In the evolving world of global trade, Canadian agriculture is at a critical crossroads. As of 2025, producers and exporters are not only battling weather patterns and changing consumer preferences, they’re also maneuvering through a labyrinth of tariffs, trade agreements, and shifting geopolitical tensions. Understanding how to navigate tariffs and seasonal trends in Canada’s agri-import and export framework is key to long-term sustainability and success.

Whether it’s dealing with Canada-U.S. agricultural tariffs in 2025, the lingering effects of China tariffs on Canadian canola, or seizing opportunities presented by the CUSMA trade agreement benefits, Canadian agri-businesses must stay nimble and informed.

Let’s explore how these dynamics are shaping the industry and what it means for the future of Canadian agriculture.

Weight of Tariffs in 2025: Economic Handcuffs or Strategic Tools

While often viewed negatively, tariffs can serve both protective and punitive functions. However, for Canadian exporters, especially those in agriculture, tariffs are more often an economic obstacle than a safety net.

Canada-U.S. Agricultural Tariffs 2025: Where Do We Stand?

Despite the existence of the CUSMA trade agreement, tensions remain between Canada and the U.S. regarding agricultural trade.

The United States has applied pressure on several Canadian sectors, notably dairy, poultry, and eggs, where Canada’s supply management system limits market access. In return, Canada has expressed concerns about U.S. subsidies that create unfair competition.

As of mid-2025, Canada-U.S. agricultural tariffs have been subject to renewed scrutiny. The U.S. has recently threatened retaliatory measures related to Canada’s grain grading system, while Canada has considered safeguarding its seasonal produce industry, which is vulnerable to U.S. imports flooding the market during peak harvest times.

These tariff threats and negotiations have created an unstable atmosphere for agri-exporters trying to plan long-term strategies.

China Tariffs on Canadian Canola: A Lingering Challenge

In 2019, China imposed restrictions on Canadian canola imports, citing pest contamination, but most analysts attributed the move to diplomatic tensions.

Though partial access was restored in subsequent years, China’s tariffs on Canadian canola remain a significant obstacle in 2025.

While trade talks have led to some easing of restrictions, tariffs and regulatory hurdles still affect export volumes. This has forced Canadian producers to re-evaluate market dependencies and look elsewhere for demand, underscoring the growing importance of agri-export market diversification strategies.

Countries like Japan, South Korea, and the United Arab Emirates are stepping up as alternative destinations for Canadian oilseeds.

Importance of Canadian Agricultural Export Seasons

Understanding Canadian agricultural export seasons is crucial to success in the global marketplace. Canada’s harsh winters and short growing seasons require precise timing for planting, harvesting, and exporting.

Seasonality and Trade Alignment

Different commodities have unique export cycles. For example:

- Canola and Wheat: Harvested in late summer; exported heavily from August to December.

- Soybeans and Corn: Harvested in early fall; peak exports between October and January.

- Fruits and Vegetables: Exported mainly in spring and summer from greenhouse and field production.

Aligning with export seasons is vital when navigating fluctuating tariffs. For example, if Canada-U.S. agricultural tariffs spike in mid-winter, exporters may delay or expedite shipments to avoid cost increases.

This is why synchronizing trade strategy with Canadian agricultural export seasons, while monitoring tariff developments, is a necessity, not a luxury.

Leveraging CUSMA: A Mixed Blessing

The CUSMA trade agreement (replacing NAFTA) introduced a new framework for North American trade. While its benefits include reduced tariff barriers, dispute resolution mechanisms, and stronger IP protections, navigating its nuances remains a challenge.

Navigating CUSMA for Agri-Exports

Navigating CUSMA for agri-exports means understanding both what the agreement offers and what it limits. For instance:

- Dairy and Poultry remain protected under Canada’s supply management system, which allows only minimal U.S. access. This has triggered complaints from the U.S. side, prompting formal dispute panels under CUSMA.

- Fresh Produce and Grains, by contrast, benefit from streamlined cross-border logistics and low to zero tariffs, especially during Canadian agricultural export seasons.

While CUSMA trade agreement benefits are tangible for many sectors, exporters must still track compliance requirements, origin documentation rules, and real-time updates on tariff adjustments.

Agri-Export Market Diversification Strategies: Thinking Beyond North America

In response to unpredictable tariff regimes and overreliance on traditional partners like the U.S. and China, Canadian exporters are adopting robust agri-export market diversification strategies in 2025.

