If you’re an exporter looking for a secure way to receive payments from international buyers, a Letter of Credit (LC) can be a reliable option. But let’s be honest, figuring out how to apply for one can feel a bit overwhelming, especially if you’re new to the process.

The good news? It’s not as complicated as it seems.

In this quick guide, we’ll walk you through the LC application process, explain what documents you’ll need, and highlight a few things to keep in mind along the way. We will keep it simple so you can actually make the most of what LC has to offer. Let’s dive in.

A Quick Look at LC and its Key Types

A Letter of Credit (LC) is a commitment issued by a bank (usually the buyer’s or importer’s bank) that ensures you, the seller/exporter, get paid in full once you meet all the LC’s conditions. These conditions usually include presenting certain documents (like a bill of lading, invoice, packing list, etc.) that prove shipment or delivery of goods. This arrangement takes the risk out of international trade and serves as a safety net for both the buyer and the seller. While the buyer receives goods in the promised quality, the seller gets the payment as agreed.

Types of LCs

You don’t have to know all the types of LC, but it’s useful to know what kind you need. A few common ones include:

- Sight LC: You get paid immediately after the buyer’s bank verifies your documents.

- Usance (or Deferred Payment) LC: Payment is made after a specific period, say 30, 60, or 90 days.

- Confirmed LC: A second bank (usually in your country) adds its own guarantee, so you’re extra protected.

- Transferable LC: Useful if you’re a middle party and need to pass the benefit to a supplier.

Check with your buyer and your bank to choose the right one for your transaction.

UCP 600: What are they and why are they important?

The Uniform Customs and Practice for Documentary Credits (commonly referred to as UCP 600) are a set of international rules issued by the International Chamber of Commerce (ICC). Their main objective is to bring uniformity and consistency to global banking practices related to Letters of Credit (LCs).

UCP 600 rules apply only when they are explicitly incorporated into the LC. This can be done by referencing them in Field 40E of the SWIFT MT700 message format. Although the UCP 600 is a voluntary code, it governs the majority of Letters of Credit used worldwide due to its wide acceptance in international trade.

The UCP 600 came into effect in July 2007, replacing the earlier UCP 500. It was introduced to reduce ambiguity in interpretation and to minimize the chances of document rejection due to unclear terms.

Other Related Rules

- ISBP 745 (International Standard Banking Practice): Designed to be read alongside UCP 600, this guide helps interpret terms that UCP 600 does not define, such as “shipping documents” and “shipping marks.” While informative, ISBP is not automatically incorporated into the LC.

Contents of a Letter of Credit (LC)

A Letter of Credit must include several important pieces of information to ensure its validity and clarity. These key details typically include:

- The date on which the letter of credit is issued.

- The full name and address of the beneficiary (i.e., the exporter).

- The total amount to be credited under the letter of credit.

- The expiration date of the LC.

- Complete bank details of the beneficiary, along with the LC number and all applicable terms and conditions.

- The signature of the authorized bank official issuing the LC.

Key Benefits of LC

When compared to traditional payment methods like cash transactions or wire transfers, Letters of Credit (LCs) offer enhanced protection against the uncertainties and risks involved in international trade. They help ensure payments are made on time and also make it easier for businesses to access working capital financing.

For Buyers

Import Letters of Credit can help safeguard your international purchases and often give you the leverage to negotiate more favorable contract terms, such as extended credit periods from your suppliers.

When you apply for a Letter of Credit:

- You demonstrate to your supplier that you have the financial capacity to pay for the goods.

- You have the option to define specific terms within the LC related to shipping, delivery timelines, insurance coverage, and product quality inspections by your suppliers.

For Suppliers

Export Letters of Credit significantly reduce the risk of non-payment and make it easier to access funds without needing an existing credit line.

When you receive a Letter of Credit:

- You gain a payment commitment from the buyer’s bank, provided your submitted documents fully meet the conditions outlined in the LC.

- In many cases, you can also request advance funding against documents that are compliant with the LC terms.

Comparison Table: Advantages and Disadvantages of a Letter of Credit

| Advantages | Disadvantages |

|---|---|

| Helps reduce risks involved in international trade | Increases business costs due to bank charges associated with issuing and managing an LC |

| Builds trust between trading partners | May not always provide coverage for unexpected or unforeseen events |

| Promotes standardisation and consistency in trade documentation and processes | Preparing an LC can be a time-intensive task, and any changes may lead to delays in processing the transaction |

| Offers flexibility and can be tailored to meet specific trade requirements | The terms of the LC might require frequent updates based on the nature of the trade deal |

Documents Required to Apply for a Letter of Credit

To apply for a Letter of Credit, the following documents are generally required:

- A completed application form along with the applicant’s address and recent photograph

- Know Your Customer (KYC) documents of the applicant and, where applicable, co-applicants, partners, or company directors (such as passport, voter ID card, Aadhaar card, etc.)

