AI Overview: Exporting Gems and Jewellery to Czech Republic

Exporting gems and jewellery to the Czech Republic can offer strong business potential in the European market when managed correctly. The first step is to ensure accurate classification of your products under the correct Harmonized System (HS) codes, critical for customs procedures. It is equally important to comply with EU hallmarking standards, as failure to meet these can result in your shipment being rejected at the border. Understanding applicable customs duties and tariffs under EU regulations helps avoid unexpected expenses and improves profitability.

Let’s say you manufacture jewellery in Jaipur or in Surat. Orders are steady. Quality is strong. Now you’re thinking bigger. Europe.

And someone mentions the Czech Republic.

Is it worth it?

Is the process complicated?

What about compliance, customs duty, shipping security?

If you are planning Gems and Jewellery Export from India to Czech Republic, this guide will walk you through it in simple, practical language. No jargon overload. Just what you actually need to know before you ship your first consignment.

Why Export Gems and Jewellery to Czech Republic

Fair question.

The Czech Republic is part of the European Union (EU). That means when you enter this market, you are not just dealing with one country. You are stepping into the larger European ecosystem.

And Europe values quality.

Diamond Jewellery Europe Market Is Stable

The diamond jewellery Europe market is not about flashy trends. It’s about:

- Certified stones

- Clean finishing

- Authentic sourcing

- Consistent quality

If you already export to the US or Middle East, you are not starting from zero. You just need to match EU compliance standards.

Gold Jewellery Export to Czech Republic Has Potential

Indian gold jewellery has three major advantages:

- Skilled craftsmanship

- Competitive pricing

- Ability to customise designs

Retailers and wholesalers in the Czech Republic often look for dependable suppliers who can maintain purity standards and deliver on time. If you can do that, there is space for you.

Handcrafted Indian Jewellery Stands Out

European buyers appreciate story and craftsmanship.

Hand-engraved bangles. Traditional filigree work. Contemporary Indo-European fusion pieces.

There is real opportunity in the export of handcrafted Indian jewellery, especially for boutique stores and online sellers in Europe.

Why Export Gems and Jewellery to Czech Republic?

| Opportunity Area | Key Highlights |

|---|---|

| Diamond Jewellery Demand |

✔ Certified diamonds ✔ Elegant gold designs ✔ Ethical sourcing ✔ Handcrafted authenticity |

| Gold Jewellery Export |

✔ Competitive pricing ✔ High purity and standards ✔ Intricate craftsmanship ✔ Custom manufacturing |

| Handcrafted Indian Jewellery |

✔ Handmade ethnic styles ✔ Fusion and modern designs ✔ Boutique/niche market appeal |

🇨🇿 Entry to Czech Republic offers access to the broader EU jewellery market.

Before You Ship: Understand the HS Code for Gems and Jewellery

Let’s slow down here. This part is important.

Key HS Codes for Jewellery Export

Common HS Codes

- 7102 – Diamonds

- 7108 – Gold

- 7113 – Articles of jewellery

Why This Matters

- Determines customs duty

- Required for export documentation

- Used for customs clearance

- Impacts taxation and compliance

Every product you export must have the correct HS Code (Harmonized System Code). One small classification mistake can delay your shipment at customs. Always double-check the HS Code for gems and jewellery with your customs broker or logistics partner.

Jewellery Export to Czech Republic – Step-by-Step Overview

| Step | Action | Details |

|---|---|---|

| 1 | Understand HS Code | Use correct HS codes like 7102 (Diamonds), 7108 (Gold), 7113 (Jewellery). Affects duty, compliance, and documentation. |

| 2 | Obtain Export Licenses | Get IEC from DGFT, register with GJEPC, and ensure GST registration. No separate license usually needed unless dealing in restricted items. |

| 3 | Ensure EU Compliance | Meet hallmarking rules (purity, stamping, REACH). Missing compliance can lead to rejection. |

| 4 | Understand Customs Duty | Duty varies by HS code and product type. VAT also applies. Always declare fair and transparent value. |

| 5 | Plan Logistics and Security | Use air freight, secure couriers, insured shipping. Avoid delays or loss by using tamper-proof packaging and discreet labeling. |

| 6 | Use Best Packaging Practices | Use inner pouches, shock-absorbing layers, and plain cartons. Avoid flashy packaging to reduce risk. |

| 7 | Prepare for Challenges | Be aware of EU scrutiny, customs delays, high insurance cost, and ensure secure payment methods like LC. |

| 8 | Follow Export Workflow | Register, verify HS Code, comply with EU norms, finalize buyer agreement, arrange shipment, prepare docs, clear Indian customs, ship, and complete EU import. |

