Key Takeaways

- Use of LCs (Letter of Credit) in international trade provides businesses the confidence to expand into new markets overseas.

- With LC, it becomes easier for you and your business to establish new connections globally (with new companies).

- A Letter of Credit/LC is highly customizable, offering improved flexibility to trading partners with respect to various terms, conditions, and requirements of transaction.

Let’s say you’ve just landed a dream export order. It’s big. It’s international. And it’s from a client you’ve never worked with before.

You’re excited, but also a bit anxious. The buyer is in another country. What if they don’t pay after you ship the goods?

If you’ve ever asked yourself that question, you’re not alone. Payment uncertainty is one of the biggest concerns, especially when trading across borders.

That’s exactly where a Letter of Credit steps in. It’s not just a document, it’s a powerful financial tool that ensures you get paid. A promise backed by a bank that says, “Yes, you’ll get your money, as long as you meet the terms.”

So, what is a Letter of Credit really? How does it work? And is it the right payment method for your business?

Let’s explore.

What Is a Letter of Credit

A Letter of Credit (LC), also known as Documentary Credits, is a written commitment from a bank that guarantees the payment to an exporter (you) on behalf of a buyer, if the conditions in the LC are met. It is an arrangement whereby bank, acting at the request of a customer (Importer/Buyer), undertakes to pay for the goods/services, to a third party (Exporter/Beneficiary) by a specified date (or as per the terms of agreement).

In simpler terms? You ship the goods, submit the right paperwork, and the bank ensures you get paid.

It’s one of the most widely used payment instruments in global trade.

How Does It Actually Work

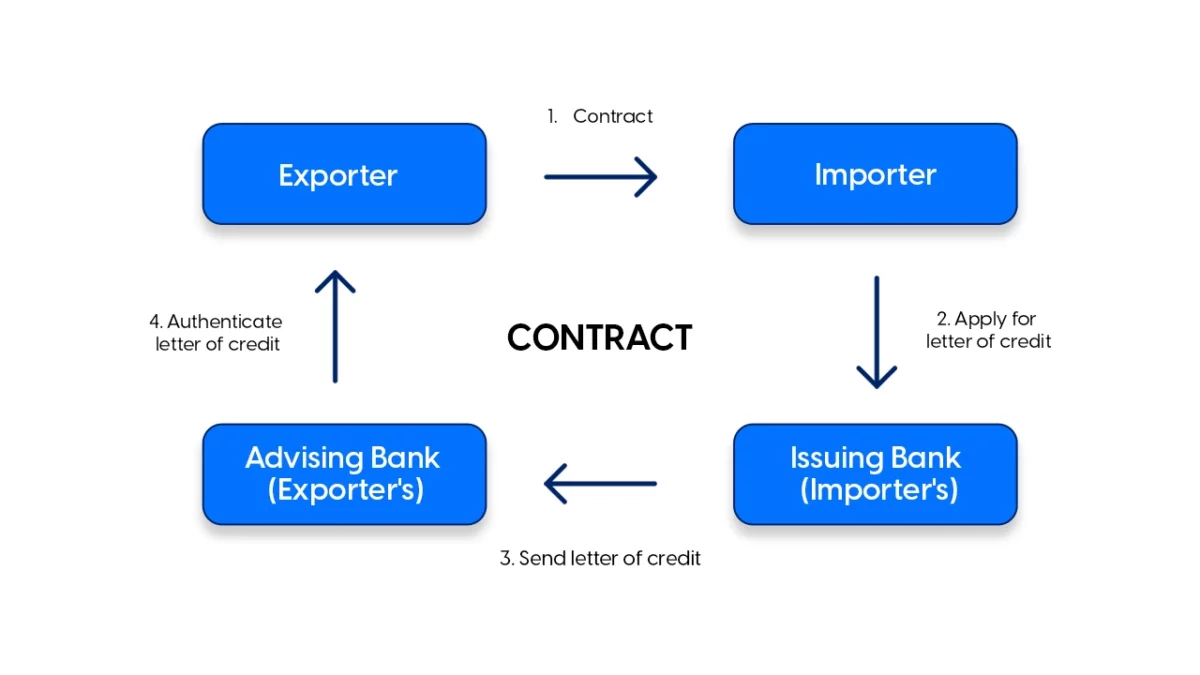

Contract

- You and the buyer agree to use a Letter of Credit.

