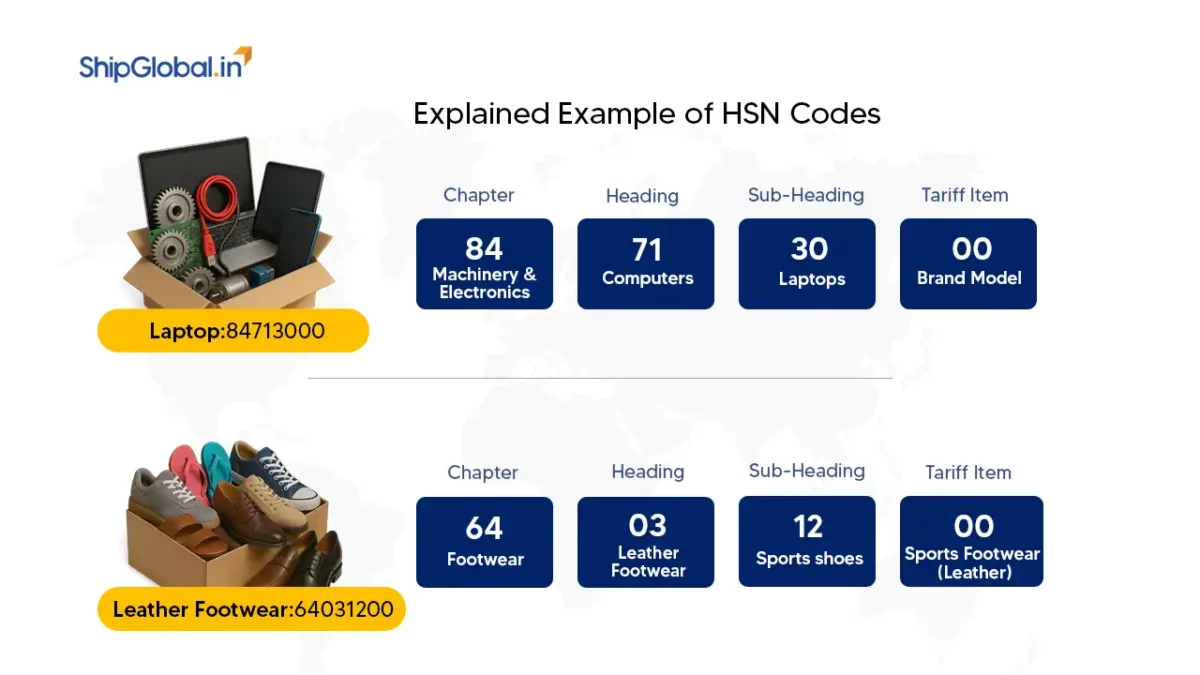

Caps are a popular clothing accessory used for fashion, uniforms, sports, and protection against sun or dust. Whether cotton baseball caps, woolen beanies, or synthetic visors, all types are classified under the Harmonized System (HS) codes to streamline trade, customs clearance, and taxation.

Caps generally fall under Chapter 65 – Headgear And Parts Thereof. The key heading is:

HS Code 6505 – Hats and other headgear, knitted or crocheted, or made up from lace, felt, or other textile fabric.

Customs Compliance

Avoids wrong classification and prevents customs delays or shipment issues.

Correct GST Application

Ensures the applicable GST rate is charged accurately for transactions.

Export Documentation

Supports accurate invoices, shipping paperwork, and COO forms.

Trade Standardization

Helps maintain consistent product classification across global markets.

HS Code Classification for Cap

Caps are classified under different HS subheadings based on design and material:

- 650500 – Caps, hats, and headgear made of textile fabrics (knitted or non-knitted)

- 650610 – Safety caps and helmets for sports or industrial use

- 650400 – Hats or caps made of felt or non-woven fabric

- 650700 – Headgear parts like peaks, linings, or chin straps

GST Rates For Caps In India

GST on caps depends on their type and usage:

- Textile caps and hats (HS 6505): 12% GST

- Protective helmets and industrial caps (HS 6506): 18% GST

- Headgear parts and accessories (HS 6507): 18% GST

Fashion and casual caps are taxed at 12%, while industrial or sports-related headgear attract 18% GST.

| Product | HS Code | Category | Current GST Rate (2025) |

|---|---|---|---|

| Textile Cap (Baseball, Cotton, Wool) | 650500 | Knitted or woven caps made of textile | 12% |

| Safety Helmet / Industrial Cap | 650610 | Protective helmets for safety use | 18% |

| Fashion Hat or Felt Cap | 650400 | Felt or non-woven hats and caps | 12% |

| Sports Cap / Helmet | 650610 | Protective headgear for sports | 18% |

| Parts Of Cap (Peaks, Straps) | 650700 | Headgear accessories and parts | 18% |

Final Thoughts

Caps are mainly classified under HS Code 6505, with separate headings for safety and industrial headgear. In India, fashion and textile caps attract 12% GST, while protective or industrial caps attract 18% GST. Proper HS code use ensures trade compliance and tax accuracy.

FAQs

Cotton or textile caps are classified under HS 650500.

Fashion or textile caps attract 12% GST, while safety or industrial caps attract 18% GST.

No, sports helmets fall under HS 650610, while regular caps are under 650500.

Yes, cap parts are classified under HS 650700.

No, caps are not GST-exempt; they are taxed at 12% or 18%, depending on type.