India’s export sector plays a crucial role in driving economic growth, creating employment, and strengthening the country’s position in global trade. Recognising the importance of boosting exports, the Indian government has implemented several incentive schemes designed to ease the cost burden on exporters and improve their competitiveness in international markets.

The Export Promotion Capital Goods Scheme (EPCG) has emerged as a critical policy tool among these initiatives. This zero-duty EPCG scheme lets you import machinery and capital goods for pre-production, production, or post-production without paying customs duty, as long as you meet the required export obligation. Typically, exporters must ship goods worth six times the duty saved within six years, making it a cost-effective way to upgrade technology, reduce capital costs, and stay globally competitive.

In this blog, we will take an in-depth look at how the EPCG scheme compares to these alternatives. Through a detailed analysis of EPCG vs. Advanced Authorization and EPCG vs. Duty Drawback, we aim to help exporters make informed decisions based on their operational priorities, financial capabilities, and long-term strategies.

What is the EPCG scheme

The EPCG scheme is designed to facilitate the import of capital goods used in the production of exportable goods or services at a significantly reduced cost. Under this scheme, eligible businesses are allowed to import capital goods – including machinery, equipment, and technology – either at zero customs duty or at a concessional duty rate.

In return, the importer assumes an obligation to export products or services equivalent to six times the duty saved on the capital goods, which must be fulfilled within six years from the date of issuance of the EPCG license.

The primary objective of the EPCG benefit is to encourage Indian businesses to upgrade their production facilities, adopt new technologies, improve product quality, and ultimately become more competitive in the international marketplace. By minimizing the initial financial burden associated with the acquisition of expensive capital goods, the scheme promotes modernization and productivity enhancement across sectors.

ईपीसीजी योजना का सारांश

| विशेषता | विवरण |

|---|---|

| योजना का नाम | ईपीसीजी (EPCG) |

| लाभ | शून्य शुल्क पर पूंजीगत वस्तुओं का आयात |

| निर्यात दायित्व | 6 वर्षों में 6 गुना निर्यात |

| वैधता अवधि | 6 वर्ष |

| क्या हस्तांतरणीय है? | ❌ नहीं |

💡 यह योजना उन निर्यातकों के लिए उपयुक्त है जो अपने उत्पाद की गुणवत्ता और उत्पादन क्षमता बढ़ाना चाहते हैं।

Key Aspects of the EPCG scheme include:

- Importation of capital goods used for manufacturing goods or providing services, at minimal duty costs.

- Applicability to both manufacturers and service providers, including hotels, hospitals, and software companies.

- Export obligation tied to the value of duty saved, requiring disciplined planning and execution over several years.

- Eligibility extended to deemed exports – supplies to projects with India that qualify under specific conditions.

The EPCG scheme offers a powerful mechanism for businesses seeking to strengthen their infrastructure, provided they are prepared to meet the corresponding export performance requirements.

