Exporting products from India to the global market can be incredibly rewarding. But let’s be honest, getting started with exports can feel overwhelming. Between customs duties, compliance paperwork, shipping regulations, and tax rules, the process can seem like a maze. This is where the Directorate General of Foreign Trade (DGFT) steps in as a valuable ally for Indian exporters.

To make international trade smoother and more cost-effective, DGFT offers a variety of incentives and schemes under the Foreign Trade Policy (FTP). These benefits are designed not just for large export houses but also for startups, solopreneurs, artisans, and MSMEs who want to take their products global without breaking the bank.

In this blog, we break down DGFT’s export schemes and show you exactly how to apply for them, step by step. Whether you’re just getting started or looking to optimise your existing export operations, this guide is designed to help you understand the DGFT online application process, eligibility, and compliance requirements.

Indian Government makes export easy

DGFT has amended the Handbook of Procedures 2023 to allow Indian exporters to self-declare Certificates of Origin (CoO) under the India-EFTA Trade and Economic Partnership Agreement (TEPA), in addition to obtaining them from authorised agencies.

Effective after the FTA’s start on October 1, this simplifies certification for trade with Iceland, Liechtenstein, Norway, and Switzerland and supports faster, more efficient processing via the upgraded electronic CoO system.

- Faster filing with self-declaration

- Authorised-agency route still available

- Works with the upgraded electronic CoO platform

Understanding DGFT and the Foreign Trade Policy (FTP)

DGFT is a government body under the Ministry of Commerce and Industry that regulates and promotes India’s foreign trade. The FTA is revised periodically – the latest FTP 2023-2028 focuses on ease of doing business, automation, and exporter digitalisation.

It plays a crucial role in administering Foreign Trade Policy benefits by offering licenses, authorisations, and financial assistance to exporters. Exporters can now access most benefits through the paperless DGFT portal, with online issuance of authorisations and e-scrips.

If you’re a manufacturer, trader, or even an individual selling online internationally, taking advantage of DGFT incentives like the DGFT RoSCTL scheme can significantly reduce your cost structure and make you more competitive in overseas markets.

Types of DGFT Schemes and License Categories

There are various DGFT license types available depending on the nature of your exports and business objectives. Exporters need to have no pending obligations or penalties under DGFT. New e-commerce exporters can claim RoDTEP or Duty Drawback if shipping via authorised platforms and having electronic shipping bills.

Below are the major schemes you can apply for:

Major Export Promotion Schemes

| Scheme | Benefit | Duty Rate | Validity | Transferable |

|---|---|---|---|---|

| Advance Authorisation | Duty-free import of inputs | 15% | 12 months | ❌ |

| DFIA | Duty-free import post-export | 20% | 12 months | ✔️ |

| EPCG | Zero-duty capital goods import | 6× duty saved in 6 yrs | 6 yrs | ❌ |

| RoDTEP | Refund of hidden taxes | NA | NA | ✔️ |

| RoSCTL | Apparel export tax rebates | NA | NA | ✔️ |

| Duty Drawback | Refund of customs duty | NA | NA | ✔️ |

💡 Tip: Choose the right export scheme based on your product type and import needs.

1. Advance Authorisation (AA)

The Advance Authorisation Scheme permits duty-free import of inputs that are physically incorporated in the export product. This includes fuel, oil, and catalysts consumed during production. It exempts importers from paying Basic Customs Duty, Additional Customs Duty, Education Cess, Anti-dumping Duty, Safeguard Duty, IGST, and Compensation Cess.

Eligible applicants include manufacturer exporters and merchant exporters tied to a supporting manufacturer. Inputs may be based on Standard Input Output Norms (SION) or self-declaration (as per Handbook of Procedures). Exporters must maintain a minimum of 15% value addition and fulfill their export obligation within 18 months. The authorisation is valid for 12 months, both extendable under specified conditions.

2. Duty-Free Import Authorisation (DFIA)

DFIA allows post-export duty-free import of inputs required in the manufacture of export goods. However, this scheme exempts only the Basic Customs Duty. Inputs must be listed under SION.

A minimum value addition of 20% is required. Merchant exporters can also apply by including the name and address of the supporting manufacturer in export documents. A Duty Credit Scrip is issued after exports, valid for 12 months and transferable.

