If you’re stepping into the world of international trade or just trying to understand what that mysterious string of numbers on your invoice means, you’ve probably come across something called an HS Code. Don’t worry, it’s not as complicated as it sounds.

Let’s break it all down

First Things First: What is an HS Code?

The term HS Code stands for Harmonized System Code. Think of it like a universal language for goods traded around the world. Every product, whether it’s a t-shirt, a mobile phone, or a bag of potatoes, is assigned a unique code so that customs authorities across the globe can recognize and process it easily.

It’s a bit like giving every product a passport.

This system was developed by the World Customs Organization (WCO) and is used by more than 200 countries, including India, for settling customs duties, taxes, and for keeping track of what’s coming in and going out of each country.

HS Code Meaning: What’s in Those Numbers?

The Harmonized System code structure is actually pretty logical once you know what to look for. It’s usually a 6-digit number, and here’s how it breaks down:

- First 2 digits (Chapter) – general category of the product

- Next 2 digits (Heading) – specific product group

- Last 2 digits (Sub-heading) – more detailed breakdown of the product

For example, a Harmonized System code example for fresh potatoes is 070190

- 07 – Chapter for edible vegetables, certain roots, and tubers

- 01 – Potatoes

- 90 – Other (not seed potatoes)

Now, in countries like India, this code often extends to 8 digits to add more detail. That’s why you’ll sometimes see HS codes called HSN codes (Harmonized System of Nomenclature) here.

Harmonized System Code India: How it Works Locally

In India, we use the slightly extended version of the global HS code known as the ITC-HS Code. It’s an 8-digit code used by the Directorate General of Foreign Trade (DGFT) for both exports and imports.

So, if you’re shipping or receiving goods in India, you’ll need to get familiar with HS code for export/import to ensure your paperwork is correct and your goods clear customs without any hiccups.

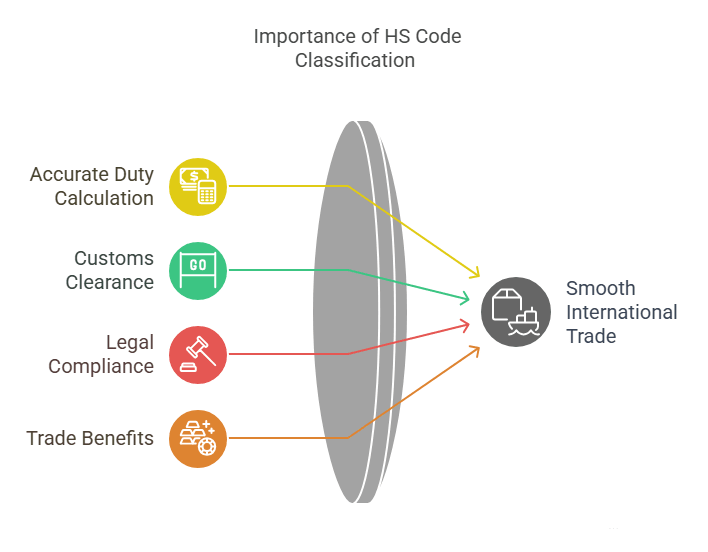

Why is Harmonized System Code Classification so important?

HS code classification is crucial for several reasons:

- It helps calculate the correct customs duties and GST

- Ensures your goods don’t get stuck at customs

- Helps comply with trade laws and restrictions

- Is necessary for availing trade benefits and exemptions

Using the wrong HS code can result in penalties, delays, or even confiscation of your goods.

How to Do a Harmonized System Code Lookup

Now that you know Harmonized System codes matter, how do you find the right one?

Here’s how you can perform an Harmonized System code lookup

- Check the Indian Trade Portal

- Use the DGFT’s official website

- Talk to your customs broker or freight forwarder

A Real-World HS Code Example (Coffee)

India is no stranger to coffee; in fact, according to the Food and Agriculture Organization (FAO), it’s the eighth-largest coffee exporter in the world. Over 70% of the country’s coffee production is exported, with shipments peaking between March and June. This seasonal boom has seen solid growth in recent years.

In FY22, India’s total coffee exports soared by 42%, reaching around Rs 8300 crore (US$ 1.04 billion). Just in March 2022, exports were valued at approximately Rs. 920 crore (US$ 114.7 million) – up 22% from the month before. Fast forward to FY23 (till September), and exports stood at nearly Rs. 4,900 crore (US$ 610.23 million), marking a 32.5% growth over the same period in the previous year.

Clearly, coffee from key growing states like Karnataka, Kerala, and Tamil Nadu is in high demand internationally.

If you’re planning to ride this coffee export wave, you’ll need to get your HS code classification right, because that’s what keeps your goods moving smoothly through customs.

Harmonized System Code classification for coffee products is as follows (Source: DGFT):

| ITC (HS) Code | Product Description | Import Policy |

| 09011190 | Coffee, not roasted – Other | Free |

| 09011200 | Coffee, not roasted – Decaffeinated | Free |

| 09012110 | Roasted coffee – Not decaffeinated, in bulk pack | Free |

| 09012190 | Roasted coffee – Not decaffeinated, other | Free |

| 09012210 | Roasted coffee – Decaffeinated, in bulk pack | Free |

| 09012290 | Roasted coffee – Decaffeinated, other | Free |

| 09019010 | Coffee husks and skins | Free |

| 09019020 | Coffee substitutes containing coffee | Free |

So, whether you’re exporting beans, husks, or substitutes, using the right HS code for export/import is non-negotiable. It ensures compliance, smooth processing, and the correct application of duties.

This HS Code will be needed while

- Filing GST

- Preparing shipping documents

- Completing customs clearance

- Claiming export benefits

Final Thoughts

Whether you’re a small business owner shipping your first product or a seasoned trader dealing with international logistics, the harmonized system code is something you just can’t ignore.

To wrap it up:

- Understand the HS code meaning

- Learn the Harmonized System code structure

- Use a proper Harmonized System code search tool

- Double-check the HS code classification for accuracy

- Refer to the right Harmonized System code list, especially for India

Doing this right the first time saves you time, money, and a ton of stress.

FAQs

The HS Code (Harmonized System Code) is an internationally standardized system of names and numbers to classify traded products for customs and taxation purposes.

HS Code stands for Harmonized System Code, developed by the World Customs Organization (WCO).

It simplifies international shipping, ensures correct taxation, and helps in customs clearance and tracking of goods worldwide.

In India, the HS Code is used in an 8-digit format known as the ITC-HS Code (Indian Trade Classification – Harmonized System).