- An airway bill

- A bill of exchange

- A bill of lading

- A commercial invoice detailing the transaction

- An insurance certificate covering the goods in transit

- A certificate of origin verifying the country where the goods were produced

- Packing list and relevant shipping and transport documents

- A certificate of inspection, where required

- Any additional documents as specified by the lending bank or financial institution

Applying for a Letter of Credit: Step-by-Step Instructions

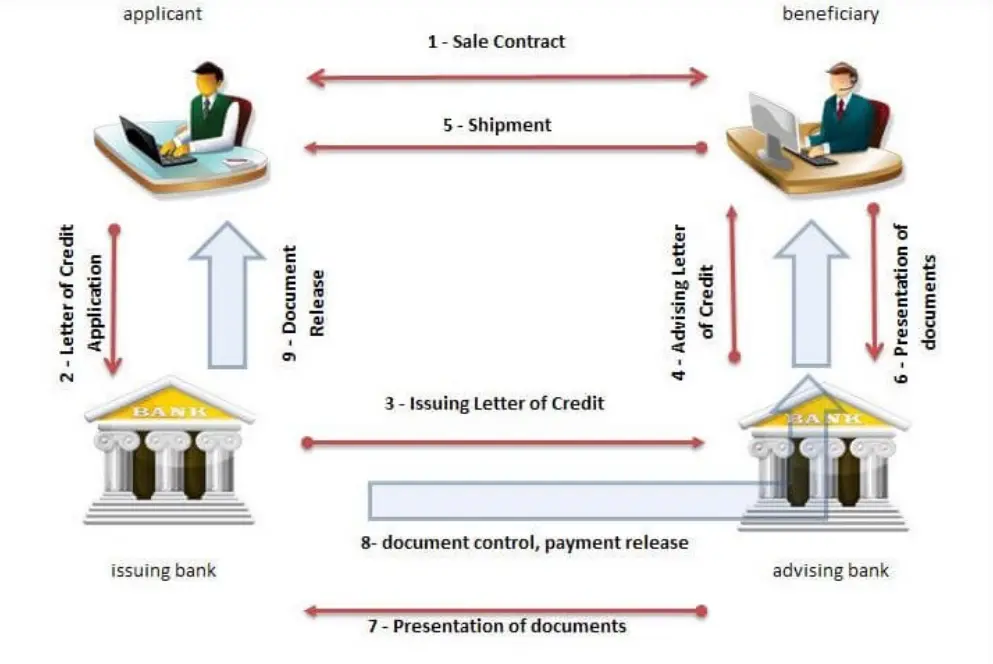

- The seller (exporter/ beneficiary) and their bank must be confident in the creditworthiness of the buyer’s (importer/applicant) bank. Once the sales contract is finalized, the importer formally approaches their bank to open a Letter of Credit in favour of the exporter.

- Based on the agreed terms and conditions outlined in the sales contract, the importer’s bank (issuing bank) prepares the Letter of Credit and sends it to the exporter’s bank (advising bank). The exporter’s bank then verifies the terms, and once satisfied, forwards the Letter of Credit to the exporter.

- The exporter then ships the goods as specified in the Letter of Credit and submits the essential documents to their bank. A freight forwarder may assist in ensuring that all documentation and shipment processes are correctly handled.

- Upon submission of the required documents, the exporter’s bank carefully checks for compliance with the terms and conditions of the Letter of Credit. If any discrepancies or errors are found, they must be corrected and resubmitted. Once all documents are in order or has been approved, the exporter’s bank forwards them to the importer’s bank.

- Upon verifying that the submitted documents comply with the Letter of Credit, the importer’s bank releases the payment to the exporter’s bank. The importer’s account is debited, and the necessary documents are handed over to the importer so they can claim the goods and complete customs clearance.

Things to Watch Out For

Applying for an LC isn’t rocket science, but a few small mistakes can lead to delays or non-payment. Here are a few tips:

- Double-check names, dates, and values in all documents

- Always keep a close eye on shipment and expiry dates

- Keep communication open with your buyer

- Work with a CHA or logistics partner who understands LC processes

- Don’t wait till the last minute as LCs take time to process

What Are the Charges for a Letter of Credit

Banks levy fees for issuing Letters of Credit, usually calculated as a percentage of the total amount being guaranteed. The exact charges can vary based on several factors, such as:

- The type of Letter of Credit being issued (for example, confirmed LCs generally come with higher fees).

- The overall complexity and duration of the deal/trade agreement.

- Creditworthiness of the issuing bank.

As an example, a bank might charge around 0.76% of the guaranteed amount. This makes it a fairly reasonable cost for businesses seeking secure and reliable international payment terms.

Conclusion

The use of Letters of Credit is especially recommended when you’re dealing with riskier situations, such as when the importer’s credit history is uncertain, when you’re entering a new trade relationship, or when longer payment terms are involved. In such cases, an LC can act as your financial safety net.

That said, the paperwork involved in a Letter of Credit is often detailed and can be tricky. Even small mistakes can lead to delays or penalties. To keep things smooth, it’s best to have experienced professionals prepare and review all the documents.

Also, don’t wait until the buyer applies for the LC—talk to your bank first. It’s important to get clarity on key points like:

- What types and sizes of export transactions are best suited for a Letter of Credit?

- What are the charges involved, and which party is responsible for paying them?

- In case of a dispute between the importer and exporter, how is it resolved?

Asking the right questions early on can save you time, money, and unnecessary stress. So, before you jump into your next big export deal, don’t hesitate to request a Letter of Credit—now that you’re fully equipped to use it with confidence.