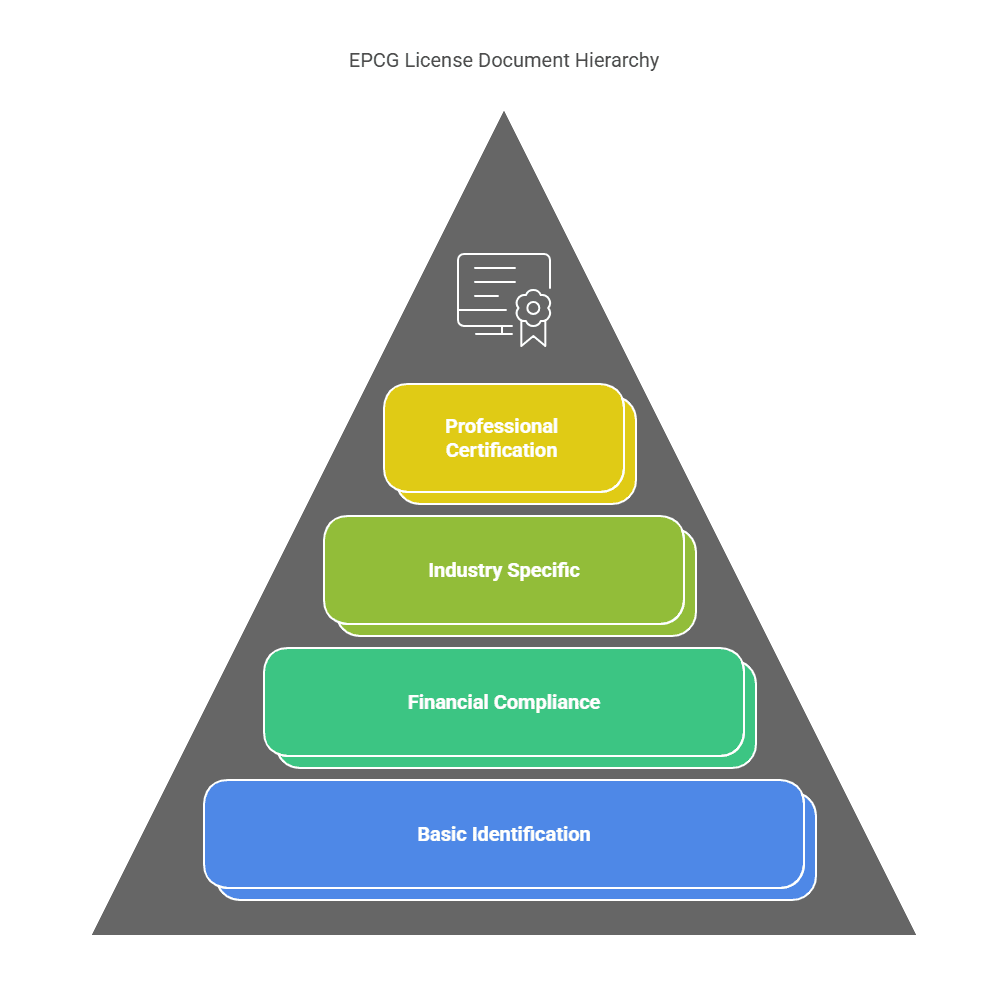

Documents Required for the EPCG License

To obtain an EPCG License, the following documents are required:

- Import Export Code (IEC)

- PAN Card

- Proforma Invoice

- Digital Signature

- GST Registration Certificate

- Excise Registration (if applicable)

- Registration Certificate from the tourism department

- Company Brochure

- Registration-cum-Membership Certificate (RCMC)

- Self-certified copies of certificates from a Chartered Accountant and a Chartered Engineer

Benefits of EPCG

The Export Promotion Capital Goods (EPCG) Scheme provides various advantages to exporters. Under this scheme, businesses are permitted to import capital goods without paying customs duties, provided they fulfill an export obligation within six years. This obligation is equivalent to six times the amount of duty saved on the imported capital goods.

Introduced by the Director General of Foreign Trade (DGFT), the scheme aims to boost exports by offering fiscal incentives and support to exporters. Key benefits include:

- Elimination of import duties on capital goods, resulting in substantial cost savings for exporters.

- Exporters with total export turnover below ₹1 crore must submit a bond or bank guarantee. However, for those with exports exceeding ₹1 crore, only a bond at the customs port is required—no bank guarantee is necessary.

- To claim duty exemptions, exporters must register their EPCG license at the port where goods will be imported before filing the bill of entry.

- The scheme helps accelerate export activities, especially for rapidly growing companies.

EPCG vs. Advance Authorization: An In-Depth Comparison

To better understand the merits of the EPCG benefits, it is important to compare it against the Advance Authorisation Scheme, another widely used export promotion tool. Although both aim to support exporters by reducing input costs, they operate on fundamentally different principles.