💡 Tip: Stay updated with trade regulations and consult a licensed export professional or logistics provider before shipping.

Do You Need an Export License for Jewellery from India

This is something many exporters overthink.

For most of the exporters, there isn’t any separate or special license required to export jewellery from India beyond the basic registrations like:

- Import Export Code (IEC)

- GST (Goods and Services Tax) registration

- Registration with GJEPC (Gem and Jewellery Export Promotion Council)

However, if you are dealing in specific restricted stones or raw materials, check regulations in advance.

The key point: get your basic registrations right before taking international orders.

Now Let’s Talk About EU Compliance

Here’s where things get serious.

The European Union does not compromise on quality standards. And the Czech Republic follows EU regulations strictly.

Hallmarking Requirements EU

If you are exporting gold jewellery to Czech Republic, purity must match exactly what you declare.

That means:

- Correct karat marking

- Proper stamping

- No misleading purity claims

If your jewellery says 18K, it must be 18K. Not close. Exact.

Shipments can be rejected if hallmarking does not meet EU standards.

Chemical Compliance (REACH)

REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulates chemicals used in products entering Europe.

If your jewellery contains restricted things or substances beyond permitted levels, customs can and will block it.

This mostly affects plated jewellery or certain alloys. So test your products if required.

Documentation: Keep It Clean and Complete

You do not want your shipment stuck because of paperwork. For Gems and Jewellery Export from India to Czech Republic, keep these vital documents ready:

Required Export Documents: Gems and Jewellery to Czech Republic

- Commercial Invoice

- Packing List

- Certificate of Origin

- Insurance Certificate

- Air Waybill (AWB – Air Waybill)

- Customs Declaration

- Hallmark Certification

💡 Tip: Ensure all documents are accurately filled and verified before dispatch to avoid delays at customs.

Make sure values match across documents. Inconsistency creates suspicion at customs.

Customs Duty on Jewellery Czech Republic

Let’s talk money.

The customs duty on jewellery Czech Republic depends on:

- HS Code

- Product type

- Trade agreements

On top of customs duty, VAT (Value Added Tax) is applied at import.

Important reminder: always declare the correct transaction value.

Under-declaring to save duty can lead to serious penalties. Over-declaring increases tax unnecessarily. Be accurate.

In most cases, your logistics partner or customs broker should guide you on updated rates before shipping.

Logistics and Security: Do Not Cut Corners Here

Jewellery is high-value cargo. Security is definitely not optional.

High Value Cargo Shipping India

For international jewellery shipments, air freight is usually the safest, fastest and bestest option.

Choose logistics providers who specialise in:

- High value cargo shipping India

- Secure handling

- Fast customs clearance

- Minimal transit time

Experience matters here.

Insured Shipping for Jewellery Exports

Never ship without insurance.

Let’s say you ship ₹40 lakh worth of diamond jewellery. If something goes wrong and you do not have coverage, that loss is yours.

Choose:

- Full-value insurance

- Door-to-door coverage

- Theft and damage protection

Insured shipping for jewellery exports is not an expense. It is protection.

Secure Courier for Jewellery Export

For small parcels or samples, use secure courier services.

Look for:

- Tamper-proof packaging

- Real-time tracking

- Discreet labeling

- Signature-based delivery

Secure courier for jewellery export is ideal for low-volume but high-value shipments.

Packaging: Simple but Smart

Do not overcomplicate packaging.

