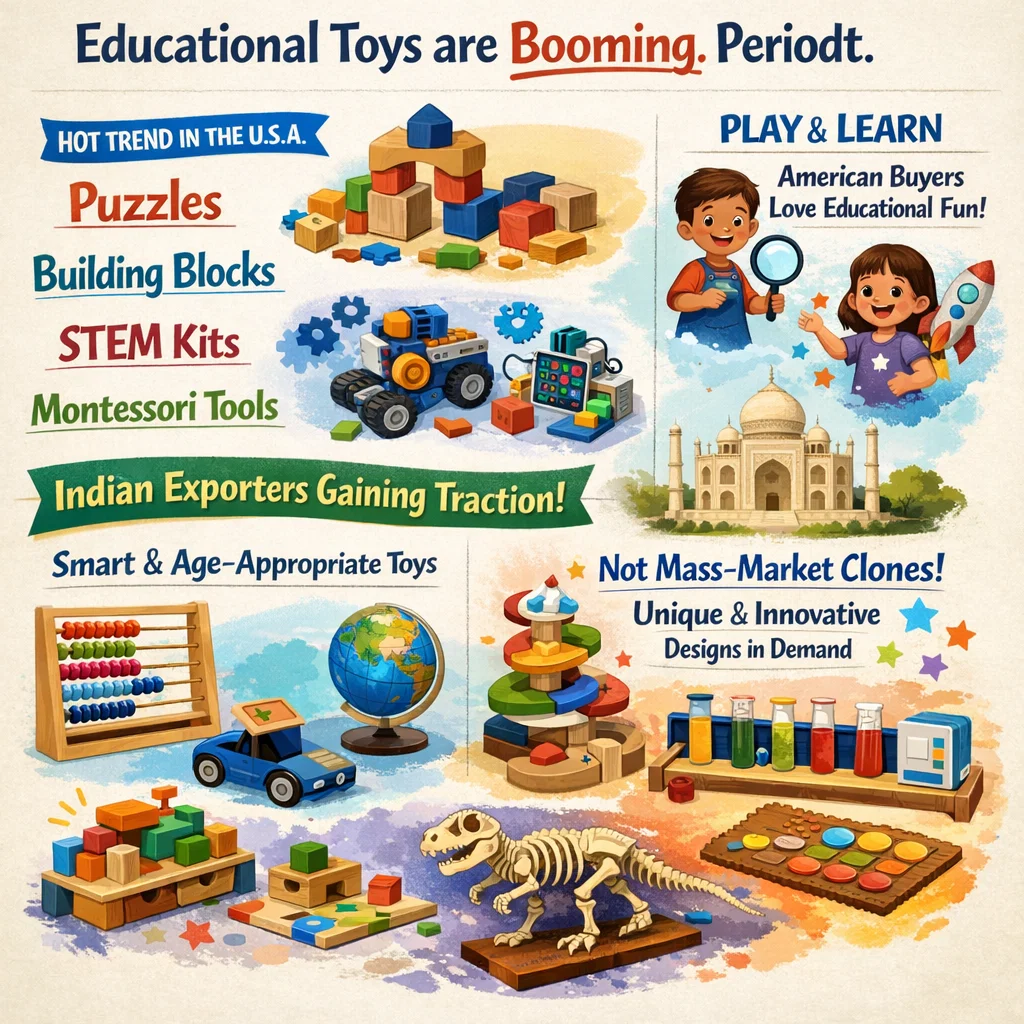

- Educational Toys

Educational toys are booming. Periodt.

Puzzles, building blocks, STEM kits, and Montessori tools are in high demand in the U.S. right now.

American buyers love products that mix play with learning.

Indian exporters who design smart, age-appropriate educational toys are seeing faster traction with distributors looking for something different, not mass-market clones.

- Baby Products and Infant Wear Exports from India

Toys aren’t the only win. India is also killing it in baby products, especially textiles which is why let’s talk more.

Children’s Toys and Playthings

To prevent toxicity hazards, the CPSC enforces strict lead limits for toys aimed at children 12 and under (e.g., blocks, dolls, and action figures):

CPSIA and ASTM F963: These standards are significantly stricter than the general 300 ppm limit often cited for non-children’s items.

Exporters of Organic Cotton Baby Garments from India to the USA

India’s textile ecosystem is a global powerhouse. From raw cotton to finished garments, the entire supply chain exists locally.

Indian exporters ship:

- Baby onesies, rompers, bodysuits

- Swaddles and blankets

- Bibs, caps, and baby accessories

Why do U.S. buyers love these? Because parents care. A lot.

- Hypoallergenic fabrics

- Sustainable sourcing

- Skin-safe materials

Certifications like GOTS and OEKO-TEX aren’t just nice to have. They build instant trust with American retailers and parents.