Nature of Imports Allowed

One of the primary differences between the two schemes lies in the type of imports they permit.

- Under the EPCG scheme, the focus is on capital goods. These are long-term assets that aid in the production process but are not consumed directly during manufacturing. Examples include industrial machinery, equipment, spares, tools, and molds. By allowing duty-free or concessional duty import of such assets, the EPCG scheme encourages businesses to invest in infrastructure improvements.

- In contrast, the Advance Authorisation Scheme caters to operational needs by permitting duty-free import of raw materials, components, consumables, and intermediates that are physically incorporated into export products. These inputs are consumed during the production process and have a short life cycle compared to capital goods.

Thus, the EPCG scheme supports long-term asset acquisition, whereas Advance Authorization focuses on short-term production requirements.

Export Obligation Conditions

Both schemes require beneficiaries to meet an export obligation; however, the nature and timeline of these obligations differ significantly.

- In the EPCG Scheme, the export obligation is quantified as six times the amount of duty saved, and the exporter must fulfil this obligation over a relatively extended period of six years. This long-term commitment reflects the capital nature of the imported goods, giving businesses sufficient time to generate returns on their investments.

- The Advance Authorisation Scheme imposes a more immediate obligation: exporters must produce and export goods equivalent to the quantity of imported inputs, typically within 18-36 months. Extensions may be granted, but the general expectation is for faster turnover.

Therefore, companies must assess their export capacity and timelines carefully when choosing between these two options.

Beneficiary profiles

The two schemes also cater to different categories of exporters:

- The EPCG Scheme is suited to businesses that are expanding their production capabilities or modernizing existing facilities. It is ideal for organizations with medium to long-term growth plans that can absorb the responsibilities associated with large-scale capital investment.

- Conversely, the Advance Authorization Scheme is more appropriate for manufacturers that operate a high-volume production line requiring a steady supply of raw materials at competitive costs. Exporters dealing with seasonal or contract-based export orders often find this scheme more advantageous.

Type of Duty Benefit

The financial incentives under each scheme differ in terms of the duties exempted.

- The zero duty EPCG Scheme focuses mainly on the reduction or elimination of customs duties on capital goods imports.

- The Advance Authorization Scheme offers broader relief by exempting importers not only from basic customs duty but also from Integrated Goods and Services Tax (IGST), compensation, and additional customs duties applicable under various heads.

Thus, while EPCG provides targeted savings n capital investment, Advance Authorization delivers more comprehensive cost relief on production inputs.

Compliance Requirements

Finally, the compliance burden varies.

- The EPCG Scheme requires extensive record-keeping and ongoing reporting to ensure the export obligation is being met over multiple years. Defaulting on obligations can attract penalties, including payment of duties saved with interest.

- The Advance Authorization Scheme requires adherence to input-output norms specified by the Directorate General of Foreign Trade (DGFT) and relatively quicker proof of export. While the documentation is still considerable, it is generally seen as more manageable over the shorter life cycle of the scheme.

EPCG vs. Duty Drawback: An Exhaustive Analysis

Moving to the comparison between the export promotion capital goods scheme (epcg) and the Duty Drawback Scheme, we find that these two mechanisms serve very different strategic purposes for exporters.

Purpose and Mechanism

- The EPCG Scheme is proactive: It reduces the cost of investing in production capacity by allowing concessional imports of machinery and equipment.

- In contrast, the Duty Drawback Scheme is reactive: It provides refunds of the customs duty paid on imported inputs after goods are exported. The idea is to neutralize the impact of import duties on exported goods, making Indian exports more price-competitive.

Thus, EPCG incentivises infrastructure development, while Duty Drawback alleviates cost burdens post-export.

Timing and Cash Flow Implications

- One of the significant advantages of the EPCG Scheme is that it provides immediate financial relief at the point of import. This improved cash flow enables the companies to invest more confidently.