Follow these very important basic steps:

- Individual sealed pouches

- Bubble wrapping

- Strong inner boxes

- Double outer cartons

- Discreet exterior labeling

Avoid flashy boxes that attract attention during transit.

Your goal is protection, not presentation.

Common Challenges Exporters Face

Let’s be realistic. It is not always smooth.

Export Risks and How to Reduce Them

| Challenges | Risk Mitigation Strategy |

|---|---|

| Strict EU inspections | Maintain full compliance with EU product and documentation standards |

| Detailed customs scrutiny | Choose experienced logistics partners familiar with EU clearance |

| High insurance premiums | Partner with trusted shippers and maintain transparent documentation |

| Payment delays from new buyers | Use secure payment methods like Letter of Credit (LC) |

✅ Tip: Always verify buyers before shipping and maintain clear communication throughout.

Step-by-Step: How to Export Jewellery to Czech Republic

Here is the process in plain language:

Jewellery Export Flow – India to Czech Republic

| Step | Action |

|---|---|

| 1 | Get your IEC and registrations ready |

| 2 | Confirm your product HS Code |

| 3 | Ensure hallmarking meets EU standards |

| 4 | Finalise buyer terms |

| 5 | Arrange insured air shipping |

| 6 | Prepare documents properly |

| 7 | Clear Indian customs |

| 8 | Shipment reaches Czech customs |

| 9 | Buyer pays duty and VAT |

| 10 | Goods are delivered |

It sounds long, but once you do it once, it becomes routine.

Is It Worth It?

If you can maintain:

- Consistent quality

- Transparent documentation

- Secure shipping

- Competitive pricing

Then yes.

The Czech Republic can be a stable European entry point for Indian jewellery exporters. Europe values reliability. If you deliver on time and maintain standards, repeat orders follow.