Expanding to New Markets

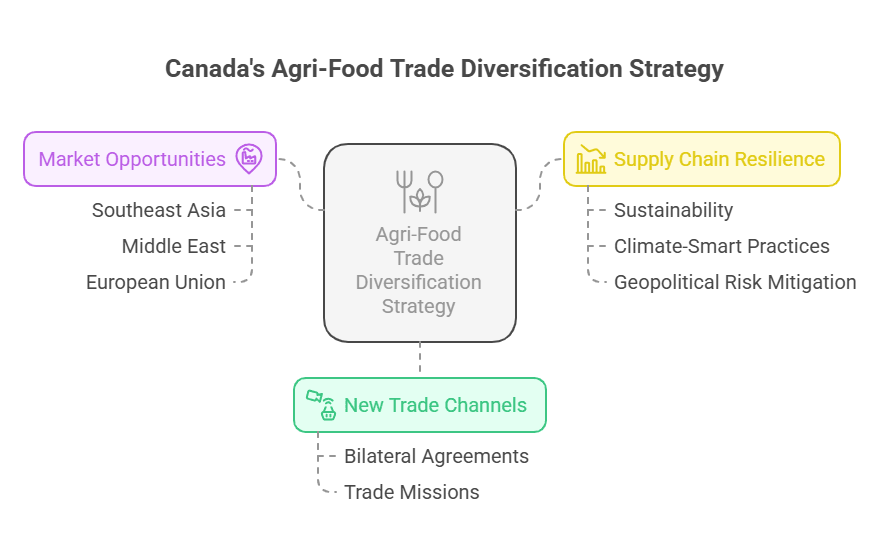

The federal government has committed to opening new trade channels under its Agri-Food Trade Diversification Strategy. This includes bilateral agreements and trade missions targeting:

- Southeast Asia (Vietnam, Philippines, Indonesia): Growing demand for pulses, cereals, and protein crops.

- Middle East: Strong market for halal-certified meats and Canadian lentils.

- European Union: Benefiting from the Comprehensive Economic and Trade Agreement (CETA) with reduced tariffs on specialty products like organic grains and maple syrup.

Canadian exporters are building more resilient supply chains by reducing dependence on markets with high tariff volatility, like the U.S. and China. This aligns with Canada’s agricultural trade policies in 2025, which emphasize sustainability, climate-smart practices, and geopolitical risk mitigation.

Government Support and Policy Outlook

In 2025, Canada’s agricultural trade policies will continue to prioritize innovation, risk management, and international competitiveness. Programs like the Agri Marketing Program and Can Export provide funding for international market development, while federal agencies such as the Canadian Food Inspection Agency (CFIA) are working to harmonize standards to facilitate trade.

At the same time, the government remains vigilant about the impact of tariffs on Canadian farmers, particularly small and medium enterprises that are less equipped to absorb sudden cost increases. Lobbying for fair dispute resolutions and proactive diplomacy remains essential to maintaining healthy trade relationships.

Final Thoughts

As we move through 2025, Canadian agri-exporters find themselves at a pivotal moment. With Canada-U.S. agricultural tariffs creating uncertainty and China’s tariffs on Canadian canola pushing producers to pivot, strategic adaptation is not just encouraged, it’s essential.

By mastering the rhythm of Canadian agricultural export seasons, leveraging CUSMA trade agreement benefits, and implementing robust agri-export market diversification strategies, the sector can buffer itself against global headwinds. And as Canada’s agricultural trade policies in 2025 continue to evolve, staying informed and agile will be key to thriving in a complex international marketplace.

FAQs

As of 2025, key friction points in Canada-U.S. agricultural tariffs revolve around dairy, poultry, and grain grading practices. The U.S. continues to push for increased access to Canada’s supply-managed sectors, while Canadian farmers are concerned about subsidized U.S. products undercutting domestic prices. Though CUSMA offers tariff protections, tensions persist through formal dispute channels.

China tariffs on Canadian canola remain a significant barrier in 2025, limiting full access to what was once Canada’s largest canola market. Although trade has partially resumed, ongoing political tensions mean that restrictions, inspections, and non-tariff barriers continue to affect Canadian exporters. This has led to increased focus on agri-export market diversification strategies.

Canadian exports follow harvest cycles. Grains and oilseeds peak from August to January, while produce surges in spring and summer. Timing exports around these seasons helps meet demand and avoid trade disruptions.

Agri-businesses are expanding into Southeast Asia, the Middle East, and the EU. They’re also using trade deals like CETA and CPTPP, and tapping into programs like CanExport to reduce reliance on traditional markets.

Exporters must understand CUSMA’s rules of origin, keep good records, and monitor policy shifts. Government tools from Global Affairs Canada and CFIA help ensure compliance and smooth trade.