If you’re in the import-export business or planning to get into it, you’ve probably heard the term ICEGATE floating around. But what exactly is it?

International trade plays a critical role in India’s economic development, with thousands of businesses depending on fast and reliable customs processing to stay competitive in the global market. Enter ICEGATE (Indian Customs Electronic Gateway) — the backbone of India’s digital customs infrastructure or a self-sufficient Indian Export portal.

This Indian Export portal is a game-changer for exporters and importers, offering seamless connectivity between trade stakeholders and Indian Customs.

In this blog, we will explore what ICEGATE means for exporters and how it is transforming the way Indian businesses handle cross-border trade.

Let’s dive in.

What is ICEGATE

ICEGATE stands for Indian Customs Electronic Data Interchange Gateway. It’s the national portal run by the Central Board of Indirect Taxes and Customs (CBIC) and plays a major role in making India’s import-export process digital, faster, and more efficient. It’s not just a portal; it’s like a digital control center for customs clearance.

At present, ICEGATE has a community of over 1.6 lakh people, supporting over 12.5 lakh importers and exporters across India. Whether you’re shipping a single product or managing a large order, it helps you connect with customs authorities electronically.

Key Services Offered

Thinking what ICEGATE offers? The platform provides a range of services designed to simplify the export and import process. Some of its key services are:

- E-filing of Shipping Bills (SB), Bills of Entry (BoE), and Others (like IGM/EGM)

Submit your import and export documents electronically—no physical paperwork required and no need to visit offices. - E-payment of Customs Duties

Make duty payments online via secure banking channel. Pay your taxes and duties digitally with ease. - Electronic Document Submission (e-SANCHIT)

Upload supporting documents digitally, reducing manual errors and processing time. - IGST Refund Processing

Get GST refunds on exports processed directly through the portal. - Shipment and Document Tracking

Track the real-time status of your documents and shipments via the portal. - Export Scheme Verification

Apply and verify eligibility for schemes like DEPB and EPCG online. - 24/7 Help Desk

Got questions? The ICEGATE support team is available around the clock to assist users with technical or procedural queries.

If you’re an Indian exporter, whether you’re just starting or looking to scale, understanding how ICEGATE works is essential.

Documents Required to Register With ICEGATE

Before you dive into registration, make sure you have these essentials ready. These documents help verify your identity and authority as an exporter:

- IEC (Importer Exporter Code)

- Export License

- Government-issued ID that proves your nationality: Choose from Aadhaar card, voter ID, driving license, or passport

Depending on your registration category/ user-type (e.g., shipping agent, airline, etc.), you may need to provide additional documents. Make sure to check the requirements for your specific role during registration. Having these identity proofs ready ensures a smooth registration process.