3. Export Promotion Capital Goods (EPCG) Scheme

The EPCG Scheme facilitates the import of capital goods (machinery and equipment) at zero customs duty, including exemption from IGST and Compensation Cess.

Exporters must fulfill an export obligation equal to six times the duties and taxes saved, within six years from the date of issue of the EPCG license. Exports under other schemes like AA, DFIA, or Duty Drawback can be counted toward this obligation. A Post Export EPCG Scheme also exists, allowing refunds instead of upfront exemptions.

4. Status Holder Certificate

This recognition is awarded to exporters who demonstrate outstanding performance in international trade. The Status Holder Certificate is based on FOB export earnings in freely convertible foreign currency over the current and previous three financial years (or two years for the Gems and Jewellery sector).

There are five categories: One Star to Five Star Export Houses. Status Holders enjoy various privileges like faster clearances and simplified procedures.

5. RoDTEP (Remission of Duties and Taxes on Exported Products)

The RoDTEP Scheme aims to refund taxes and duties incurred during manufacturing and distribution that are not otherwise reimbursed. These include embedded levies at the Central, State, and local levels, like cumulative indirect taxes on inputs and distribution costs.

Applicable from 1 January 2021, RoDTEP benefits are disbursed via transferable e-scrips, usable for payment of Basic Customs Duty.

6. RoSCTL (Rebate of State and Central Taxes and Levies)

RoSCTL is specific to apparel and made-up exports (under Chapters 61, 62, and 63). It offers a rebate on state and central taxes, such as VAT on fuel used in transport and embedded levies on electricity, which are otherwise non-creditable.

Extended from 1 January 2021 to 31 March 2024, the DGFT RoSCTL scheme is implemented with full digitisation and scrips are maintained in an electronic ledger via ICEGATE.

7. Duty Drawback Scheme

The Duty Drawback (DBK) scheme, administered by the Department of Revenue, offers a rebate of customs duties on inputs used in the manufacture of exported goods. However, IGST and Compensation Cess are excluded from the refund.

This scheme is aimed at making Indian goods price-competitive by eliminating tax costs that are embedded in the supply chain.

There are also sector-specific schemes for industries like agriculture, coffee, and spices, operated by agencies such as APEDA and the Spices Board.

DGFT Schemes Eligibility – Who Can Apply?

Understanding DGFT schemes eligibility is essential before you begin your application. The following entities can apply for DGFT benefits:

- Manufacturer exporters

- Merchant exporters with a supporting manufacturer

- MSMEs and registered companies

- Individual exporters with a valid IEC

- E-commerce exporters (for certain schemes)

Ensure your export activity aligns with the specific requirements and obligations of the chosen scheme.

What You Need Before Applying for DGFT Authorisation

To apply for any DGFT scheme, gather the following documents and registrations:

- Importer Exporter Code (IEC)

- GST Registration

- Digital Signature Certificate (DSC)

- Active DGFT Account (linked to IEC)

- Shipping Bills and Tax Invoices

- Bank Realisation Certificates (eBRCs)

Having these ready ensures a smoother DGFT registration and application process.