- Buyer asks their bank to issue the LC in your favor.

- Your bank (advising bank) receives and informs you of the LC terms.

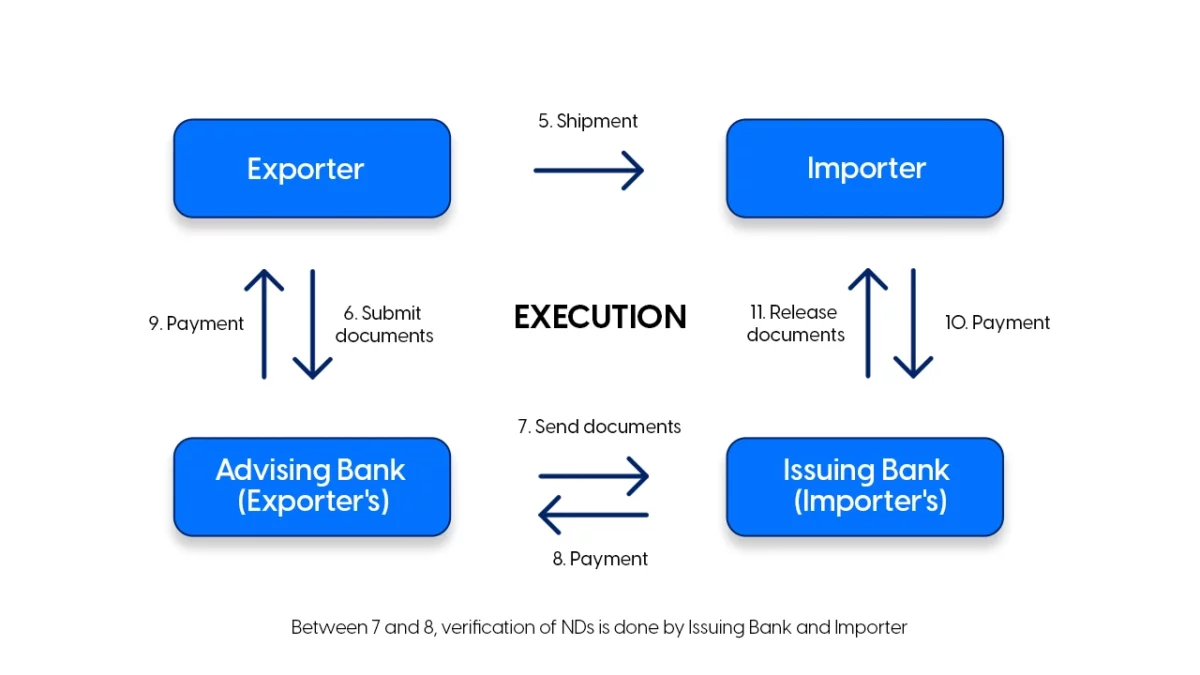

Execution

- You ship the goods as agreed and submit all documents to your bank.

- If the documents match the LC conditions, payment is released.

Why Should You Care About It

Here’s the truth: trust takes time, especially in business. When you’re working with buyers across oceans and time zones, things like delays, defaults, and disputes can happen. An LC removes that uncertainty by involving a trusted third party: the bank.

Letters of Credit: Select Statistics

- In 2022, the total value of global trade reached $32 trillion, which included $25 trillion in goods and $7 trillion in services.

- Approximately 80% of this global trade is facilitated through trade finance mechanisms.

- Of the total trade finance used for goods, around 20% is done through Letters of Credit (LCs).

With a Letter of Credit, you get:

- Payment assurance even if you’ve never met the buyer; this gives you the confidence to step into the unknown territory/ start international trade.

- A legal framework governed by international rules.

- Documentation driven security, not just empty promises.

LC also acts as an indicator of the creditworthiness of the buyer, since its issuance implies the bank’s willingness to support the buyer financially.