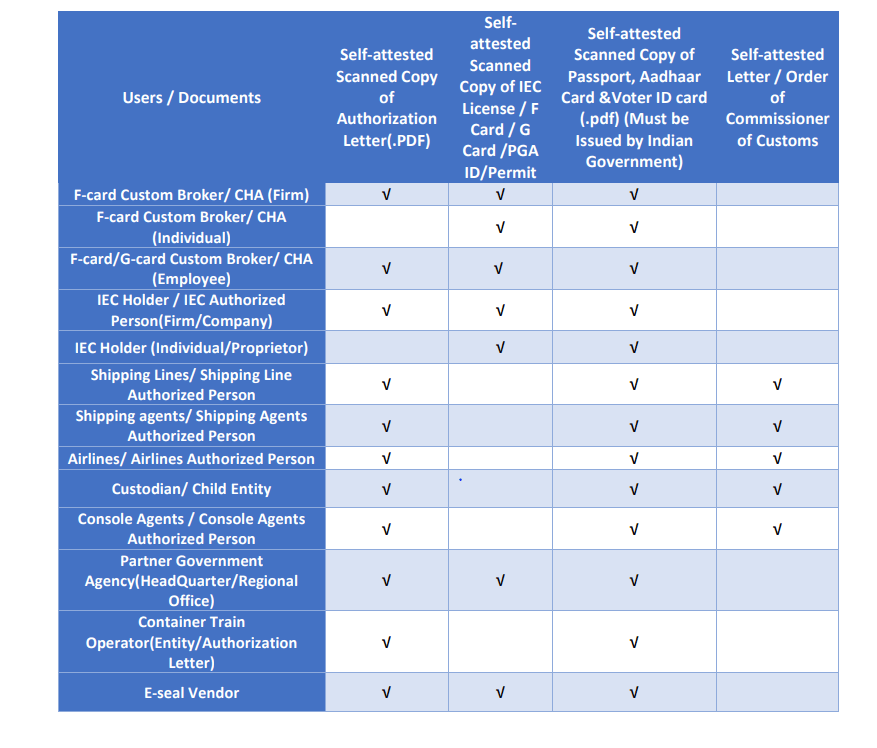

The table below outlines the specific documents needed for each user category:

Just a heads-up, all uploaded documents must be self-attested.

Procedure to Register

Now that you know about the essential documents, you must be ready to register. Once your documents are sorted, follow these steps to register on the ICEGATE portal:

- Visit the ICEGATE website: Click on the Log in/ Sign Up button, which will take you to the dashboard where you need to select ‘Register Now’ to proceed further.

- Begin the Registration Process: After clicking on ‘Register Now’, you will be redirected to a page with two options- Continue Using Reference ID or Fresh Registration. Select ‘Fresh Registration- Don’t have Reference ID’ to go to the next step.

- Choose Your Role: Select your user type from the given options— importer/exporter, shipping agent, airline, shipping line, etc.

- Enter Your IEC and GSTIN Number: Input your Importer Exporter Code to auto-fetch your business details from the ICES system. You will also be required to enter your GSTIN number. Once you have entered valid details, click on ‘Proceed’.

- Upload Valid ID Proof: Use one of the accepted IDs mentioned above.

- Upload Your Digital Signature Certificate (DSC): This will be used to sign documents digitally on the portal.

- Confirm and Submit: Enter the OTP sent to your email to complete the registration.

After you’re done, your application is sent to the customs department for approval. Once verified, you’ll be all set to use ICEGATE!

Points to note while registering on ICEGATE for any role/user type:

| Tips to Remember | Details |

|---|---|

| One Parent User Rule | Each entity (like a company or customs broker) can register with only one F-card holder or parent user, even if there are multiple F-card holders listed on the license. All others must register as child users under that parent account. |

| Built-In Security Checks | ICEGATE’s system prevents impersonation and misuse. The parent user has application-level access with proper role mapping and can approve or disable their child users. |

| Already Registered Email? Check First! | If your email is already registered, check within your organization to find out which user ID it’s linked to before attempting to create a new one. |

| PAN Card is a Must | During registration, users must enter their details and upload a soft copy of their PAN card. The information is automatically verified with the Income Tax Department. |

| Name Should Match PAN | The name used during registration must exactly match the name on the PAN card. Any mismatch can cause delays. |

| Multiple Roles, One PAN | The same PAN can be used to register under different roles such as Shipping Agent, Customs Broker, Airline, Custodian, and more. |

Benefits of Registering With ICEGATE

Registering on the ICEGATE portal opens up a host of benefits for new exporters:

- Simplified Documentation: Say goodbye to physical forms—everything is digital.

- Real-time Updates: Stay in the loop about your shipments and customs clearance processes.

- Efficient/ Direct Communication: Raise queries or get clarifications directly from customs. No more dealing with middlemen and intermediaries.

- Cost Effective: It’s easy on the pocket too! By cutting down on manual work and paperwork, it helps save on overheads. And since there’s no middleman involved, things move faster and cost less.

Making Customs Duty Payments Online With ICEGATE

Paying customs duties through ICEGATE is as easy as ordering food online. Here’s how:

- Log in to the CBIC-GST portal and create a challan.

- Head to the ICEGATE portal, and go to the ‘E-payment’ section.

- Choose a payment method from the list of authorized banks.

- Complete the payment and get your confirmation receipt instantly.

Boom! Customs paid. No bank visits. No stress.