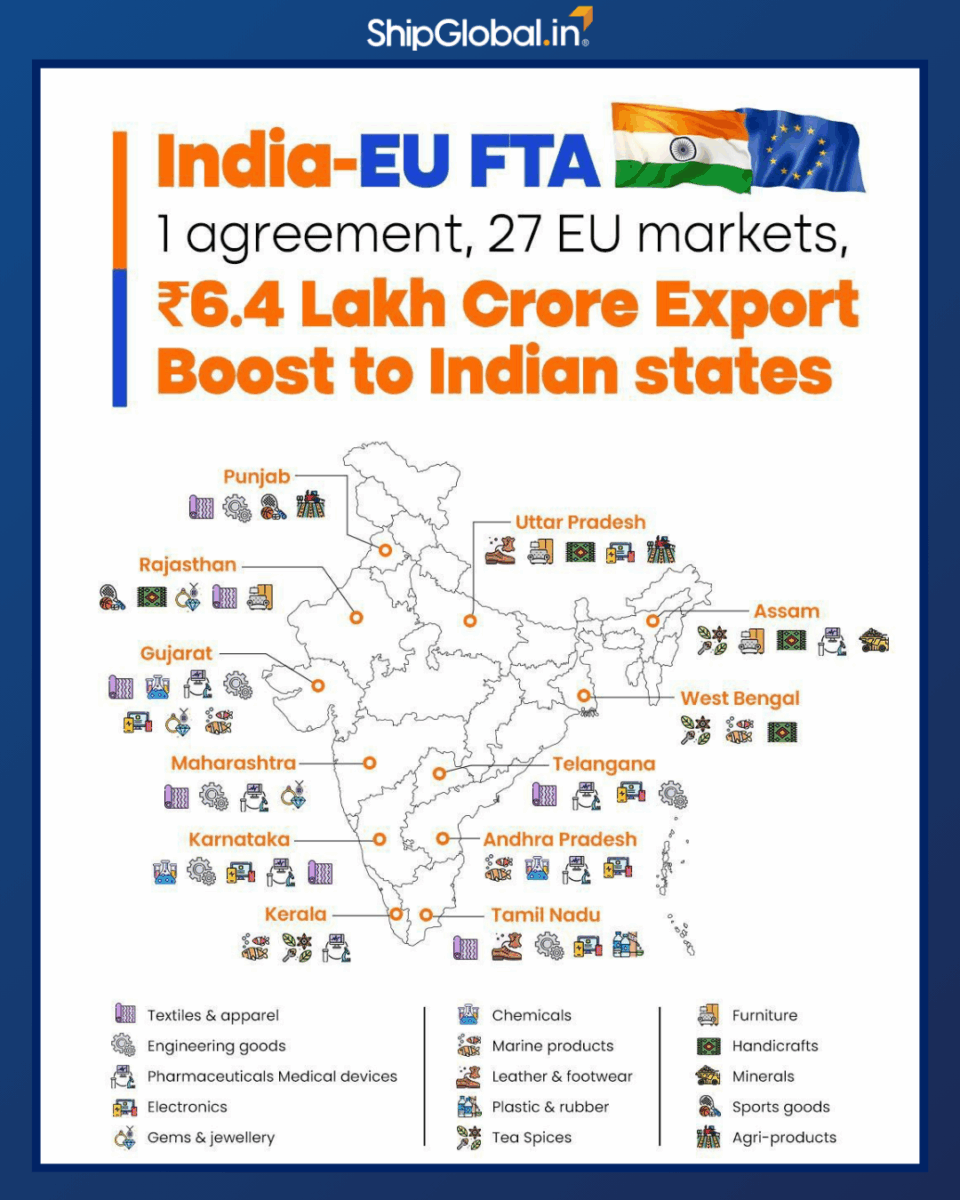

Will the India–EU FTA Change the Legal or Documentation Process?

This is something many exporters are asking right now.

If and when the India–European Union Free Trade Agreement (FTA – Free Trade Agreement) is fully implemented, it could positively impact jewellery exporters. But let’s understand what may actually change.

1. Customs Duty May Reduce

One of the biggest benefits of an FTA is reduced or eliminated customs duty.

If gems and jewellery are included under preferential tariff terms, the customs duty on jewellery Czech Republic could decrease significantly. That would make Indian products more price-competitive in the European market.

Lower duty = better margins or more competitive pricing.

2. Documentation May Become More Structured, Not Necessarily Simpler

An FTA does not usually remove documentation. In fact, it may introduce additional documentation requirements to claim preferential duty benefits.

For example:

- Certificate of Origin under FTA rules

- Proof that goods meet Rules of Origin criteria

- Additional compliance declarations

So while duties may reduce, paperwork may become more specific. You may need to prove that your jewellery genuinely qualifies as “originating from India” under FTA rules.

3. Compliance Standards Will Not Disappear

This is important.

Even if the FTA reduces tariffs:

- Hallmarking requirements EU will still apply

- REACH compliance will still apply

- Quality and purity checks will remain strict

An FTA affects tariffs, not safety or purity regulations.

4. Legal Documentation Process: What Actually Changes?

Here’s the simple way to understand it:

Without FTA:

- Standard export documents

- Regular customs duty

- Standard EU compliance

With FTA:

- Standard export documents

- Additional FTA-related origin documentation

- Reduced or zero customs duty (if applicable)

- Same EU compliance standards

So the legal process does not become relaxed. It becomes more trade-efficient, but still regulated.

Final Thoughts

Gems and Jewellery Export from India to Czech Republic is not complicated. But it demands discipline.

Get your HS Code right.

Follow the EU hallmarking requirements carefully.

Understand customs duty on jewellery Czech Republic.

Choose insured shipping for jewellery exports.

Work with experts in high-value cargo shipping in India.

Do these things properly, and exporting to Europe becomes a structured, manageable process.

No shortcuts. Just smart exporting.

Frequently Asked Questions (FAQs)

Jewellery must clearly display correct purity markings and meet EU standards. Incorrect or misleading hallmarking can lead to rejection.

Common codes include 7102 for diamonds, 7108 for gold, and 7113 for articles of jewellery. Always verify the correct HS Code for gems and jewellery before export.

Customs duty on jewellery Czech Republic depends on product type and HS classification. VAT is also applied at import.

Yes, strongly recommended. Insured shipping for jewellery exports protects you against loss, theft, or damage during transit.