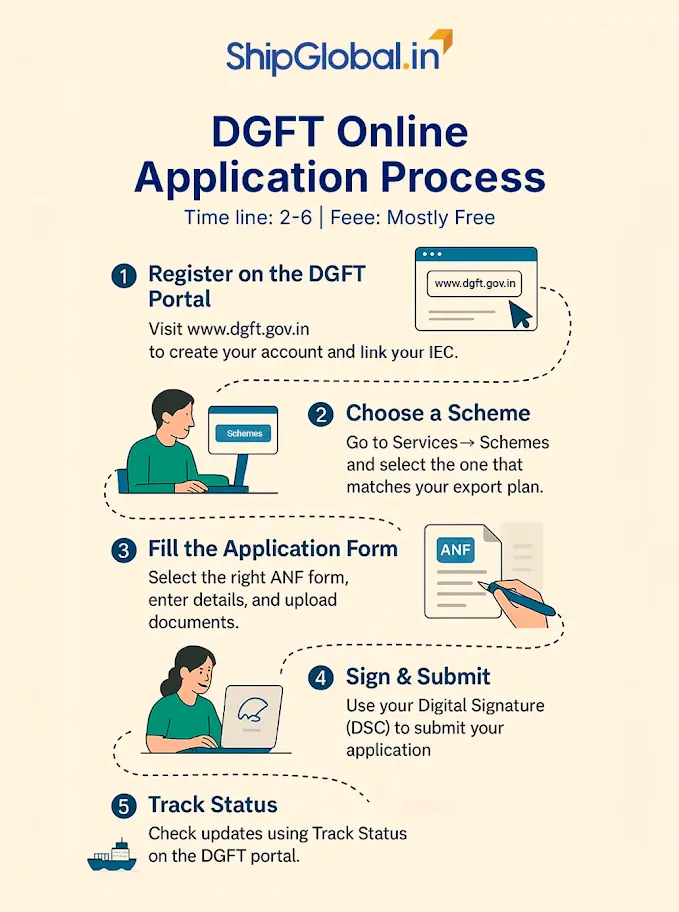

Step-by-Step DGFT Online Application Process

Timeline: Approvals typically take 2–6 weeks, depending on scheme and regional office workload.

Fee: Most schemes are free; some may involve minimal processing charges.

Step 1: Register on the DGFT Portal

Visit www.dgft.gov.in and create your account. Link your IEC to access scheme-specific applications.

Step 2: Choose the Appropriate Scheme

Go to the ‘Services’ tab and select the DGFT scheme relevant to your product and export strategy. Read the eligibility and requirements carefully.

Step 3: Fill out the Application Form

Choose the correct ANF (Aayat Niryat Form), fill in your details, and upload supporting documents.

Step 4: Submit with Digital Signature

All DGFT applications must be signed digitally using your DSC before submission. You will receive a reference number post-submission.

Step 5: Track Application Status

Use the portal’s ‘Track Status’ option to check updates and take necessary follow-up actions.

DGFT Compliance Requirements to Keep in Mind

To maintain eligibility and avoid penalties, follow these key compliance steps:

- Maintain accurate export records

- Fulfil export obligations within the prescribed time

- Ensure proper classification of goods using the correct HS codes

- Update DGFT portal details if business structure or contact information changes

- Follow minimum value addition norms where applicable

Common Mistakes to Avoid When Applying

- Entering wrong HS Codes

- Not linking the IEC correctly to the DGFT account

- Submitting poor-quality scanned documents

- Missing scheme specific deadlines

- Not meeting value addition or export obligation targets

Avoiding these mistakes improves your chances of faster approvals and uninterrupted benefits.

Tips to Maximise DGFT Benefits

- Keep all export records digital and neatly archived

- Sign up for DGFT updates and policy notifications

- Consult export advisors or legal experts for tricky cases

- Apply early for post-export schemes to avoid deadline pressure

- Monitor your export turnover and obligations for status upgrades

Conclusion: Take Advantage of DGFT Incentives Today

Applying for DGFT schemes can save you 5–20 % in landed cost and strengthen global competitiveness. DGFT incentives under the Foreign Trade Policy are a strategic opportunity for Indian exporters, particularly MSMEs, startups, and digitally-driven businesses, to lower their export costs and compete more effectively in international markets.

ShipGlobal helps exporters prepare compliant shipping documents, generate valid shipping bills, and stay aligned with DGFT requirements. With the introduction of streamlined digital platforms, well-defined documentation processes, and clearly outlined eligibility norms, the DGFT online application process is now more transparent and accessible than ever before.

Whether you’re selling through e-commerce platforms, wholesale channels, or traditional retail exports, understanding the right DGFT license types, meeting DGFT compliance requirements, and applying for the correct DGFT authorisation can lead to significant long-term gains in profitability and global reach.

So if you’re ready to scale your export business, now is the perfect time to explore the full range of Foreign Trade Policy benefits available to you. Visit the DGFT portal, choose the scheme that aligns with your business goals, and kickstart your journey by initiating your DGFT registration for exporters today.

FAQs for How to Apply for DGFT Benefits

Any individual, MSME, or company engaged in exporting and holding a valid IEC can apply.

Yes, a DSC is mandatory for submitting applications on the DGFT portal.

Yes, provided the schemes are not overlapping and you meet the eligibility criteria for each.

It varies depending on the scheme, but applications can be tracked online and usually progress within a few weeks if documents are complete.

The full form of DGFT is the Directorate General of Foreign Trade.