Steps to Check BOE Status and Shipping Bills

Your products are packed, shipped, and ready to travel across borders. But what’s happening at the customs office? Let’s go through the steps to track that via the ICEGATE portal.

Follow these steps to check the status of Bills of Entry (BOE) and Shipping Bills:

Step-by-Step Guide

Step 1:

Log in to the ICEGATE website using your credentials.

Step 2:

Select ‘Job Status Link’ from the list of services.

Step 3:

Choose the document type from the left-hand menu.

- For Bill of Entry (BoE):

Click on ‘Bill of Entry’, select your customs location, and hit ‘Submit’. You’ll see info like job number, job date, and the current status of BOEs filed in the last 24 hours. - For Shipping Bills (SB):

Click on ‘Shipping Bills’, select your location, and submit. ICEGATE will display all recently filed shipping bills along with their statuses and processing stages.

Now you can breathe easy, knowing exactly where your goods stand in the export pipeline.

Checking Duty Drawback Status

Getting money back is always fun, especially when it’s your customs duty. Here’s how to check if your duty drawback has been approved:

- Log in to ICEGATE and go to the ‘Drawback Enquiry’ section.

- Enter your IEC, PAN, location, and a relevant date range.

- Choose between ‘Drawback Pending Status’ or ‘Drawback Sanctioned Status’.

- Hit ‘Submit’ to view the refund details.

This helps you plan your finances better while ensuring everything is running on time.

Role of ICEGATE in Supporting MSMEs and First Time Exporters

India’s micro, small, and medium enterprises (MSMEs) often face the brunt of bureaucratic complexities. ICEGATE simplifies global shipping for Indian businesses by bringing everything—from registration and documentation to payment and tracking—under one roof. With its seamless digital interface and 24/7 support, it’s an indispensable tool for MSMEs.

ICEGATE democratizes access to international trade by offering:

- Simplified user interface

- Helpdesk support in multiple languages

- Training modules and FAQs

- Document templates for error free submissions

This inclusivity empowers MSMEs to expand their market reach with confidence.

Conclusion

ICEGATE is not just another Indian Government Export Portal; it’s your personal customs assistant in the digital age. From registering your business and uploading documents to tracking shipments and receiving refunds, ICEGATE makes exporting from India seamless, transparent, and less stressful.

Registering with ICEGATE is a smart first step toward building a compliant and scalable export business. Whether you’re selling customized stationery or handmade jewelry, the platform gives you the confidence to ship your products around the world. With the right setup and a little bit of learning, you can confidently take your products from local shelves to global doorstep.

FAQs

To file customs documents like Shipping Bills and Bills of Entry online, registration on ICEGATE is mandatory. Without a registered ICEGATE ID, you won’t be able to access the portal’s digital services.

By registering on ICEGATE, you get benefits like you can:

-Use a single ICEGATE ID to file all import/export documents online

-Access real-time job status through the document tracking system

-Receive acknowledgments and document references (SB/BE numbers) via your registered email

-Submit and respond to customs queries directly through the portal

Note: While incoming documents are accepted from any email, all official outbound responses are only sent to your registered email.

Simply visit the ICEGATE website. Go to ‘Services’ and click on ‘Registration on ICEGATE’. Now, click on ‘Fresh Registration’ and follow the steps shown on the dashboard. You’ll need your IEC, valid ID proof, and a Digital Signature Certificate to complete the process.

You can register for various transaction types, including:

-Exports

-Imports

-Import General Manifest (IGM)

-Export General Manifest (EGM)

-Consol Manifest

For any technical or document-filing assistance, you can:

Email: Send your query to <icegatehelpdesk@icegate.gov.in>. Most queries are addressed within an hour.

Call: Dial 011-23379020 or 011-23370133 for prompt support during business hours.

Yes, you can expand your registration by adding new transaction types or locations. To do so, email your request from your registered email ID to <registration@icegate.gov.in> with the necessary details.

No, ICEGATE IDs are unique and permanent. Once assigned, your ICEGATE ID cannot be modified or changed.

Yes, profile updates are allowed. You’ll need to email your request for any modification or update from your registered email ID to <registration@icegate.gov.in>, including all relevant details for processing.