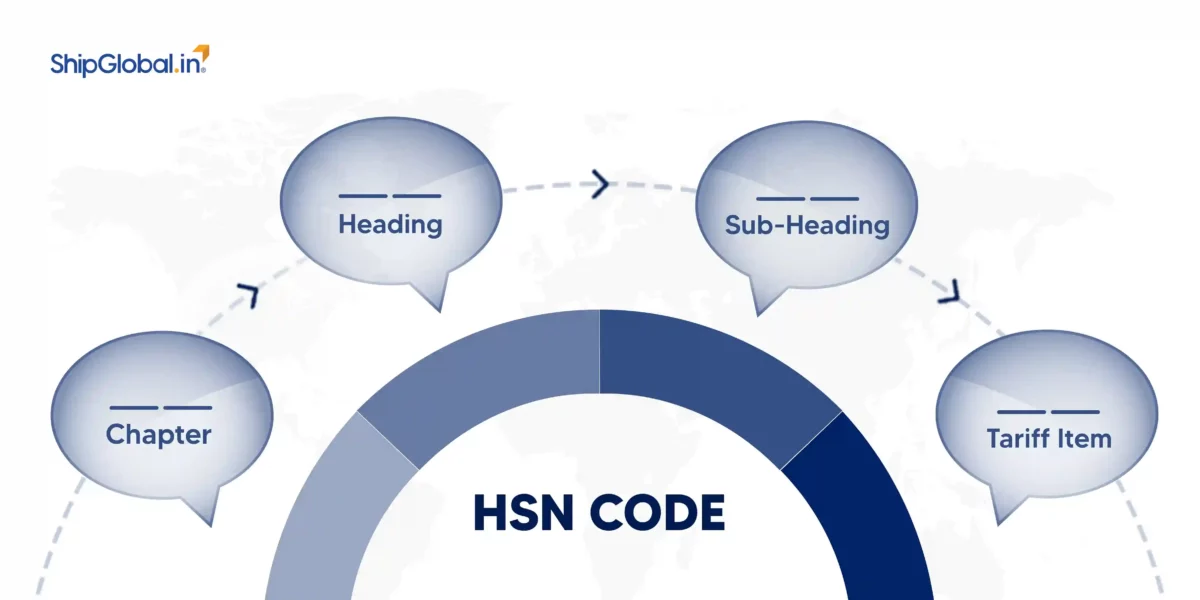

Ceramic tiles are widely used in flooring, walls, roofing, and decorative surfaces across residential, commercial, and industrial sectors. Available in glazed, unglazed, vitrified, and mosaic forms, ceramic tiles are classified under Harmonized System (HS) codes for trade compliance, taxation, and logistics.

Ceramic tiles fall under Chapter 69 – Ceramic Products. The key heading is:

HS Code 6907 – Ceramic flags and paving, hearth or wall tiles, glazed

HS Code 6908 – Ceramic tiles, unglazed

Importance of HS Code for Ceramic Tiles

Accurate HS classification for ceramic tiles is important for:

- Correct Customs Duty: Helps in determining import/export duties.

- Proper GST Filing: Ensures accurate invoicing and tax application.

- Trade Agreements: Aids in availing preferential duty rates.

- Compliance and Documentation: Essential for COO, shipping bill, etc.

HS Code Classification for Ceramic Tiles

Ceramic tiles are classified into HS codes based on their surface treatment and type:

- 690710 – Glazed ceramic tiles for walls

- 690721 – Glazed ceramic tiles for flooring

- 690730 – Mosaic tiles, glazed

- 690810 – Unglazed ceramic tiles for flooring

- 690890 – Other unglazed tiles (industrial or heavy-duty)

GST Rates for Ceramic Tiles in India

Ceramic tiles in India are taxed at 28% GST, irrespective of whether they are glazed or unglazed. No distinction is made in the GST rate based on finish or material.

- All ceramic tiles (glazed, unglazed, vitrified, mosaic): 28% GST

- Ceramic roofing tiles (sometimes under 6905): 28% GST

HS Codes and GST Rates for Ceramic Tiles

Here’s a table listing popular ceramic tile types, HS codes, and current GST rates:

| Product | HS Code | Category | Current GST Rate (2025) |

|---|---|---|---|

| Wall Tiles (Glazed) | 690710 | Glazed ceramic wall tiles | 28% |

| Floor Tiles (Glazed) | 690721 | Glazed ceramic floor tiles | 28% |

| Mosaic Tiles (Glazed) | 690730 | Glazed ceramic mosaic tiles | 28% |

| Floor Tiles (Unglazed) | 690810 | Unglazed ceramic tiles for flooring | 28% |

| Other Ceramic Tiles (Unglazed) | 690890 | Other unglazed tiles (industrial use) | 28% |

Final Thoughts

Ceramic tiles are classified under HS Code 6907 for glazed and 6908 for unglazed types. In India, all ceramic tiles attract 28% GST, making them fall into the highest GST slab. Accurate classification by HS code ensures compliance, proper invoicing, and helps avoid delays or penalties in customs.

FAQs

The HS code for glazed ceramic wall tiles is 690710.

All ceramic tiles (glazed and unglazed) attract 28% GST.

No, floor tiles are under 690721, and wall tiles are under 690710.

Mosaic tiles have a separate HS code: 690730 for glazed mosaic tiles.

No, both glazed and unglazed tiles are taxed at 28% GST.