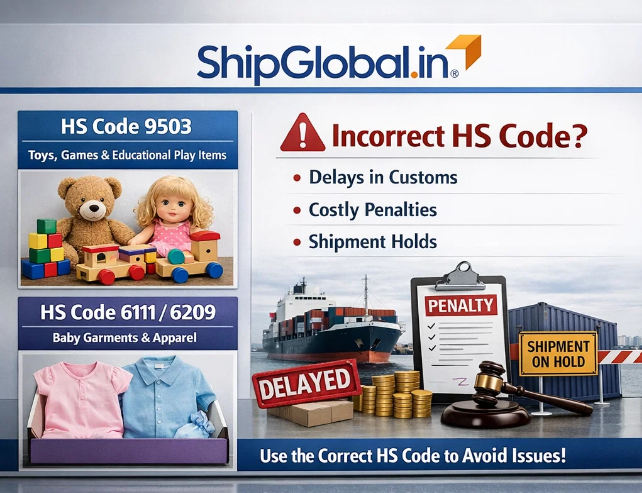

Understanding the HS Code for Toys and Baby Products

Let’s be real. HS codes decide whether your shipment flies through customs or gets stuck.

The HS code for toys and baby products impacts:

- Import duties

- Required documents

- Level of customs scrutiny

Common HS codes include:

- HS Code 9503 – Toys, games, educational play items

- Plush toys and dolls also fall under 9503

HS Code 6111 or 6209 – Baby garments, depending on fabric and construction

Wrong HS code = delays, penalties, or shipment holds.

USA Customs Duties and Import Tariffs Explained

Good news first: The U.S. does not charge VAT. But don’t relax yet. USA customs duties and import tariffs still apply based on:

- HS classification

- Material used

- Country of origin

USA Common Customs Tariff (CET)

You might hear people mention the USA Common Customs Tariff (CET). In reality, the U.S. follows the Harmonised Tariff Schedule (HTS). It aligns with global HS standards but has product-specific duty rates.

Bottom line: If you don’t know your exact duty rate, you can’t price confidently.

Why the USA Beats Europe on Landed Cost

In Europe, import taxes hit harder.

For example, VAT on imports in France can seriously push up landed costs for buyers. That’s why many United States buyers prefer sourcing from India for volume shipments, especially when CIF pricing is competitive.

CIF Value Calculation and Why It Matters

Most shipments to the U.S. move on CIF terms. What is the CIF value calculation? It includes:

- Cost of the goods

- Insurance

- Freight up to the U.S. port

United States customs calculates duties on the declared CIF value. If the value looks off, expect audits or inspections. Children’s products are already under high scrutiny, so accuracy matters even more.

Clean CIF declarations = smoother clearance + more trust with buyers.

Compliance and Safety: No Compromises. For toys and baby products, compliance isn’t optional. It’s the price of entry. Key U.S. compliance requirements Indian exporters must meet:

- CPSIA testing and certification

- Limits on lead, phthalates, and harmful substances

- Clear labeling and traceability

- Manufacturer or importer identification

Skipping compliance can lead to rejected shipments, recalls, and damaged credibility. Think of compliance as insurance for your export business. Packaging, Labelling, and Paperwork

Why Packaging and Labelling matter? Because U.S. buyers expect retail-ready products. That means:

- Age grading and safety warnings

- Country of origin labelling (Made in India)

- Packaging that survives shipping and store handling

Export Documentation, Paperwork Errors are Silent Killers

You’ll need

- Commercial invoice with correct HS code and CIF value

- Packing list

- Bill of Lading or Airway Bill

- CPSIA certificates and lab test reports

One missing document can stall the entire shipment.

Who is Buying from India?

India exports toys to over 150 countries, and the U.S. sits right at the top. USA Toy Importers Indian suppliers work with:

- Wholesale importers

- Private-label sourcing firms

- Brand owners and distributors

These buyers want consistency, clean documentation, and predictable delivery.

American Baby Product Distributors

U.S. baby product distributors are shifting sourcing to India for one big reason reliability. Once trust is built, these relationships often turn into long-term supply contracts.

Big Retail Names You Already Know

Yes, India supplies to them.

- Walmart Inc. – One of the largest importers in the world

- Costco Wholesale Corporation – Major importer of consumer goods

- Target Corporation – Imports a wide range of consumer products

They don’t gamble on suppliers. Compliance and consistency are non-negotiable.

Logistics and Shipping from India to the USA

For toys and baby products, ocean freight is usually the most cost-effective option. But to skip delayed delivery exporters are preferring cost effective and reliable courrier partners like ShipGlobal.

Working with experienced freight forwarders and customs brokers makes life easier especially during peak seasons.