Parties to a Letter of Credit (LC)

Key Parties:

i) Applicant/Opener: This refers to the buyer of goods or services (importer) on whose request the Letter of Credit is established. The LC is opened by the bank on behalf of this party.

ii) Issuing Bank: The bank that issues the Letter of Credit. It commits to making payment on behalf of the applicant, provided the terms and conditions specified in the LC are met.

iii) Beneficiary: The seller of goods or services (exporter) in whose favor the Letter of Credit is opened. Upon presenting the required documents in accordance with the LC terms, the beneficiary becomes eligible to receive payment.

iv) Advising Bank: The bank that authenticates and conveys the Letter of Credit to the beneficiary. This is usually a bank located in the beneficiary’s country and confirms the genuineness of the LC issued by the issuing bank.

Other Parties:

v) Confirming Bank: A bank that adds its own undertaking to that of the issuing bank, guaranteeing payment, acceptance, negotiation, or deferred payment under the LC. This is generally a bank in the beneficiary’s country and its confirmation enhances the creditworthiness of the LC for the exporter. The confirmation is provided at the request or with the authorization of the issuing bank.

vi) Nominated Bank: A bank, usually in the exporter’s country, that has been authorized by the issuing bank to receive and examine documents, negotiate or pay the amount due under the LC.

vii) Reimbursing Bank: A bank designated to settle reimbursement claims submitted by the bank that makes the payment, acceptance, or negotiation under the LC. Typically, this is a bank with which the issuing bank maintains a Nostro Account, and payments are made to the nominated bank from this account.

viii) Transferring Bank: In the case of a transferable Letter of Credit, this is the bank that facilitates the transfer of the LC from the first beneficiary to one or more second beneficiaries, at the request of the first beneficiary. In freely negotiable credits, a transferring bank is specifically named in the LC and authorized to carry out such transfers.

Types of a Letter of Credit

A Quick Look at Key LC Types

| Type of Letter of Credit | What It Means |

|---|---|

| Sight Letter of Credit | Payment is made immediately once the required documents are verified by the bank. |

| Revocable Letter of Credit | Can be modified or cancelled by the issuing bank at any time without the seller’s approval. |

| Irrevocable Letter of Credit | Cannot be changed or cancelled unless all parties agree. This is the most commonly used type. |

| Transferable Letter of Credit | Lets the original seller (beneficiary) transfer all or part of the LC value to another party (like a supplier). |

| Back-to-Back Letter of Credit | Involves two linked LCs—one from the buyer to the middleman, and another from the middleman to the supplier. Useful in trading situations. |

Detailed Breakdown

Sight Credit

This type of Letter of Credit allows for immediate payment upon presentation of the required documents. Once the correct documents are submitted, the payment is made “at sight.” For instance, a businessperson can present a bill of exchange along with a sight LC to a lender and obtain the necessary funds instantly. Among all types of LCs, sight credits are known for their immediacy.

Revocable Letter of Credit

A Revocable Letter of Credit, as the name suggests, can be amended or cancelled at any time by the issuing bank, without prior notice to or consent from the beneficiary. From an exporter’s perspective, such credits are considered insecure. Banks generally do not add confirmation to revocable LCs, making them even less reliable. However, if a negotiating bank has already honored the bills before receiving revocation notice, the issuing bank remains liable for payment. The LC must explicitly state that it is revocable.

Irrevocable Letter of Credit

An Irrevocable LC cannot be changed or cancelled unless all involved parties agree.

For instance, if an applicant uses an irrevocable, confirmed LC (or a bill of exchange that is unconditionally co-accepted or guaranteed by a bank) to apply for a duty credit scrip or to meet export obligations, the exporter’s bank certifies this in the Bank Certificate of Export and Realization. In such cases, payment is treated as received. For Status Holders, an irrevocable LC is considered sufficient.

Revolving Letter of Credit

A Revolving LC allows the credit amount to be automatically restored or renewed under specified terms, without requiring amendments each time. This may occur based on time intervals or value used. Common in domestic trade and sometimes used for imports, a revolving LC is issued for a specific amount, and the available credit is replenished once payment is made for earlier transactions.

