Understanding HS Code for Chocolate

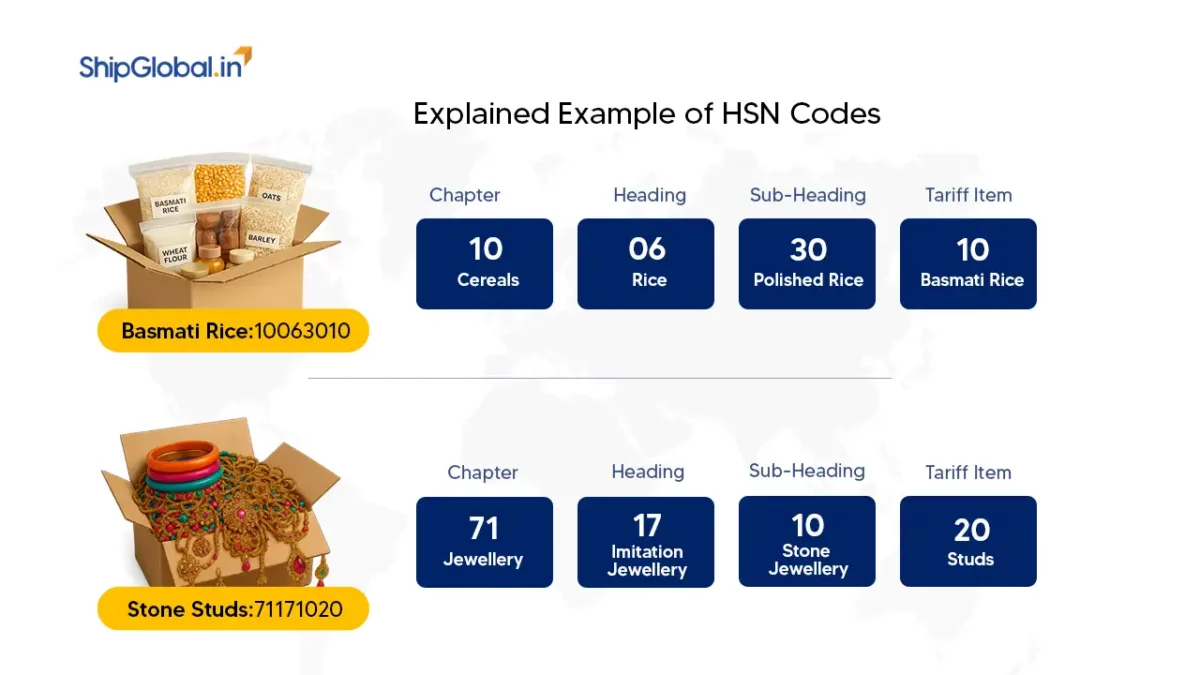

Every product traded internationally requires classification under the Harmonized System (HS) of nomenclature. For chocolate and other cocoa-based foods, the classification falls under Chapter 18 – Cocoa And Cocoa Preparations.

The primary HS code used is 1806, which covers chocolate and other food preparations containing cocoa. Whether it is chocolate bars, blocks, spreads, or beverages made from cocoa, they all sit under this category. Correct classification ensures accurate taxation, smooth customs clearance, and proper trade documentation.

Importance Of HS Code for Chocolate

Getting the HS code correct is critical for importers, exporters, and distributors. Here is why:

- Customs Clearance: Incorrect HS codes can delay shipments and attract penalties.

- Accurate GST Application: GST is levied based on product classification under HS codes.

- Trade Benefits: HS codes help access preferential duties under trade agreements.

- Global Uniformity: Since the HS system is standardized, it makes cross-border trade easier.

If you are dealing with chocolate and cocoa products, you must always verify the latest HS codes published by customs authorities.

HS Code Classification For Chocolate Products

Chocolate falls under HS Code 1806, but within it, multiple subheadings exist:

- 180631 – Chocolate, filled bars or slabs

- 180632 – Chocolate, unfilled bars or slabs

- 180690 – Other food preparations containing cocoa (like spreads, candies, and cocoa-based drinks)

GST Rates For Chocolate And Cocoa Preparations

Earlier, most cocoa-based products attracted 18% GST in India. However, after the GST Council’s 56th meeting in September 2025, the rate was reduced to 5% for chocolate and other cocoa preparations under Chapter 18.

This change is a major relief for both businesses and consumers. Importers benefit from reduced costs, and domestic manufacturers see increased demand as prices become more affordable.

HS Codes And GST Rates For Chocolate Products

Here are the most searched chocolate and cocoa products under Chapter 18, their HS codes, and the current GST rates:

| Product | HS Code | Category | Current GST Rate (2025) | Earlier GST Rate |

|---|---|---|---|---|

| Cocoa Beans | 180100 | Raw or roasted beans | 5% | 18% |

| Cocoa Shells And Husks | 180200 | By-products of cocoa | 5% | 18% |

| Cocoa Paste | 180310 / 180320 | Not defatted / defatted | 5% | 18% |

| Cocoa Butter | 180400 | Edible cocoa fat | 5% | 18% |

| Cocoa Powder | 180500 | Unsweetened powder | 5% | 18% |

| Chocolate (General) | 180600 | Bars, blocks, spreads | 5% | 18% |

| Filled Chocolate Bars | 180631 | Chocolate with fillings | 5% | 18% |

| Unfilled Chocolate Bars | 180632 | Plain chocolate bars | 5% | 18% |

| Other Cocoa Preparations | 180690 | Spreads, candies, drinks | 5% | 18% |

Final Thoughts

Chocolate may sound simple, but when it comes to global trade, classification under the right HS code is essential. With the GST rate now at 5%, the chocolate industry in India stands to gain from reduced costs, higher consumption, and smoother exports.

Always ensure you use the correct HS code for customs clearance and verify GST applicability through the latest CBIC notifications.

FAQs for HS Code for Chocolate

The primary HS code for chocolate is 1806, which encompasses chocolate bars, spreads, and other cocoa-based products.

According to the latest GST Council updates, most chocolate and cocoa preparations are subject to a 5% GST.

No, cocoa beans (180100) and cocoa butter (180400) fall under different subheadings of Chapter 18.

The GST Council rationalized rates in September 2025 to make essential and widely consumed food items more affordable.

Yes, the HS system is globally harmonized at the 6-digit level, though some countries add extra digits for more detail.