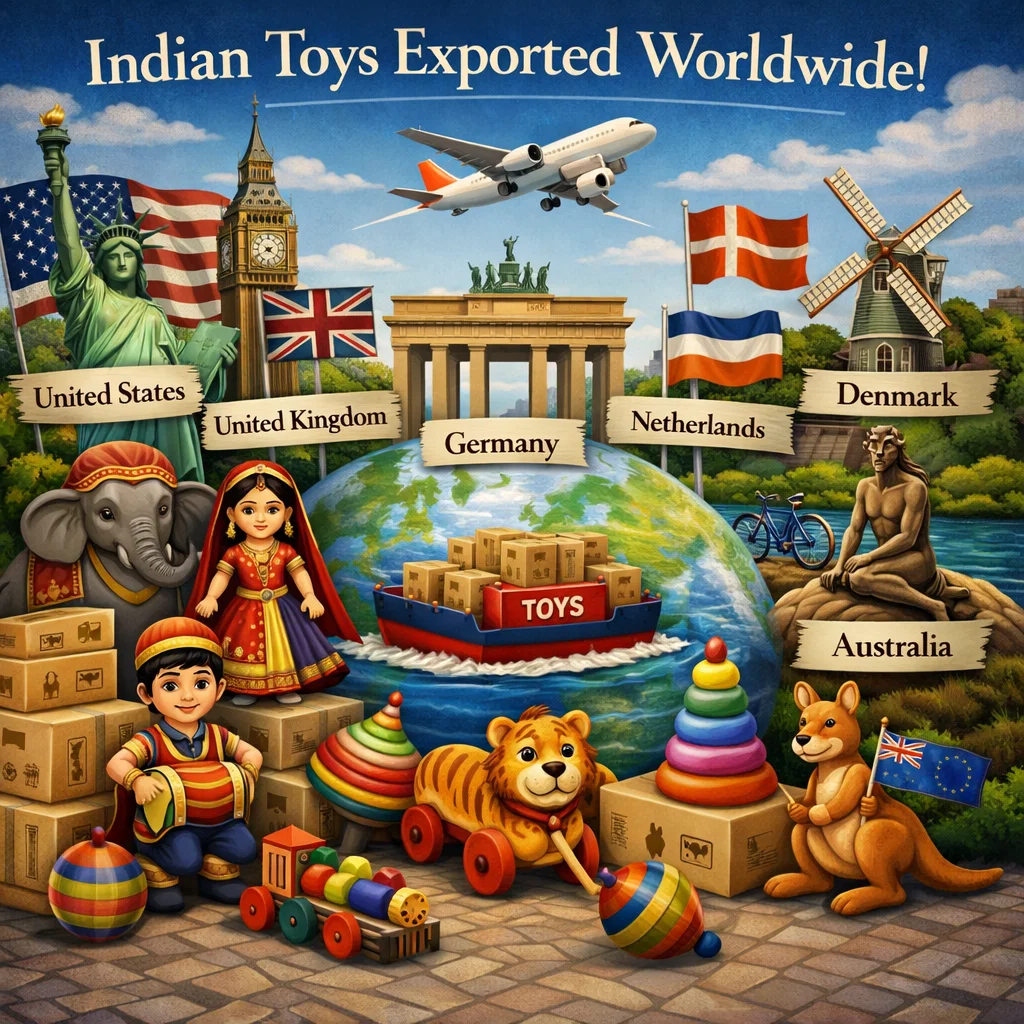

Indian Toy Export Data: The Bigger Picture

Indian toys go to over 150 countries. Top importers include:

- United States

- United Kingdom

- Germany

- Netherlands

- Denmark

- Australia

Together, developed markets account for more than 70% of India’s toy exports. That says a lot about global confidence in Indian manufacturing. Most exporters start small. That’s normal.

Scaling happens when you nail:

- Consistent quality

- Strong internal QC

- Compliance readiness

- Reliable logistics and documentation

Get this right, and trial orders turn into containers. Containers turn into contracts.

Conclusion

Exporting toys and baby products from India to the USA is not just a short-term opportunity; it’s a long-term business with strong growth potential. Success in this market depends on mastering key export fundamentals:

- HS code for toys and baby products

- USA customs duties and import tariffs

- CIF value calculation

- Compliance with safety and regulatory requirements

Meeting the expectations of USA toy importers and American baby product distributors

As the B2B trade United States-India relationship continues to expand, Indian exporters who focus on quality, compliance, transparency, and professional logistics are best positioned to build sustainable and scalable export businesses in one of the most demanding and rewarding markets in the world.

Frequently Asked Questions

Exporters must comply with CPSIA and ASTM F963 standards, including strict limits on lead, phthalates, flammability, proper labelling, and third-party lab testing.

Most toys fall under HS Code 9503, while baby garments are classified under HS 6111 or 6209, depending on fabric and construction.

U.S. customs duties are calculated on the CIF value, which includes product cost, insurance, and freight up to the U.S. port, based on the applicable HTS duty rate.

The USA offers great demand, no VAT, stable import volumes, and a growing preference for compliant, sustainable, and responsibly made products from India.

Key documents include a commercial invoice, packing list, Bill of Lading or Airway Bill, correct HS code declaration, and CPSIA test reports and certificates.