Limits can be imposed both on the amount that can be drawn at any one time and on the overall total. The issuing bank must inform the negotiating bank upon acceptance or payment to trigger reinstatement.

When used for imports, the total amount and validity of a revolving LC must fall within the bounds of the relevant import license, if one is required. Though rarely issued for imports, revolving LCs may be considered in exceptional situations, subject to appropriate safeguards and full compliance with the Foreign Trade Policy and Exchange Control Regulations—especially regarding shipment schedules and total drawings.

In essence, a revolving LC allows the applicant to reuse the LC facility based on prior usage and payments.

Transferable Letter of Credit

A Transferable LC can be passed on by the original (first) beneficiary to one or more second beneficiaries. This type is commonly used when the beneficiary acts as a dealer or intermediary, rather than the actual supplier or manufacturer.

Provided that the LC allows partial shipments, it may be transferred to multiple second beneficiaries, as long as the total transferred amount does not exceed the original LC value.

The LC can be transferred only once and only on terms stated in the credit, with the exception of:

- Credit amount

- Unit price

- Expiry date

- Latest shipment date or shipment period

- Document presentation period

The insurance coverage percentage may be increased to match the level required in the credit.

Importantly, a letter of credit is deemed transferable only if explicitly stated as such. While the second beneficiary cannot further transfer the LC, they can retransfer it back to the first beneficiary.

Back-to-Back Letter of Credit

If a transferrable LC is not an option—yet the intermediary wants to purchase goods from suppliers without revealing the end buyer’s identity—a Back-to-Back LC may be used. Here, the irrevocable LC received from the buyer is offered as collateral to the intermediary’s bank, which then issues a new LC (the back-to-back LC) in favor of the actual supplier or manufacturer. The beneficiary of the first LC becomes the applicant for the second one.

While the terms of the second LC mirror the original LC, changes are made to the amount, unit price, and shipment timelines to ensure delivery occurs before the first LC’s expiry.

In this arrangement:

- The original LC is called the Principal Credit or Overriding Credit.

- The new LC is known as the Back-to-Back or Countervailing Credit.

This setup is typically used to finance suppliers under a non-transferable LC structure.

Red Clause Letter of Credit

A Red Clause LC allows the beneficiary to receive an advance before shipment, up to the limit specified in the LC. This clause used to be printed in red ink, hence the name. The nominated bank provides the pre-shipment finance based on instructions from the issuing bank. If the exporter fails to ship the goods or repay the advance, the issuing bank is responsible for reimbursing the nominated bank.

Green Clause Letter of Credit

This LC is an extension of the Red Clause LC. In addition to pre-shipment advances for procurement and packing, it also covers expenses for warehousing and insurance at the port, pending shipment. Such advances are generally released after the goods have been placed in bonded warehouses. Warehouse receipts are required as security and documentation for the advance.

Payment Letter of Credit

A Payment LC is a sight credit where payment is made immediately upon submission of the required documents to the issuing or nominated bank.

Unlike other LCs, a bill of exchange may not always be required. In many countries, bills of exchange are avoided to bypass stamp duties, even in sight transactions.

Deferred Payment Letter of Credit

This type of LC functions like a usance credit, where payment is scheduled for a future date, as specified in the credit terms. No bill of exchange is required to be drawn under this arrangement.

It must clearly define the maturity date or the method for determining when payment is due.

For imports, deferred payments exceeding 6 months but under 3 years are classified as Trade Credits. Such arrangements must comply with the Reserve Bank of India’s guidelines on External Commercial Borrowings and Trade Credits.

Acceptance Letter of Credit / Time Credit

In this LC, the beneficiary draws a usance bill of exchange, which is accepted by the bank upon presentation. The bill is then honored on its maturity date.

Unlike deferred payment credit, in an acceptance LC, the drawing of a usance bill is mandatory.

The designated bank must accept and eventually pay the bill as per the credit terms.