- On the other hand, the Duty Drawback Scheme requires exporters to pay all applicable duties initially and subsequently claim refunds. This approach temporarily locks working capital and increases dependency on procedural clearances from customs authorities.

In industries where liquidity is critical, the timing difference between these two schemes can significantly affect operational planning.

Conditions and Flexibility

- EPCG services impose a long-term export obligation tied specifically to the machinery imported. This condition demands sustained business performance and meticulous tracking over several years.

- Duty Drawback, however, does not impose long-term obligations. Exporters simply need to ship goods, file the necessary documents, and claim the drawback. There is no requirement to track export performance over multiple years for each piece of machinery or input imported.

Thus, Duty Drawback offers more flexibility, especially to small and medium enterprises (SMEs) that may not have the resources to manage long-term obligations.

Type of Beneficiaries

- EPCG services are typically best suited for manufacturers and service providers with established business models, long-term export plans, and the capability to handle complex compliance requirements.

- Duty Drawback is more accessible to all types of exporters, including traders, intermediaries, and SMEs, due to its simplicity and immediate financial benefits post-export.

Practical Business Scenarios: Which Scheme Fits Best

Let us illustrate through practical examples how businesses can choose the most appropriate scheme:

- A manufacturing company planning to build a new state-of-the-art plant to produce engineering goods for global markets would benefit most from the EPCG Scheme, as it minimizes capital costs and supports long-term expansion.

- A textile exporter needing consistent imports of specialized yarn and dyes for quick turnaround orders would find the Advance Authorization Scheme more suitable, ensuring lower raw material costs and timely deliveries.

- A trading company specializing in exporting finished leather goods procured from various local manufacturers may find the Duty Drawback Scheme most beneficial, enabling it to claim refunds without tying up resources in compliance-heavy obligations.

Conclusion: Choosing the Right Export Incentive

The EPCG Scheme is a transformative initiative for Indian exporters looking to enhance production capacities, adopt world-class technology, and build a strong global footprint. However, it comes with significant commitments in terms of export obligations and compliance management.

When compared against Advance Authorization and Duty Drawback, the EPCG Scheme is not necessarily “better” or “worse” it simply serves a different purpose. Each scheme is tailored for specific business contexts and operational strategies.

Therefore, exporters must undertake a thorough assessment of their immediate needs, long-term objectives, financial capabilities, and organisational capacities before opting for an export incentive scheme. In many cases, a combination of schemes can also be utilised to maximise benefits.

By understanding the nuances of EPCG vs. Advance Authorisation and EPCG vs. Duty Drawback, exporters can align their incentive strategy with their broader business vision, ensuring sustainable growth, improved competitiveness, and compliance with government regulations.

FAQs

The Export Promotion Capital Goods (EPCG) Scheme is a government initiative that allows Indian manufacturers and service providers to import capital goods at zero or concessional customs duty, provided they commit to fulfilling an export obligation. The objective is to support technological upgradation and make Indian exports globally competitive by lowering the cost of production equipment.

EPCG is called an export incentive scheme because it allows exporters to import capital goods at zero or concessional customs duty, on the condition that they earn foreign exchange by exporting goods or services. This reduces upfront costs for exporters and incentivises them to increase exports to meet the export obligation.

Any manufacturer exporter, merchant exporter tied to a supporting manufacturer, or service provider (such as hotels, hospitals, and software companies) can apply for an EPCG license, provided they hold a valid Importer Exporter Code (IEC) and are registered with the DGFT.

Yes. Capital goods can also be sourced from domestic manufacturers under the EPCG Scheme, where the supplier may avail benefits like deemed export incentives. However, the export obligation still rests with the EPCG authorization holder.

If the exporter fails to meet the export obligation, they are liable to pay the full amount of duty saved, along with interest and penalties as applicable under customs law. The DGFT may also restrict future incentives or suspend the IEC in serious cases of non-compliance.