Negotiation Letter of Credit

A Negotiation LC can either be a sight or usance credit. In this case, the beneficiary typically draws a bill of exchange according to the terms of the LC. Negotiation may be restricted to a particular bank, or it may be open—known as a Freely Negotiable Credit—allowing any bank willing to negotiate the documents to do so.

Even if the nominated negotiating bank declines to negotiate, the issuing bank remains obligated to pay.

If the bill is drawn at a usance tenor (e.g., on DA basis), the issuing bank may deduct a discount.

In all cases, the issuing bank is liable to honor the credit terms and cannot shift responsibility to the negotiating bank.

Once a negotiating bank purchases the documents, it becomes a holder in due course.

Confirmed Letter of Credit

A Confirmed LC involves a second bank—other than the issuing bank—that adds its confirmation to the credit. This additional undertaking assures the beneficiary that payment will be made, not only by the issuing bank but also by the confirming bank.

The confirming bank is usually located in the beneficiary’s country to make the process more accessible and reduce risk. However, this additional layer comes with added cost due to confirmation charges.

Only irrevocable LCs can be confirmed.

Unlike an advising bank, which merely authenticates the credit, a confirming bank takes full responsibility and becomes a principal obligor, promising to pay, negotiate, or accept documents under the credit.

Standby Letter of Credit

A Standby LC acts as a financial guarantee and represents an obligation by the issuing bank to make payment if the applicant defaults on a financial or performance obligation.

This form of LC is common in countries like the U.S. and Japan, where traditional bank guarantees are not permitted. Instead of standard commercial documents, standby credits often require just a statement of claim or certificate of non-performance.

While it functions like a guarantee, it is rarely expected to be drawn upon. Due to its unsecured nature, this facility is offered selectively to applicants with strong credit histories.

What Are the Costs Involved in a Letter of Credit

Before proceeding with a Letter of Credit (LC), it’s important to be aware of the various fees and charges that may apply. These can include:

- Documentation Charges

- Commitment Fees

- Collateral Charges

- Processing Fees

- Penal/Overdue/Default Charges

- Charges for Issuance of Certificates

- TOD (Temporary Overdraft) Charges

- Foreclosure Charges

- Subsidy Related Charges

- Collateral Swap Charges

Make sure to go through these charges in detail to fully understand the total cost of using a Letter of Credit for your transaction.

Understanding LC with an Example

To better understand how a Letter of Credit functions, let’s consider a practical scenario. Suppose an importer based in the United States intends to purchase Ayurvedic products from a manufacturer located in India. To secure the payment for this international transaction, the Indian manufacturer asks the importer to provide a Letter of Credit from a reputable bank.

In response, the U.S.-based bank issues a Letter of Credit in favor of the Indian manufacturer. This document serves as a payment guarantee, stating that the bank will make the payment once the manufacturer submits the required shipping documents, such as the bill of lading and the commercial invoice, as per the terms outlined in the LC.

After the manufacturer dispatches the goods and presents the necessary documents to the bank, the bank verifies them for compliance. Upon successful verification, the bank proceeds to release the payment to the manufacturer.

This arrangement ensures a secure transaction for both parties. The importer is assured of receiving the goods as agreed, and the manufacturer is guaranteed payment upon fulfilling the specified conditions.

What to Watch Out For

Yes, Letters of Credit are protective, but only if handled correctly. Mistakes in documentation are one of the top reasons exporters miss payments.

Avoid these pitfalls:

- Sending incorrect or incomplete documents

- Misunderstanding LC terms and timelines

- Ignoring bank fees or hidden charges

- Not clarifying the payment conditions (sight vs. usance)

When in doubt, ask your bank for help. It’s always better to clarify than to assume.

Conclusion: Is a Letter of Credit Worth It

Here’s the big question: Do you need a Letter of Credit for every export?

Not necessarily. But for large-value orders, new buyers, or countries with currency/payment restrictions, an LC can be a game-changer.

Think of it like insurance. You hope you never need it, but when things go wrong, you’ll be so glad it’s there.

If you’re just entering the world of global trade, take this as your sign to explore the LC route—one of the safest and smartest tools in your exporter toolkit.